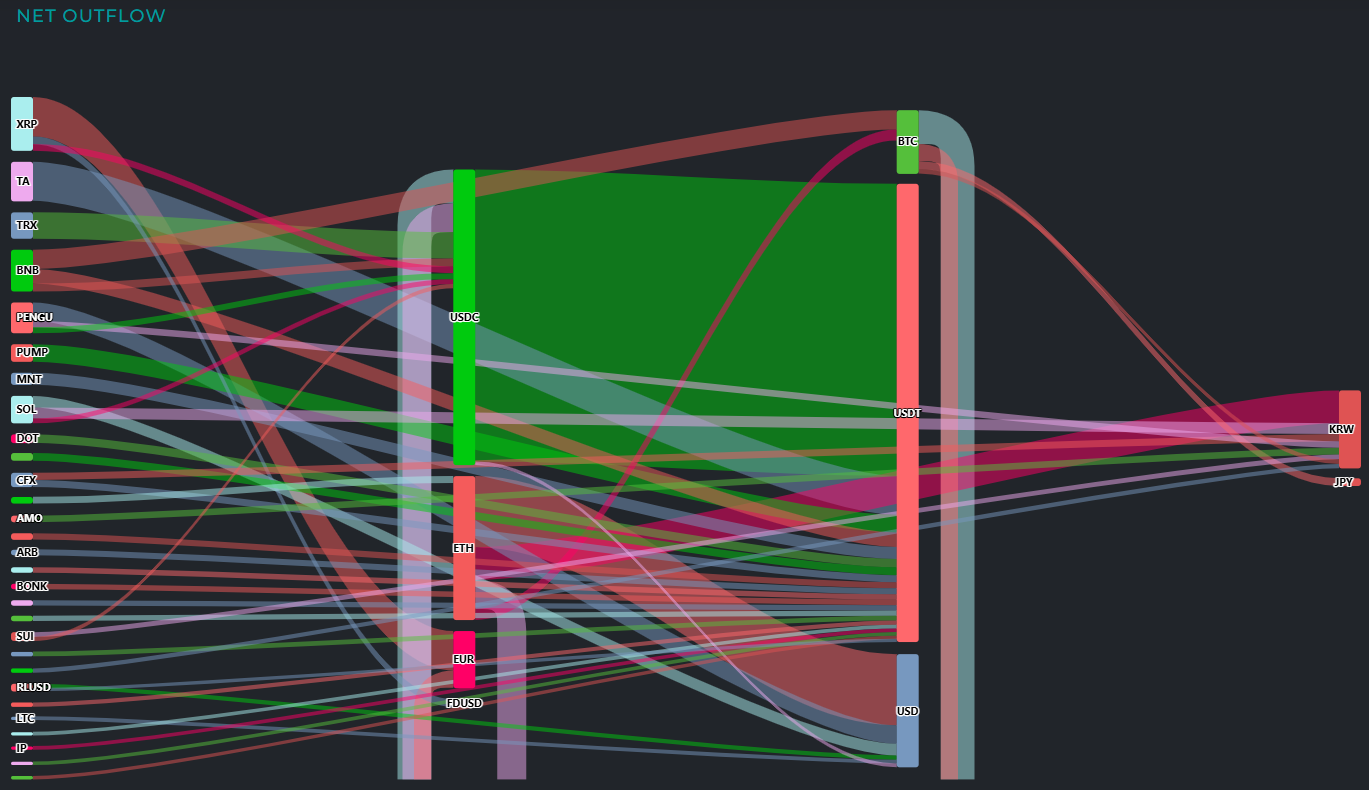

Stablecoin funds centered on Tether (USDT) have moved to major assets such as Ethereum (ETH). Meanwhile, a trend of selling to fiat currency and stablecoins was confirmed in some altcoins like XRP, BNB, and SOL.

According to CryptoMeter as of the 4th, the most active inflow in the global cryptocurrency market over the past 24 hours was in US dollars (USD), with a total inflow of $106.1 million.

Dollar funds were widely distributed to ▲Bitcoin (BTC, $56.1 million) ▲XRP ($34.6 million) ▲XLM ($7.2 million) ▲USDT ($4.6 million) ▲ENA ($1.8 million) ▲HBAR ($1.8 million).

The Korean won (KRW) inflow was $13.5 million, mostly flowing into ▲USDT ($10.2 million) ▲XRP ($3.3 million).

Euro (EUR) funds of $11.2 million were divided into ▲ETH ($6.4 million) ▲USDC ($2.3 million) ▲RLUSD ($1.3 million) ▲SOL ($1.2 million).

Brazilian real (BRL) inflow of $3.2 million was distributed to ▲USDT ($1.7 million) ▲ETH ($1.6 million). Turkish lira (TRY) funds of $1.7 million moved entirely to USDC.

Among stablecoins, USDT recorded the highest inflow at $370 million.

Funds were circulated around ▲ETH ($120.6 million) ▲BTC ($59.1 million) ▲USDE ($57.7 million) ▲DOGE ($43.8 million) ▲SUI ($21.4 million) ▲FDUSD ($13.6 million), with liquidity also supplied to altcoins such as LTC, PENGU, SPK, HBAR, and SEI.

USDC had an inflow of $45.2 million, distributed to ▲FDUSD ($30.5 million) ▲XMR ($12.4 million) ▲PEPE ($1.2 million) ▲DOT ($1.2 million).

FDUSD funds of $112.7 million were reallocated to ▲ETH ($81.8 million) ▲SOL ($16.3 million) ▲BTC ($10.2 million) ▲DOGE ($2.7 million) ▲BNB ($1.7 million).

Based on the final inflow, ▲ETH ($210.4 million) attracted the most funds, followed by ▲BTC ($102.2 million) ▲USDE ($57.7 million) ▲DOGE ($46.5 million) ▲SOL ($41.7 million) ▲XRP ($37.8 million) ▲SUI ($21.4 million).

Funds were also injected into ▲TRX ($15.6 million) ▲XLM ($13.3 million) ▲ENA ($1.8 million) ▲RLUSD ($1.3 million) ▲BNB ($1.7 million) ▲WBTC ($1.9 million).

On this day, a total of $14.1 million flowed out of XRP, distributed to ▲Euro (EUR, $10.3 million) ▲FDUSD ($2.1 million) ▲USDC ($1.7 million).

BNB saw $10.8 million outflow, divided into ▲BTC ($5 million) ▲USDT ($3.7 million) ▲USDC ($2.1 million), with $10.1 million moving to USDT in TA, and TRX's entire $6.9 million moving to USDC.

A selling trend of $8.2 million was observed in PENGU, with funds moving to ▲dollars ($4.8 million) ▲USDC ($1.5 million) ▲won ($1.8 million).

For SOL, a total of $7.4 million was withdrawn, distributed to ▲dollars ($3.1 million) ▲won ($2.9 million) ▲USDC ($1.5 million).

A conversion trend to fiat currency and stablecoins was also confirmed in numerous altcoins such as PUMP, DOT, MNT, CFX, AMO, ARB, APEX, SUI, RLUSD, ENA, IP, and SAHARA.

A total of $76.1 million was concentrated in USDC, the intermediate asset, mostly flowing into ▲USDT ($75.2 million), with some moving to ▲dollars (about $950,000).

ETH outflow was a total of $37.2 million, converted to ▲dollars ($18.6 million) ▲won ($8.5 million) ▲USDC ($7.3 million) ▲BTC ($2.9 million).

BTC outflow funds of $16.9 million were redistributed to various fiat currencies such as ▲USDC ($9 million) ▲Euro ($4.7 million) ▲yen ($2 million) ▲won ($1.2 million).

Ultimately, $118.2 million was concentrated in USDT. Among fiat currencies, dollars were recorded as the final destination for the most funds at $29.4 million. Following were ▲won ($20.3 million) ▲Euro ($15 million) ▲yen ($2 million).

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>