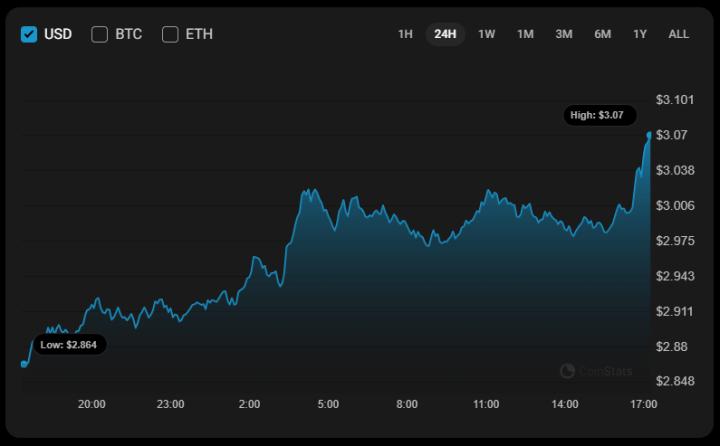

XRP surged to $3.05 during a volatile 24-hour period, posting a 4.45% gain from $2.92 as traders reacted to unprecedented minute-level volumes and whale liquidations.

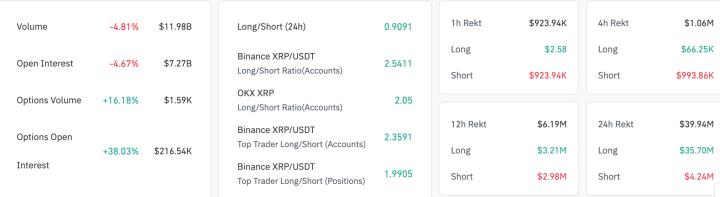

A $33 million spike in volume was recorded within a single minute, marking one of the largest such spikes for the token.

Despite technical resistance at $3.09 and short-term sell signals flashing, machine-learning forecasts continue to target upside toward $3.12 by month-end.

What to Know

- XRP rallied from $2.92 to $3.05 between 3 August 21:00 and 4 August 20:00, gaining 4.45% with a trading range of $0.18 (6% spread).

- The $3.00 psychological level was breached during the 13:00–14:00 session on extreme volume, peaking at 151.97 million trades.

- Institutional trading triggered $2.10 billion in sell flows, even as leveraged long positions totaling $14 million were opened on major exchanges.

- A single-minute volume record of $33 million was observed during the height of the breakout.

- AI trading models from multiple platforms forecast $3.12 by 31 August, despite the upcoming SEC regulatory status update on 15 August.

- The TD Sequential indicator flashed a sell signal on the three-day chart, suggesting a short-term top may be forming.

News Background

The price spike followed a broader risk-on move in crypto markets as traders rotated out of lower-cap altcoins and into high-liquidity majors.

However, on-chain data revealed aggressive sell-side flows from whale addresses and smart money funds—raising concerns that the rally may have been driven by short-term positioning ahead of regulatory catalysts.

The SEC is expected to clarify XRP’s securities treatment by mid-August, a potential binary event for the token.

Price Action Summary

- XRP hit intraday highs of $3.08 before fading slightly to close the session at $3.05.

- Price action reversed sharply at $3.09, establishing the level as near-term resistance.

- Support was observed at $2.97 during the 05:00–06:00 window, with back-to-back volumes of 57.65 million and 44.77 million.

- The final hour saw a $0.01 range between $3.04 and $3.05 with high intrabar volatility and no clear directional bias.

Technical Analysis

- Price held above the $3.00 psychological zone but failed to break higher despite massive volume surges.

- TD Sequential shows a 9-count sell signal on 3D, typically followed by consolidation or downside pressure.

- RSI on the 1H and 4H remains elevated but has not crossed into extreme overbought territory.

- The $3.09 rejection came on 69.89 million volume, well above the 24H average of 62.11 million.

What Traders Are Watching

- Whether XRP can maintain support above $3.00 heading into the weekend.

- The impact of the SEC’s mid-August decision on XRP’s market classification.

- If institutional sellers re-enter at $3.10+ or if long exposure builds at current levels.

- Machine learning-driven price targets ranging from $3.10 to $3.12 by month-end, assuming volatility compresses.