The cryptocurrency market capitalization in August is not showing the same strong performance as in July. The upward trend has stopped as long-dormant whales awaken and traders prefer to realize profits.

This raises an important question: Should investors sell in August and wait for a new low point? Recent expert analysis provides deeper insights.

Realize Profits in August? Or Would That Be a Wrong Investment Strategy?

Compared to July's peak of $4 trillion market capitalization, the market has adjusted by 6.7% and is currently at $3.67 trillion.

While this is not a major correction, new developments in August have raised concerns. These include awakened whales, slowing ETF inflows, resumed tariff pressures, and DXY (US Dollar Index) rebound. These factors combined increase fears of a strong correction in August.

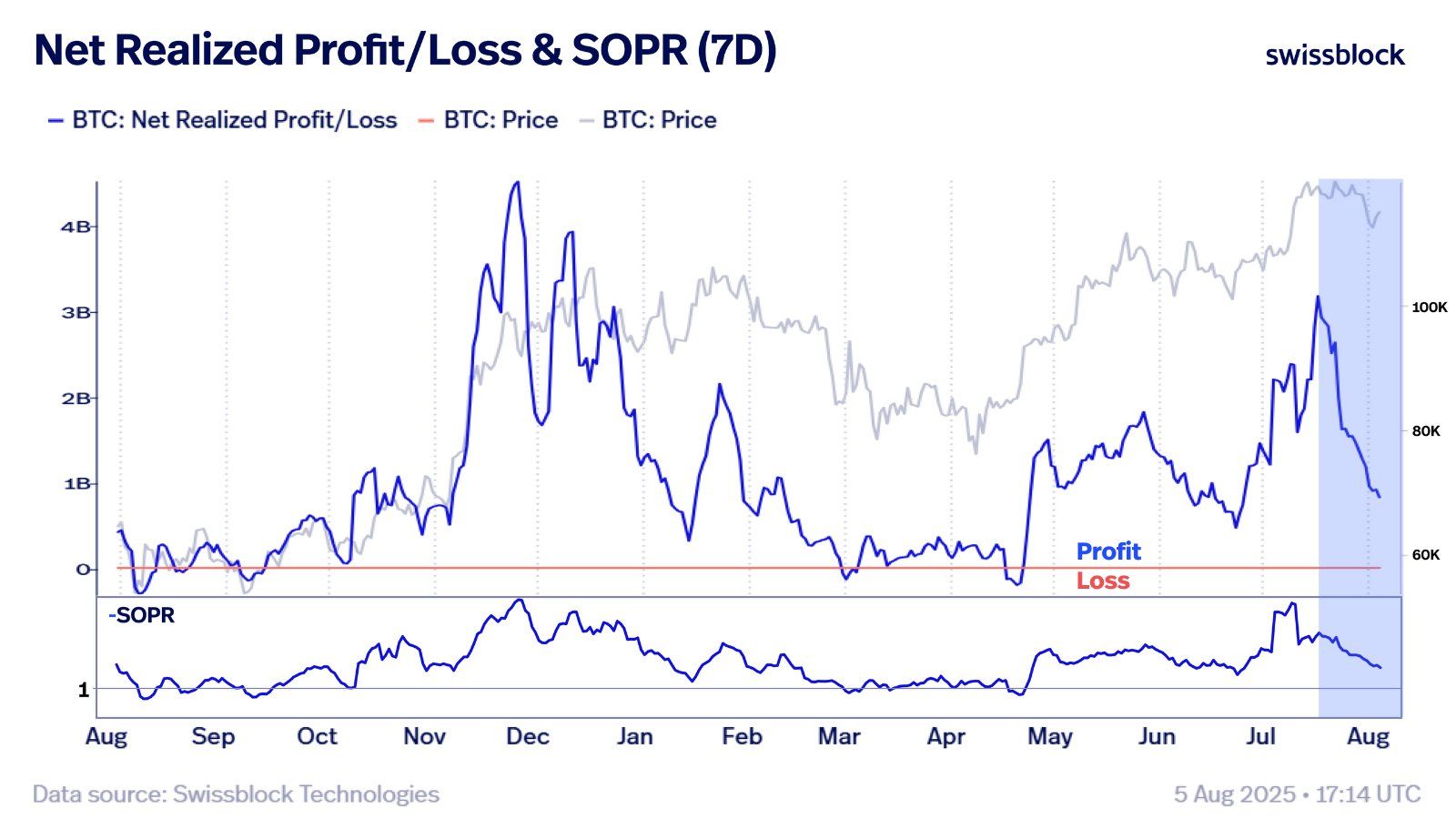

However, Swissblock's latest report on Bitcoin views the recent price drop as a positive stage, seeing it as a necessary cooling period after a previous price surge.

The report focuses on two key indicators: Net Realized Profit/Loss (PnL) and 7-day SOPR (Spent Output Profit Ratio). Both indicators are declining but not severely.

"This correction is a healthy cooldown, not a structural weakness. Net realized PnL is dropping sharply, and selling intensity is low. SOPR is declining but not collapsing. Investors are not panicking out but want to sell at higher prices. This is a constructive reset." – Swissblock statement.

While the report does not predict specific price levels for Bitcoin's rebound, other analysts believe BTC could adjust to around $95,000 before recovering.

For altcoins, the altcoin market capitalization (TOTAL3) has dropped by over 10% from July's $1.1 trillion to $96.3 billion in August.

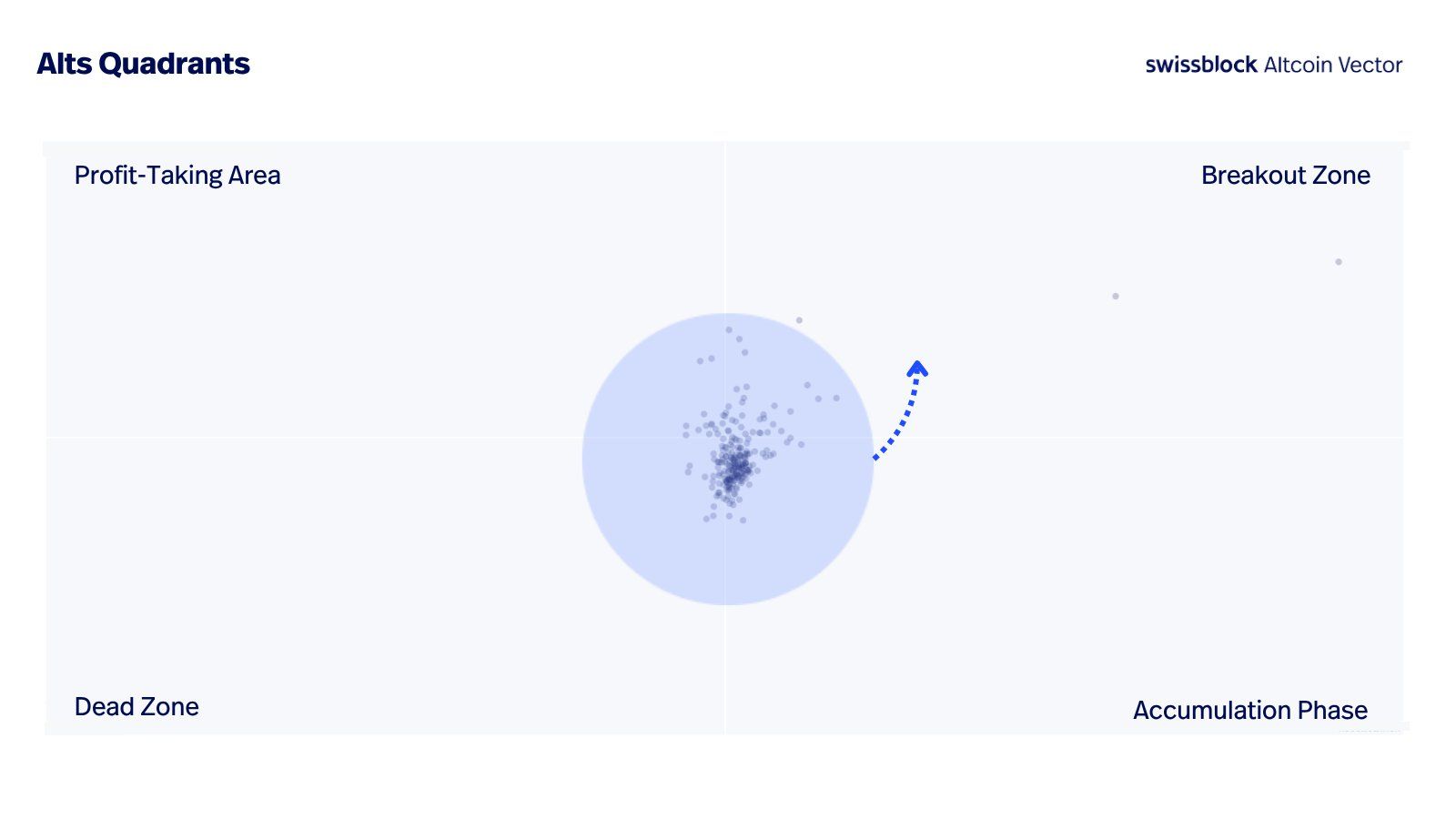

However, Altcoin Vector's report maintains that altcoins remain very promising.

The report uses a quadrant chart dividing the altcoin cycle into four stages. The chart has moved counterclockwise since July and is now heading towards the "breakout zone".

"Smart capital rotates here before the crowd sees it. Momentum is shifting, and the structure is stabilizing. This is not a breakout: pre-positioning is now beginning." – Altcoin Vector.

Cryptocurrency analyst VirtualBacon explained why selling in August could be a costly mistake.

🚨Why Selling in August is a Big Mistake🚨

— VirtualBacon (@VirtualBacon0x) August 5, 2025

Markets look shaky. FUD is everywhere. But if you sell now, you could miss the best setup of the year.

Here's why I'm staying patient and what I'm doing instead 🧵👇

He acknowledged that some events might be concerning but there's no need to panic. The reasons are:

- The tariff announcement on August 7 may just be short-term noise similar to past events.

- Weak labor data could increase the possibility of a Fed rate cut.

- The US Treasury could withdraw $500 billion, which might cause short-term volatility but is not a full liquidity crisis.

Moreover, market sentiment has calmed down. It was in the "greed" zone in July but has now retreated to the "neutral" zone. The market has not entered the "extreme greed" state since February, which is typically considered an ideal time to make selling decisions.