A $60,585,668 XRP move has triggered bullish buzz on a top Korean exchange, causing some to wonder if this might be a strategic play by a large holder ahead of XRP's next major move.

According to blockchain tracker Whale Alert, 20,000,000 XRP — worth approximately $60,585,668 — was transferred from major South Korean exchange Upbit to an unknown wallet.

🚨 🚨 🚨 20,000,000 #XRP (60,585,668 USD) transferred from #Upbit to unknown wallethttps://t.co/WIjP5HeLGZ

— Whale Alert (@whale_alert) August 5, 2025

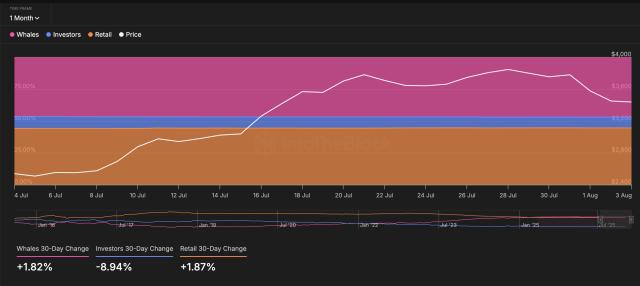

Large-scale withdrawals from centralized exchanges are frequently interpreted as a sign of accumulation, indicating that whales may be positioning for long-term holding rather than immediate trading. The fact that the XRP stash was moved to an unknown wallet might signal self-custody, an increasing trend among large holders looking to secure their crypto assets.

XRP price breakout in view?

At press time, XRP was up 0.93% in the last 24 hours to $3.03. It reached an intraday high of $3.10, continuing its recovery from Sunday's low of $2.72. The recovery marked two days in the green; the price movement reversed at $3.10, establishing it as short-term resistance.

With whales showing renewed activity, traders are waiting to see if XRP will maintain momentum above $3. A failure to hold might put the $2.55-$2.40 support zone back into play, while further accumulation could ignite a fresh breakout.

XRP institutional accumulation ramps up

XRP enthusiast Bill Morgan shared an update on companies planning to include XRP on their balance sheets. Hyperscale's Form 8-K filing discloses that the company will begin reporting monthly updates on its digital asset holdings this month, with the first report reflecting initial XRP assets added to the balance sheet.

On May 28, 2025, Hyperscale announced that its subsidiary, Ault Capital Group Inc., planned to buy $10 million in XRP.

Flora Growth Corp's Form 10-Q filing shows that the company holds XRP (along with Solana and ETH) on its balance sheet. According to the company's website, it purchased digital assets to improve its balance sheet.