XRP rose by 5% in the past 24 hours, providing temporary relief from the selling pressure that caused a price decline last week.

The recent uptrend reflects an improvement across the cryptocurrency market. On-chain data shows asset-specific trends that could potentially boost XRP's rebound.

XRP Sentiment Shift... Increasing Futures Buying Pressure

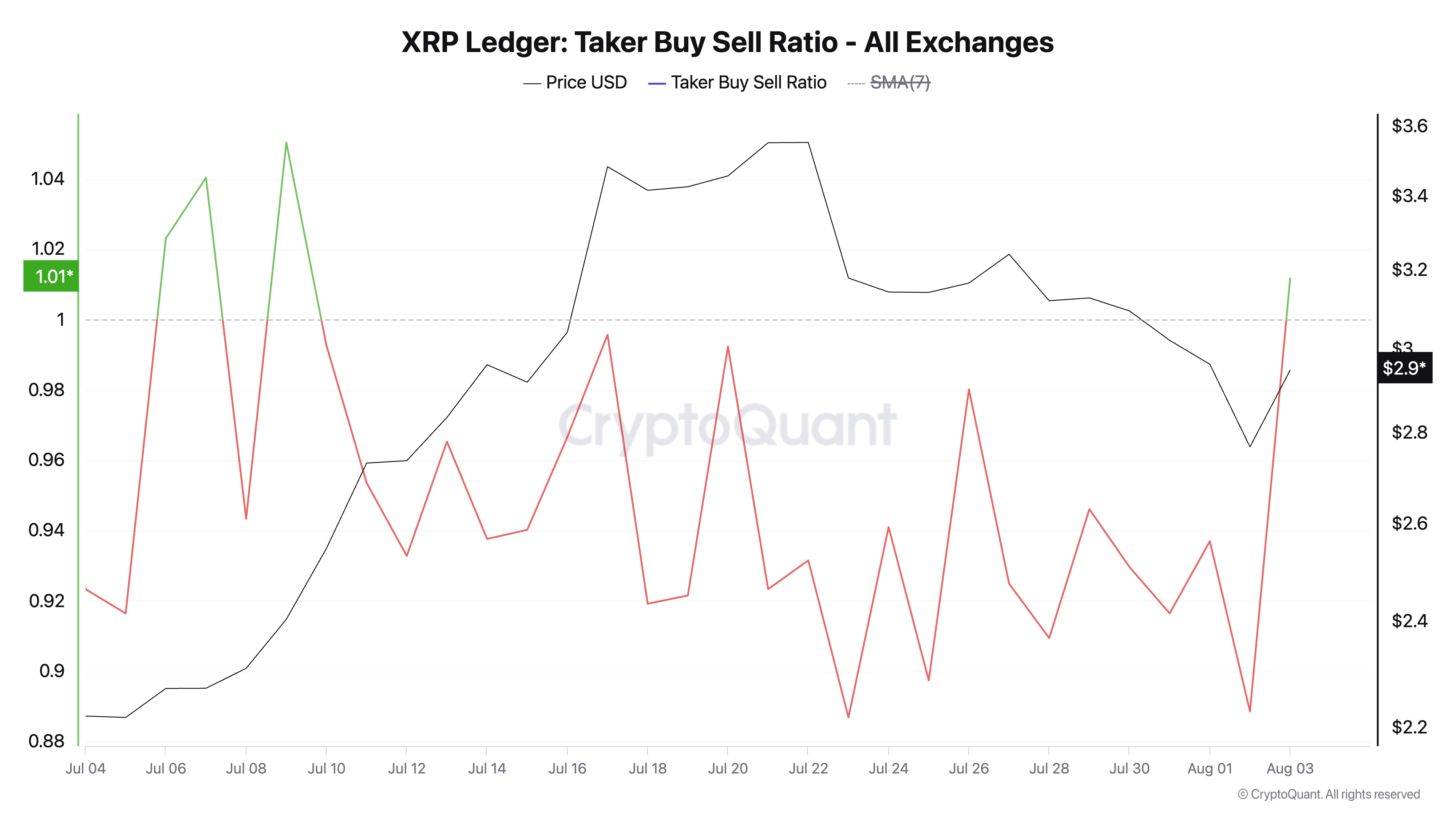

One key indicator demonstrating this change is XRP's taker buy/sell ratio. Yesterday, this ratio closed in the green area. According to Cryptoquant, this is the first time the indicator has closed positive since July 10th. This confirms that market sentiment has turned positive.

Token TA and Market Update: Want more of these token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

The asset's taker buy-sell ratio measures the ratio between buy and sell volumes in the futures market. A value above 1 indicates buy volume is higher than sell volume, while below 1 suggests more futures traders are selling their holdings.

The rise in XRP's taker buy/sell ratio indicates that selling pressure in the futures market is slowing down. This emphasizes that bearish sentiment among futures participants is weakening. If this trend continues, it could further support XRP's upward movement.

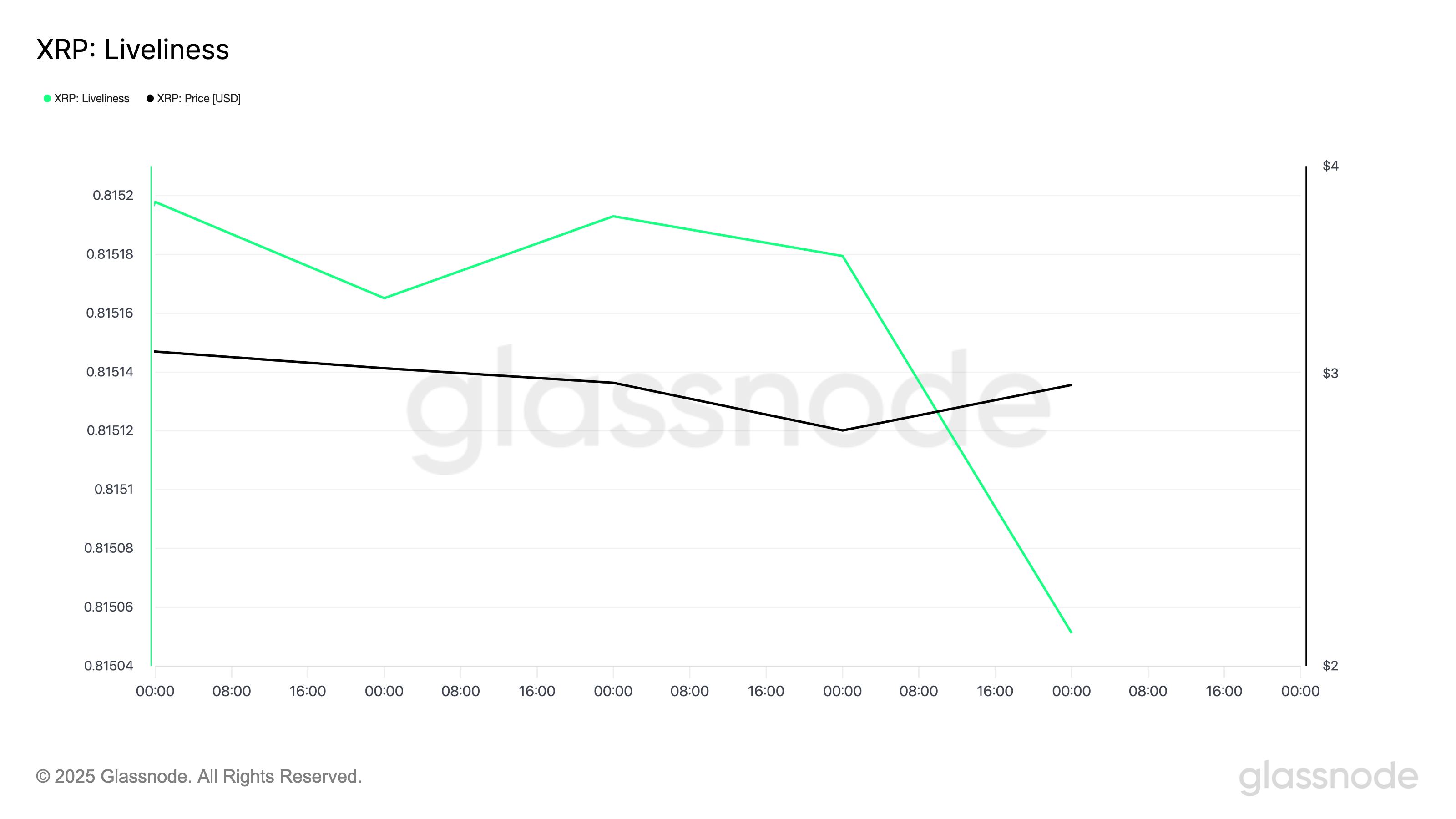

Another notable trend is that XRP's liveliness has been steadily decreasing since early August. According to glassnode, this indicator closed at 0.8150 on August 3rd, down from 0.8152 recorded on August 1st.

Liveliness tracks the movement of long-term held/dormant tokens. It is measured by the ratio of coin days destroyed to total coin days. When this indicator rises, it means long-term holders are moving or selling their coins.

Conversely, when it falls like this, it indicates that profit-taking is slowing down, and major holders are returning to accumulation mode after selling pressure.

Resistance, Halt Uptrend or Drop to $2.87?

The combination of decreased selling and increased futures interest could help XRP stabilize above the $3 price level in the short term. If accumulation strengthens, the altcoin could rise to $3.22. Successfully breaking this barrier could lead to a rally to $3.33.

Otherwise, the altcoin could reverse its gains and drop to $2.87, resuming its recent downward trend.