Some companies have continued to build altcoin reserves this week, particularly focusing on Solana and Ethereum. Both tokens are attracting strong interest from companies as the market becomes increasingly diversified.

GameSquare spent 10 million USD on ETH today after revealing holdings of 200 million USD over the weekend, while Bitmine is accumulating over 2.9 billion USD. Meanwhile, SOL is also becoming popular among market leaders and new investors.

Altcoins are filling corporate treasuries

Companies' Bitcoin purchases have become a global phenomenon in recent months, but this market may be saturated.

Instead, many companies have started shifting to altcoins for their treasury strategies, choosing a more diverse range of assets. Based on the latest reports today, Ethereum remains a popular choice:

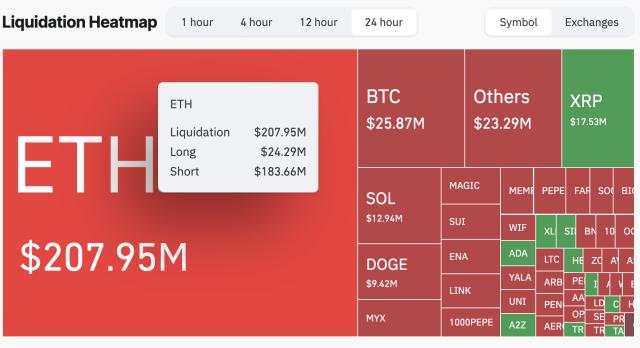

Ethereum has emerged as a popular investment choice for companies in recent weeks. Inflows into the ETH ETF surpassed Bitcoin-based products in July, and private treasuries are buying a lot of this altcoin.

GameSquare committed 200 million USD over the weekend, and today's 10 million USD investment shows continued high confidence.

Additionally, Bitmine became the world's largest Ethereum treasury today, holding over 2.9 billion USD of this asset. The Ether Machine also spent 40 million USD on ETH. All of this indicates very high enthusiasm for this token in the corporate world.

Meanwhile, Verb Technology, a Nasdaq-listed company based in Nevada, announced today a 558 million USD investment to buy TON. This could be the first time a public company adds Toncoin to its treasury.

However, Solana is emerging as a new favorite after Bitcoin.

Could Solana become the new favorite?

DeFi Development aimed to become the "MicroStrategy of Solana," announcing a 100 million USD investment in early July, achieving more milestones throughout the month.

Today, they surpassed the 200 million USD threshold, becoming a large SOL buyer. Artelo Biosciences also became the first pharmaceutical company to build a SOL treasury today, indicating its growth.

Although corporate altcoin treasuries are impressive, BTC remains the primary choice for corporate accumulation. Thanks to its maximalist Bitcoin approach, MicroStrategy reported over 10 billion USD in net income in Q2 2025. This is particularly impressive given their large losses in Q1.

Moreover, Twenty One Capital is focusing solely on BTC, quickly buying over 5 billion USD of the token.

All of this shows that altcoins like Ethereum and Solana are certainly building their positions in corporate treasuries. However, currently, Bitcoin remains at the top.

This diversification could provide valuable market insights, especially when considering which major tokens are not receiving much investment.