It was revealed that the supply and demand in the US spot ETF market, which was one of the 'dual-engine' driving the rise of Bit and ETH in the second quarter, has significantly deteriorated.

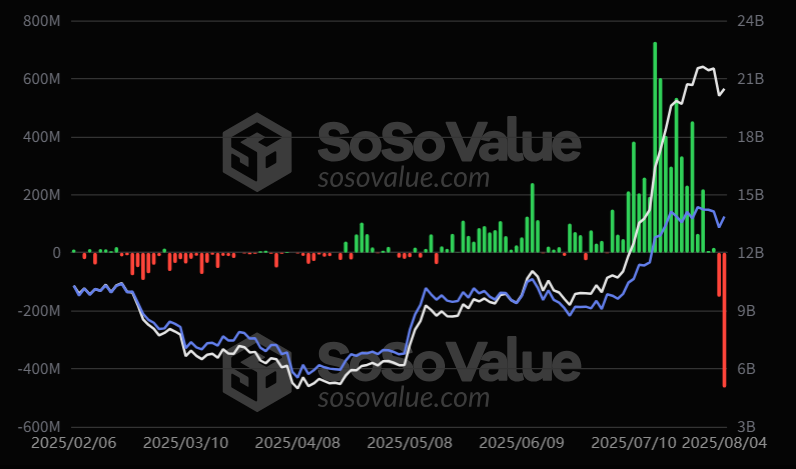

According to Soso Value, a cryptocurrency data platform, $333.19 million was withdrawn from the US Bit spot ETF market on the 4th (local time).

Notably, BlackRock's spot ETF (IBIT), which holds the most Bit, recorded a net outflow of $292.21 million. This is the first time such a large amount of funds has been withdrawn from IBIT since May 30th, about two months ago.

The US ETH spot ETF performed even worse. On this day, approximately $465.10 million was withdrawn from all ETH spot ETFs, the largest outflow since the ETF was listed in July 2024. BlackRock's ETHA had an overwhelming outflow of $375 million. This ended the 21-day net inflow streak, and BlackRock's ETH holdings decreased by 3%.

Interestingly, the prices of Bit and ETH were not bad that day. Both coins rose by about 1% and 5% respectively, riding on the recovery of the US top three stock markets.

ETF buying, along with purchases from US-listed companies, led the cryptocurrency rise in the second quarter. It is still difficult to confirm whether the ETF market's net outflow will continue for another 5 days. However, if ETF buying decreases, downward pressure on Bit and ETH prices is expected to increase.

These changes in Bit and ETH ETFs are causing confusion among investors. After the US employment data last week caused a significant market shock, the situation is gradually stabilizing.

The FedWatch site provided by the CME Group, which predicts the Fed's interest rate decision, saw the possibility of a September rate cut surge to 95%. Goldman Sachs expects the Federal Reserve to cut rates for three consecutive months starting in September.

Trump is expected to announce a new Federal Reserve board member and BLS director within this week.