Bitcoin Reserve Strategy Pioneer MicroStrategy Strategy (formerly MicroStrategy) buys another 21,021 bitcoins, expanding its Bitcoin holdings to 628,791 coins, with an average cost of $73,277, and at today's Bitcoin price of $118,000, unrealized profits reach as high as $28.1 billion. Strategy will release its second-quarter financial report after the US stock market closes on 7/31, potentially recording $14.05 billion in quarterly unrealized gains, and it remains to be seen whether this could drive its long-stagnant stock price.

Table of Contents

ToggleSTRC Preferred Stock Highly Popular, Raised Funds Entirely Invested in Bitcoin

After issuing 28,011,111 shares of STRC preferred stock, Strategy immediately invested the proceeds in Bitcoin purchases. It acquired 21,021 bitcoins for approximately $2.46 billion, with an average purchase price of $117,256. As of July 29, 2025, Strategy holds 628,791 bitcoins, with an average cost of $73,277 per bitcoin.

STRC will be officially listed on Nasdaq on 7/30 with an issue price of $90, allowing investors to buy this new floating-rate preferred stock in the open market.

Strategy Accelerates Bitcoin Purchases, Unrealized Profits Reach $28.1 Billion

However, MSTR dropped over 2% to $394.66 yesterday, with mNAV declining to 1.7, suggesting pressure on the Bitcoin flywheel effect.

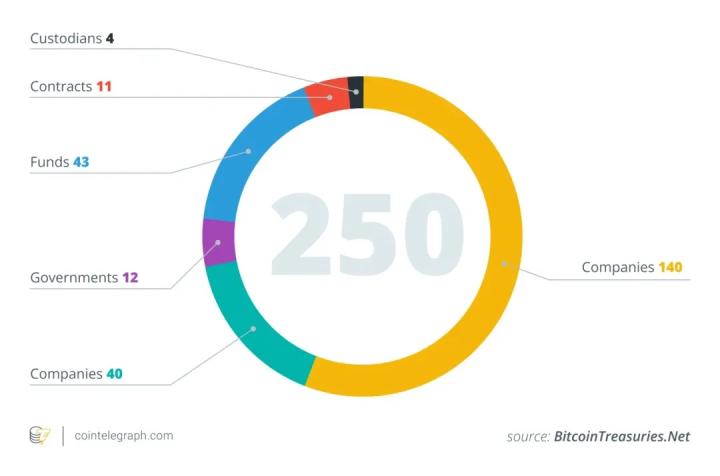

Strategy will release its second-quarter financial report after the US stock market closes on 7/31, adding 20,000 bitcoins before the report, seemingly wanting to dispel recent claims of slowing bitcoin purchases. Its 628,791 bitcoins firmly hold the top spot among listed companies, with the second-place MARA holdings only holding 50,000 bitcoins. Strategy's early purchases have kept its cost at a low $73,277, and at today's Bitcoin price of $118,000, unrealized profits reach as high as $28.1 billion.

Due to the Bitcoin price rebound and recent accounting changes, Strategy is expected to record $14.05 billion in unrealized gains in the second quarter. This could help Strategy be included in the S&P 500 index next quarter, and it remains to be seen whether this could drive its long-stagnant stock price.

Risk Warning

Cryptocurrency investment carries high risks, and its price may fluctuate dramatically. You may lose all your principal. Please carefully assess the risks.