XRP is not yet surging, but is close to $3 and maintaining a 35% monthly growth rate. However, over the past week, more than 5.3% of this increase has disappeared. As a result, investors are uncertain whether a breakthrough is imminent or further decline is coming.

August is historically a highly volatile period for XRP. The price is at a critical moment near $3, depending on the actions of traders and whales.

Exchange Inflows and Liquidation Map... Preparing for a Short Squeeze?

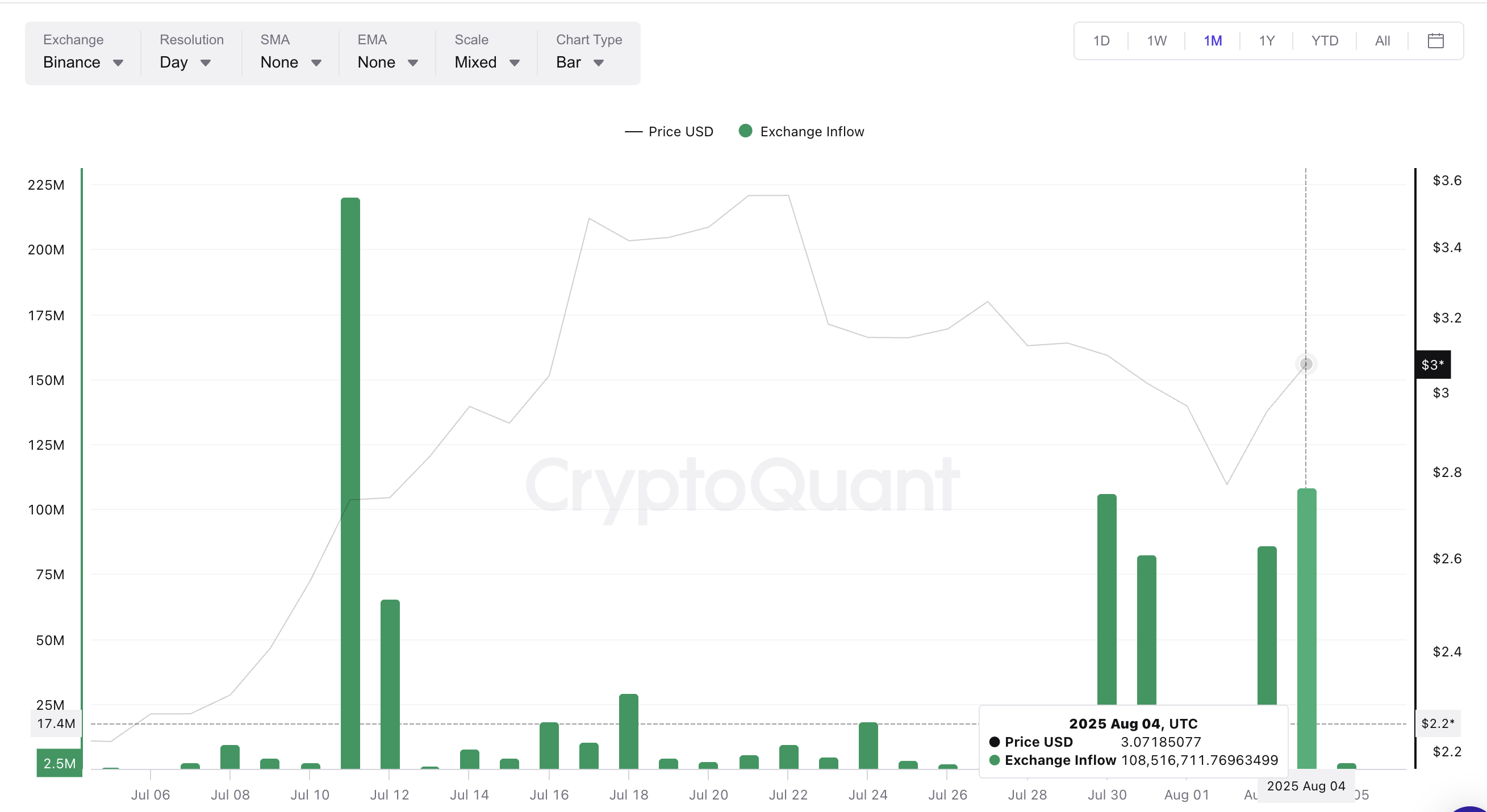

One of the main reasons XRP is not showing a clear surge is the increased selling pressure on exchanges. Since July 30, net inflows have begun to increase again as the price approaches $3.

A similar movement occurred on July 11, when exchange inflows exceeded 220 million XRP. At that time, the price did not immediately adjust and rose above $3.60. Selling followed later. This indicates that traders did not immediately sell but kept funds on exchanges near the top.

Coming back to the present: Inflows are increasing again. This suggests that traders are preparing to sell if XRP exceeds $3. However, despite this downward trend setup, the liquidation map tells a different story and can indicate when actual selling might begin.

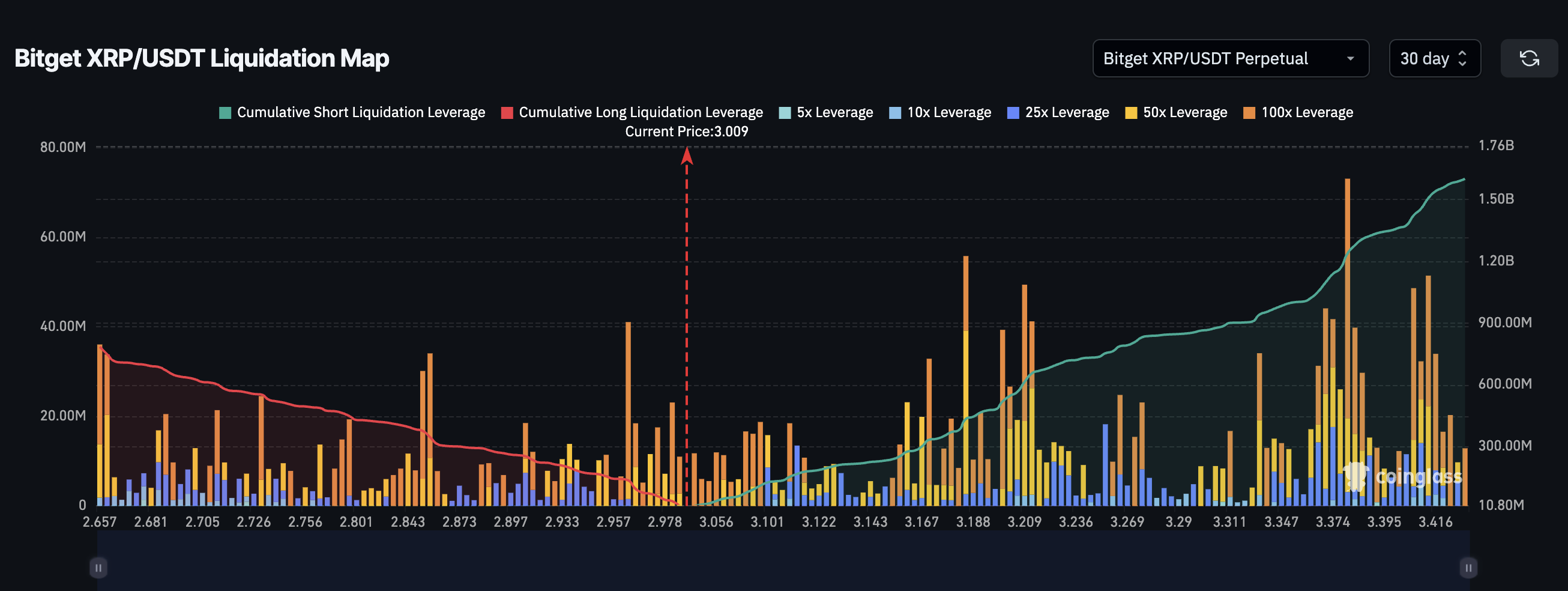

According to Bitget's XRP liquidation data, the market is still heavily skewed towards short positions. Short positions reach $1.6 billion, while long positions are only $784 million. This imbalance means a sudden upward movement could liquidate many short positions. With the current price near $3, a 10% to 14% increase could trigger a short squeeze up to $3.40.

Note: A similar event occurred between July 24 and July 27 when XRP's price suddenly jumped from $2.95 to over $3.30 without a clear catalyst, raising price manipulation suspicions. However, we cannot rule out the possibility of a similar situation recurring.

Token TA and Market Update: Want more of these token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

Whales' Movements to Watch

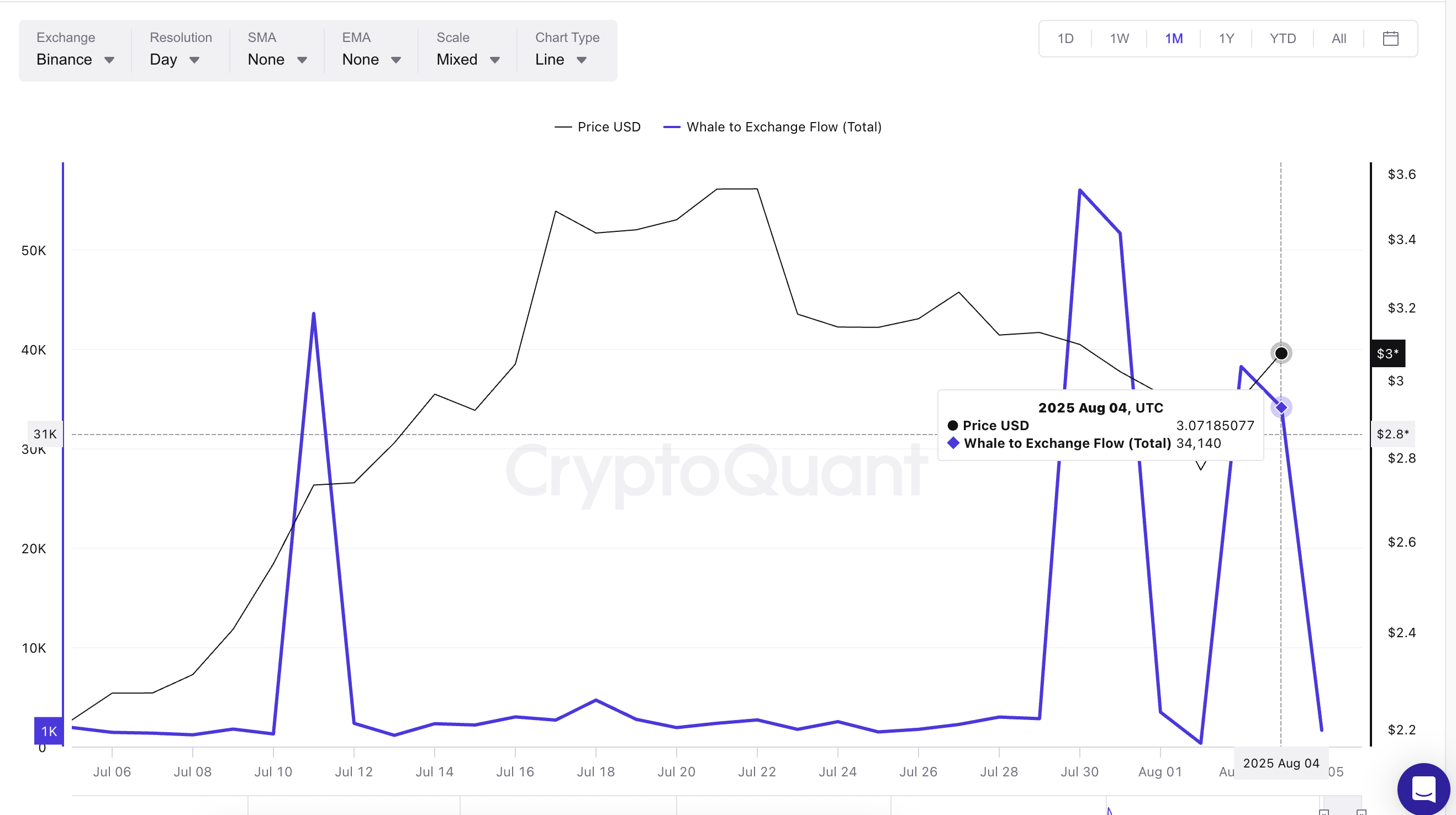

Interestingly, whales could also influence this movement. According to whale-exchange inflow data, large holders have aggressively sold during past rallies. On July 30, whale inflows exceeded 55,000 XRP, the highest in a month, when XRP's price fell below $3. On August 3, inflows reached 38,226 XRP as the price approached $3.

However, afterward, on August 4, inflows decreased to 34,140 XRP. XRP's price is still maintaining above $3. This shows that the number of tokens whales send to exchanges is decreasing even as the price rises. This could mean they are cautiously observing or that whale-driven selling pressure has finally eased. These two signals are positive for XRP's price in the short term.

However, if whale inflows increase again between $3.08 and $3.30, they could generate enough selling pressure to limit the "short squeeze" movement. Traders should carefully observe whale behavior before expecting a sustained rally.

Whale-exchange inflows track the number of tokens large holders (whales) send to centralized exchanges. High numbers indicate selling intent, while low inflows might mean whales are holding.

XRP Price Pattern, Key Breakout Level at $3.30

XRP's current price structure is within a descending expanding wedge pattern, often appearing before an upward breakout. This pattern is defined by two downward-tilting expanding trendlines, with price bouncing between them. XRP is now approaching the upper trendline, and breaking $3.19 could put it on a trajectory to challenge $3.30.

The $3.30 level is not just a number. It aligns with an important Fibonacci retracement level and coincides with a cluster of large liquidations. Crossing this point could trigger a wave of liquidations, paving the way for a stronger breakout. Until then, movement between $3 and $3.30 should be seen as part of a potential short squeeze, not a full rally.

A rally could occur if XRP surpasses $3.45, an important Fibonacci target. At this price, all short positions on the Bitget chart would be liquidated. Until then, the short squeeze narrative remains.

However, if it fails to maintain above $3 and falls below $2.72, the upward setup could be invalidated, potentially leading to larger losses.