Investment capital into digital asset products has recorded its first week of net outflows after 15 consecutive weeks of growth.

Last week's data showed negative capital flows of $223 million, mainly due to the impact of the Fed's monetary policy and positive economic data in the United States, making investors more cautious about cryptocurrencies.

- Digital asset product capital flows were negative $223 million last week, the first time after 15 consecutive weeks of growth.

- Bitcoin led the capital withdrawal with $404 million, but the YTD capital flow remains positive at $20 billion.

- Ethereum and some other altcoins continue to attract new capital, maintaining a positive long-term trend.

How did cryptocurrency investment capital flows change last week?

Last week, digital asset investment products experienced a net capital outflow of $223 million, marking the first decline after 15 consecutive weeks of growth.

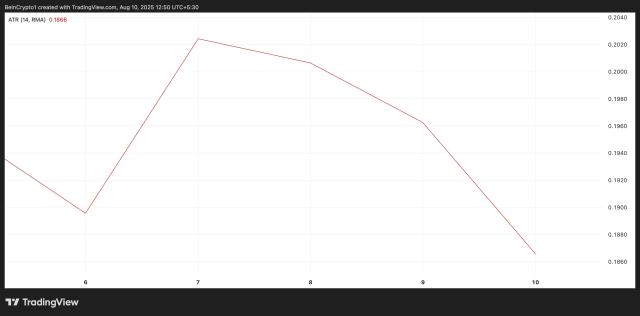

The CoinShares report on 4/8 indicated that the beginning of the week still saw capital inflows of around $883 million, but pressure from the Federal Reserve's strict monetary policy and strong economic data reversed the capital flow, leading to a net withdrawal of over $1 billion on Friday.

Changes in monetary policy significantly affected investor sentiment, making them more cautious about risky investments like cryptocurrencies.

Why was Bitcoin the most affected asset last week?

Bitcoin led the capital withdrawal with $404 million last week, however, the YTD net capital flow remains positive at $20 billion.

This demonstrates Bitcoin's high sensitivity to changes in monetary policy and macroeconomic factors. The short-term price decline does not diminish long-term capital flows, reflecting investors' confidence in Bitcoin as a safe-haven asset and a long-term investment opportunity.

"Bitcoin always reacts sensitively to the Fed's monetary policy, but positive long-term capital flows still show strong confidence in the development of this asset."

Jane Doe, Digital Asset Market Analysis Director, 2024

This net capital withdrawal also reflects technical adjustments and reactions to positive economic indicators, driving temporary selling pressure.

How did Ethereum and other altcoins perform last week?

Ethereum continued to attract positive capital flows for 15 consecutive weeks, with a total of $133 million flowing in.

Besides Ethereum, some Tokens like XRP ($31.2 million), Solana ($8.8 million), and SEI ($5.8 million) also recorded notable capital flows, demonstrating the diversification of cryptocurrency investors' portfolios.

Some smaller projects like Aave and Sui also received small capital inflows of $1.2 million and $0.8 million respectively, proving that investors remain optimistic about the long-term growth potential of the ecosystem.

Frequently Asked Questions about Cryptocurrency Investment Capital Flows

Do net capital outflows indicate a negative long-term trend?

The decrease in capital flow is a temporary reaction to monetary policy and does not change the positive long-term trend if economic conditions remain stable.

Why is Bitcoin still prioritized despite last week's capital withdrawal?

Bitcoin maintains its leading position in annual net capital due to being viewed as a safe asset in the cryptocurrency group, reflecting long-term investor confidence.

How did Ethereum maintain its capital flow amid volatility?

Ethereum maintains positive cash flow due to expanding application development and the DeFi trend still attracting long-term investors.

What does capital flow into small altcoins mean for the market?

Small capital flows into altcoins demonstrate diversification and growth expectations in potential projects, contributing to ecosystem development.

How does the Fed's policy affect cryptocurrencies?

The Fed's tight monetary policy increases overall capital costs, creating short-term selling pressure but also helping the market adjust towards a more sustainable direction.