A surprisingly soft employment report is causing the market to speculate whether the scenario of "holding steady in July and significantly cutting rates in September" from last year will repeat itself, with Nick Timiraos, known as the "new Fed messenger," and renowned economist El-Erian both noting a sense of déjà vu in the current situation.

Just after the Federal Reserve announced maintaining interest rates this week, the July non-farm employment data released on Friday showed that the U.S. labor market is cooling at an astonishing speed. The data not only fell far below expectations, but the significant downward revision of employment numbers for the previous two months also revealed the potential weakness in the economy, putting the Fed's previous wait-and-see stance to the test.

Facing this soft employment report, BlackRock's Global Fixed Income Chief Investment Officer Rick Rieder stated directly:

Today's report provides evidence for the Fed to adjust rates in September, with the only question being the magnitude of the adjustment.

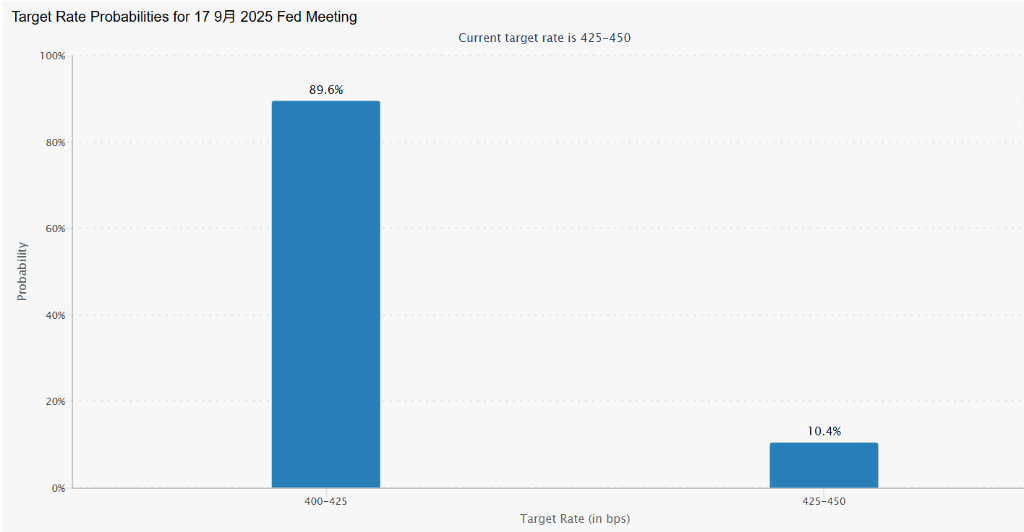

According to CME Group data, the probability of the Federal Reserve cutting rates in September has soared from less than 40% on Thursday to nearly 90%.

(Probability of 25 basis point rate cut in September reaches 89.6%)

(Probability of 25 basis point rate cut in September reaches 89.6%)

History Repeating? Market Bets on Fed's "Remedial" Rate Cut

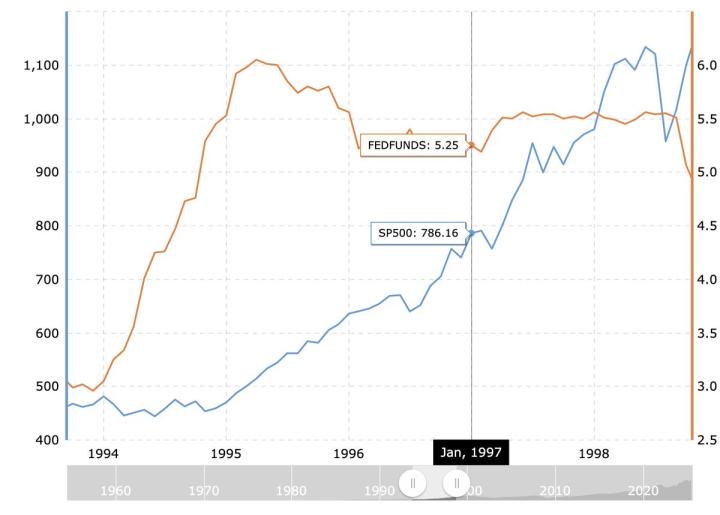

The sudden cooling of the job market immediately reminded the market of the Fed's policy trajectory last summer.

At that time, the Federal Reserve also chose not to cut rates at the July meeting, but a weak employment report two days later changed the situation. Ultimately, officials "remedied" the situation at the September meeting by cutting rates by 50 basis points (more than the conventional 25 basis points).

Before the July Fed rate resolution, renowned economist El-Erian had posted a preview of the Fed's potential rate path:

How likely is it that the Fed will completely replay last year's pattern? Specifically, maintaining rates in July and then making a significant rate cut in September, despite seemingly unchanged economic conditions.

Previously, according to Wall Street News, well-known financial journalist Nick Timiraos also suggested that the current scenario might create a sense of familiarity for Fed officials.

However, Timiraos pointed out a key difference: Last year, U.S. inflation was in a continuous downward trajectory; this year, due to a series of broad tariff measures implemented by the Trump administration since spring, Fed officials are actually concerned that inflation pressure might rebound.

Therefore, Timiraos emphasized the key question facing the Fed: Are the U.S. economic fundamentals truly deteriorating, or is the recent slowdown just a temporary phenomenon caused by policy lag?

But BlackRock's Global Fixed Income Chief Investment Officer Rick Rieder stated in a report to clients on Friday afternoon:

If labor market slack intensifies or new employment continues to be below 100,000, the Fed is expected to start cutting rates, and a 50 basis point cut in September is possible.

It's worth noting that despite Rieder suggesting the possibility of a significant 50 basis point cut, current futures market prices indicate that traders believe the probability of this happening is zero.

Before the September meeting, decision-makers will still receive an employment report and two months of inflation data, which will collectively determine whether the Fed will choose to be cautiously observant or, like last year, respond to the changing economic landscape with a decisive action.