The market, project, currency, and other information, opinions, and judgments mentioned in this report are for reference only and do not constitute any investment advice.Written by 0xBrooker

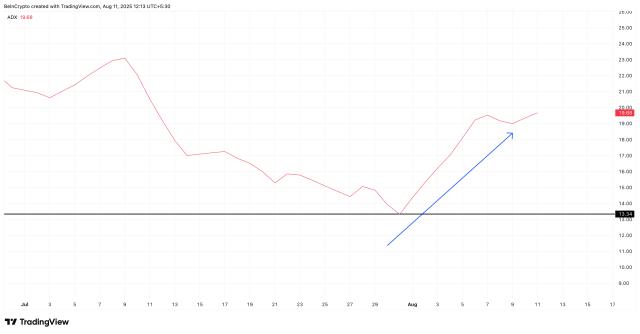

BTC Daily Trend

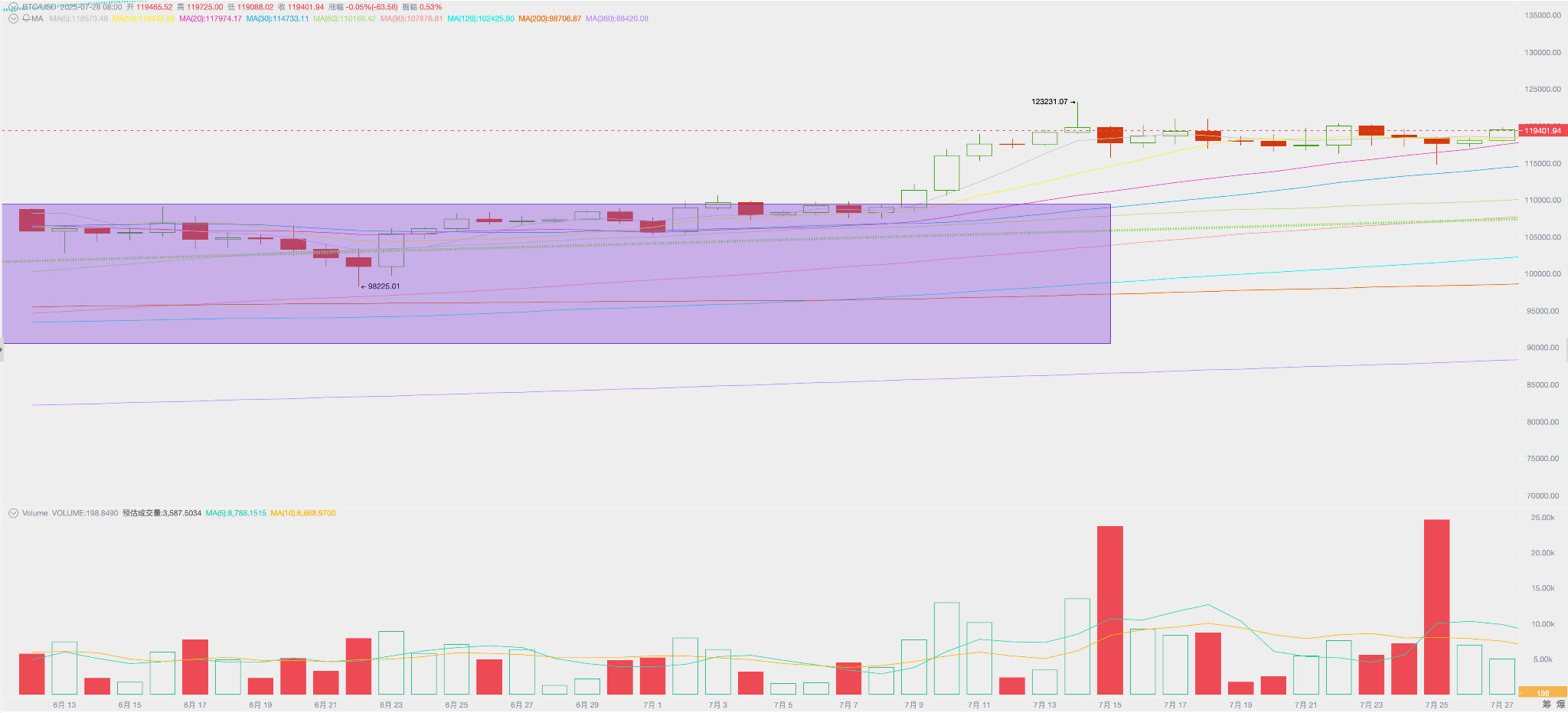

BTC opened at $117,315.68 this week, closed at $117,312.70, up 1.84%, with a high of $120,300.00, a low of $114,750.00, and a volatility of 4.73%, with trading volume at a relatively high level.

This week's US economic data maintained the September interest rate cut expectation, but the probability of a rate cut is only 64.5%. Due to the August 1st tariff war deadline, long positions continued to sell at the key point of $120,000 to realize profits. Buying power from corporate purchases and BTC Spot ETF absorbed all selling pressure, showing a balanced buying and selling situation.

With BTC consolidating at high levels, ETH, which surged 26.4% last week, consolidated with a slight increase of 3.07%, supporting the Altseason expectation. Most small-cap Altcoins declined, but quality projects remained strong, pushing BTC's market dominance to slightly drop to 60%.

Excluding the interest rate cut expectation, the most market-impacting factor - the tariff war - also made further progress this week. Japan and the EU both signed a 15% tariff increase, generally in line with market expectations, with US stocks responding with gains.

Policy, Macroeconomic, and Economic Data

Following last week's CPI data that met expectations, this Thursday's US initial jobless claims were 217,000, lower than the expected 226,000 and previous 221,000, again showing the resilience of the US economy and temporarily lowering the September interest rate cut expectation.

On the same day, the US July S&P Global Manufacturing PMI preliminary value was 49.5, lower than the expected 52.7 and previous 52.9, providing slight positive support for a rate cut.

US President Trump rarely went to the Federal Reserve for "accountability", but was met with a cold shoulder from Chairman Powell. As the Federal Reserve's internal division on whether to cut rates becomes clear, the July 31st monetary policy meeting becomes more uncertain. However, the market generally believes the probability of a July rate cut is very low and has been priced in.

Regarding the tariff war, clear progress was made in the third stage (signing) this week.

US-Japan agreement - Japan's exports to the US will uniformly apply a 15% "reciprocal tariff" (significantly lower than the previously claimed 25%~35%), Japan will invest $50 billion in the US in the next 10 years, and agree to further open import quotas for cars and agricultural products. The 15% tax rate + investment and US goods import, lower than market expectations, caused the Nikkei index to surge 4.1% this week.

US-EU agreement - EU exports to the US (including automobiles) will be subject to a 15% tariff, while US exports to the EU enjoy a 0% tariff. The EU pledged to invest an additional $600 billion in the US, purchase $75 billion of US energy products (mainly liquefied natural gas), and buy a large amount of US military equipment.

On July 25th, the White House updated the draft of the "Reciprocal Tariff Act", raising tariffs to 12% generally, while maintaining a maximum additional tax rate interval of 70%, and announced sending letters to about 150 trading partners before August 1st to confirm the final tax rate.

Although major trading countries like China, Canada, and Mexico have not yet signed a final agreement, the market generally believes the tariff war is coming to an end, and its impact on the market has given way to economic and employment data, as well as interest rate cut expectations.

Under the US economic resilience and AI spending expectations, most Q2 earnings reports from companies have been better than expected, giving funds confidence to continue long positions at high levels. The three major US stock indices remained stable this week, with Nasdaq, S&P 500, and Dow Jones recording increases of 1.02%, 1.46%, and 1.26% respectively.

EMC Labs believes that the opening of the rate cut cycle, the impending end of the tariff war, and AI driving US corporate performance growth are the psychological support for US stocks creating new highs at high valuations. The fluctuations and downward adjustments of these three expectations may also provide downward pricing momentum for US stocks and BTC. However, systemic market risks have been basically cleared, and a new economic cycle is about to open.

Crypto Market

This week, BTC oscillated in the $115,000~$120,000 range, with the 5-day and 10-day moving averages sticking together and briefly retracing to the 20-day moving average.

In our previous report, we pointed out that BTC has launched the fourth wave of this cycle's rise, but after challenging $120,000, it returned to a consolidation trend. This is because the long momentum weakened in August 1st's uncertain tariff war situation after a sharp rise in early July, coupled with continuous selling by long positions.

Long position reduction is not necessarily negative. Both off-market and on-market, we observe funds rapidly flowing into Altcoins led by ETH.

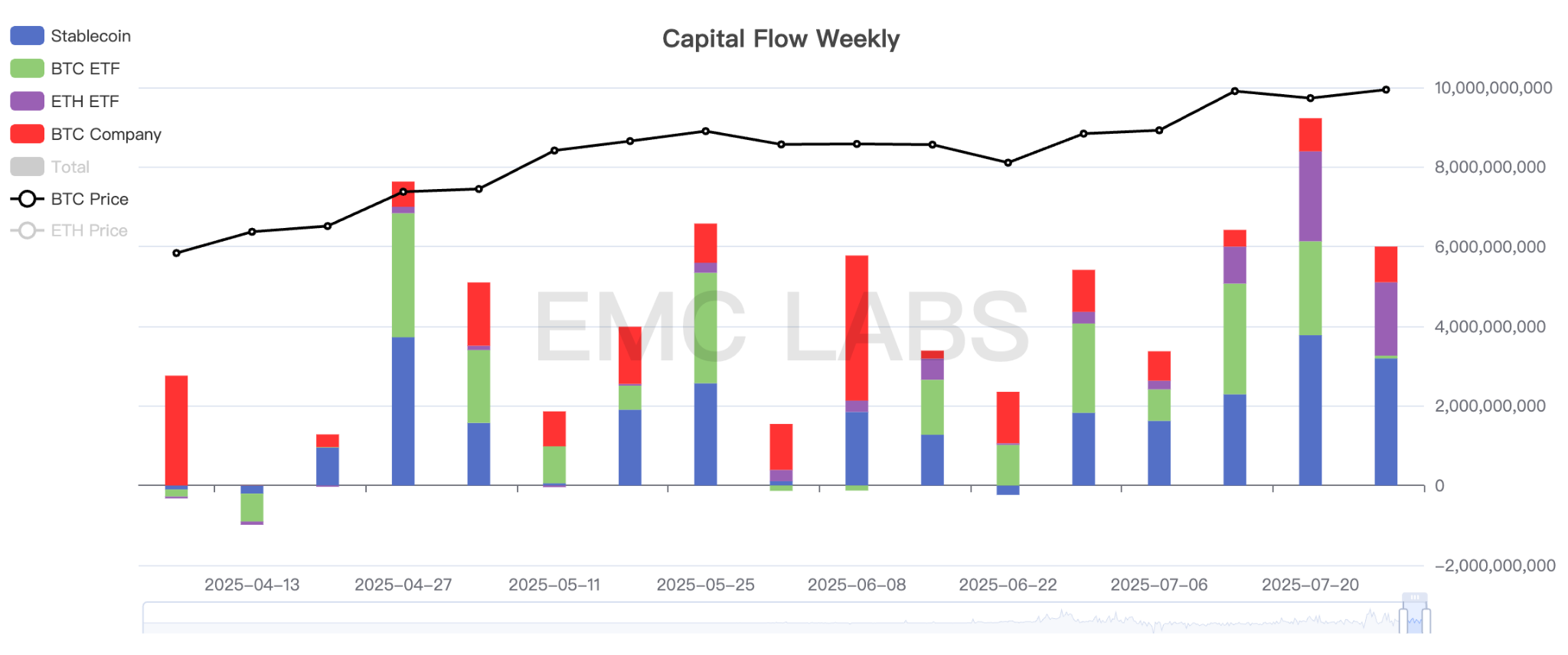

The Crypto market is in a style transition period within the cycle, marked by the reversal of the ETH/BTC trading pair. Subsequently, BTC's rise will more come from corporate purchases and capital inflow through BTC Spot ETF channels.

Capital Inflow and Selling

With the fourth wave of rise launched, long positions again started large-scale selling, disposing of over 190,000 coins in the past three weeks, slowing down centralized exchange destocking.

Especially the awakening and selling of ancient whales have created significant psychological pressure on the market. With insufficient on-market buying power, strong off-market buying power has provided strong support for BTC prices.

This week, total market capital inflow reached $6.002 billion, including $3.192 billion through stablecoin channels, $702 million through BTC Spot ETF channels, $898 million in corporate purchases, and $1.842 billion through ETH Spot ETF channels, again exceeding BTC Spot ETF buying power.

Two changes in the off-market are worth high attention: corporate purchases becoming the main buying power, and indications of ETF channel funds shifting from BTC to ETH.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0.5, in the rising period.

EMC Labs (Emerging Laboratory) was created in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and Crypto secondary market investment, with industrial foresight, insight, and data mining as core competitiveness, committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and crypto assets to bring benefits to humanity.

For more information, please visit: https://www.emc.fund