The madness of Bitcoin, the restructuring of trade patterns, and the evolution of the labor market are all microcosms of the era of hyper-speculative capitalism.

Written by: arndxt

Compiled by: AididiaoJP, Foresight News

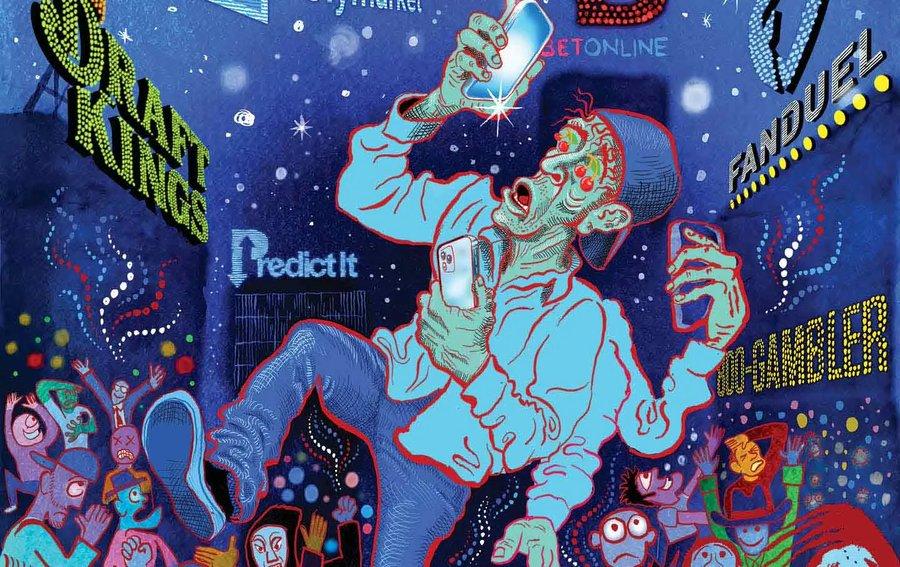

Welcome to the era of hyper-speculative capitalism.

Please pay close attention to the M2 money supply in mid-September.

In the current irrational economic environment, hyper-speculation has become a natural response.

Fiscal and monetary policies were once tools to anchor the market in a certain stable state, but now this stability has developed cracks:

- The United States is running a 7% GDP deficit, which is occurring during a period of full employment.

- Interest rates remain at 5%, yet Bitcoin is approaching its historical high point.

- Monetary policy has been replaced by fiscal dominance, with stimulus measures continuing even during economic "prosperity".

The market no longer reflects fundamentals, but liquidity.

Bitcoin's Madness: Is It Rational in a Chaotic World?

Bitcoin no longer needs a weak economy or interest rate cuts. In fact, the best macroeconomic environment might be one without new shocks, with continuing favorable liquidity conditions.

And liquidity is surging:

- Global M2 money supply remains high and may have peaked.

- If Bitcoin rises 10%, over $13 billion in short positions will be liquidated, indicating that the market still has sufficient funds to drive a parabolic rise.

- Bitcoin typically peaks 525 to 530 days after halving, which means September 21, 2025, could be a key time point.

@MintedMacro provided a clear roadmap based on historical halving cycles:

Liquidity-driven cycle: Bitcoin performs strongly when M2 grows. Currently, M2 has formed a Double Top pattern, with the second peak lower than the first.

Top time prediction:

- 2013: 525 days after halving

- 2017: 530 days after halving

- 2021: 518 days after halving

- 2025: Around September 21

Expected top range:

Bitcoin may reach $135,000 to $150,000

But upside potential may be limited by macroeconomic tightening policies.

Key conclusions:

A rebound may occur in September, followed by a potential liquidity-driven pullback.

In a context of distorted fundamentals and liquidity as the dominant force, market participants are adapting.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]- The protocol aims to shift more manufacturing activities to the United States, but it remains unclear how to fill positions amid labor shortages and tightened immigration policies.

- This contradiction weakens the strategy of reducing trade deficits through reshoring.

Automotive Industry Rebound: Unfair Competition

U.S. automakers face higher costs compared to Japanese importers, including:

- 25% tariffs on imported parts.

- 50% tariffs on imported steel and aluminum.

- Complex tax refund processes under the North American Free Trade Agreement (NAFTA/USMCA).

Industry leaders warn that the agreement favors Japan over U.S. manufacturers and workers, fearing it sets a precedent for future trade agreements.

Agreement in Doubt: Negotiation Rather Than Contract Signing

- No formal treaty signed; both parties have already diverged in interpreting terms.

- Raising widespread concerns about U.S. reliance on non-binding trade commitments, potentially eroding trust and stability in future negotiations.

Job Market:

New Graduates Face Unprecedented Recruitment Downturn

- Recent college graduates' unemployment rate hits a decade high, only one percentage point lower than all young workers, with an unusually narrow gap.

- Historically, college graduates' employment prospects were far superior to peers, and this convergence is a warning signal for white-collar employment trends.

AI Not the Primary Cause, At Least for Now

- Despite generative AI being blamed for eliminating entry-level positions, its impact remains limited to specific industries (such as tech).

- Broader measures are insufficient to explain the widespread recruitment weakness for graduates.

Policy Uncertainty Cools the Market

- Uncertainty in trade policies, Federal Reserve interest rate direction, and immigration restrictions may hinder corporate hiring, especially for technical positions.

- This uncertainty also affects employee behavior, with low resignation rates reflecting hesitation to change jobs in an unstable market.

- Reduced resignations = fewer job vacancies, leading to slower labor market mobility.

Technical Worker Shortage Easing

- The long-standing shortage of college graduates, which was a key driver of high wage premiums, is weakening.

- As more workers enter the technical labor pool, wage premiums tend to flatten or decline, potentially further suppressing creativity in traditional high-growth industries.

India Focus

UK-India Trade Agreement: A Significant Non-U.S. Pivot

- The UK and India have reached a milestone trade agreement, reducing tariffs on over 90% of UK exports to Indian merchants.

- The UK expects exports to India to grow by 60% by 2040, benefiting from rapidly growing market access.

Automotive Industry Big Winner

- India has reduced car import tariffs from 100% to 10%, a dramatic change that could reshape the automotive market.

- However, quota limits restrict total imports, dampening short-term commercial gains for UK automakers.

India Gains Significantly

Despite news focusing on UK export growth, India benefits more from its own tariff reductions:

- Lower consumer prices

- Increased domestic competition

- Enhanced global competitiveness of Indian enterprises

These structural advantages may boost India's long-term export capacity and productivity.

50% of India's Exports to UK Duty-Free

Approximately 50% of Indian exports previously facing 4%–16% tariffs will now enter the UK duty-free, supporting Indian textile, pharmaceutical, and food exporters.

Strategic Trade Restructuring

- The agreement reflects a global trend: as U.S. tariffs disrupt existing trade patterns, countries are attempting to diversify partnerships.

- India is actively seeking trade liberalization with the EU, ASEAN, and even the U.S., positioning itself as a key player in the post-globalization reset.

Summary

The core characteristics of the hyper-speculative capitalist era are liquidity-driven, fiscally dominated, and market deviation from traditional economic logic. Bitcoin's frenzy, trade pattern reconstruction, and labor market evolution are microcosms of this era. Investors and policymakers need to adapt to this new reality, flexibly addressing challenges from liquidity fluctuations and policy uncertainty.

A notable feature of the current global economy is market behavior driven by liquidity. Traditional economic theory suggests asset prices should reflect intrinsic value or discounted future cash flows. However, in the hyper-speculative capitalist era, liquidity—the abundance of available funds—becomes the primary factor driving market prices.

Taking Bitcoin as an example, its price fluctuations are highly correlated with global M2 money supply growth. When central banks inject large amounts of funds into the market through quantitative easing or other means, these funds often flow to high-risk, high-return assets like cryptocurrencies. This phenomenon is particularly evident in 2025, where despite the Federal Reserve maintaining relatively high interest rates, Bitcoin continues to rise, reflecting market dependence on liquidity that now supersedes attention to traditional economic indicators.