Tom Lee, co-founder of Fundstrat and chairman of BitMain Emerging Technologies, called Ethereum (ETH) the 'biggest macro trade over the next 10 years'.

While acknowledging Bitcoin's (BTC) role as a store of value, he emphasized that Ethereum is becoming increasingly important in the digitalization of assets.

Ethereum's Future? Tom Lee Reveals 10-Year Crypto Bet

In a recent Coin Story interview with Natalie Brunel, Tom Lee, who has long supported Bitcoin, is also an Ethereum advocate and emphasized that there is no conflict between the two coins because both Bitcoin and Ethereum play unique and valuable roles in the cryptocurrency ecosystem.

He views Bitcoin as a store of value and mentioned that it is replacing gold. However, he stressed that Ethereum's utility goes beyond value storage. Lee explained that the world is transitioning to digitalization, and Ethereum is at its center.

"We are storing information and tokenizing businesses... and dollars... Stablecoins have now actually become major buyers of government bonds. We don't need to worry about deficits because stablecoins will buy the debt. This is the ChatGPT moment for crypto because the first killer app of crypto that is widely adopted is stablecoins," he said.

He added that this change has encouraged Wall Street to tokenize assets and explore blockchain for financialization, which requires smart contracts.

While Bitcoin paved the way by showing digital assets can create value, Lee believes Ethereum is the optimal choice for stablecoins and asset tokenization as a secure and legally compliant platform.

"When I first wrote about Bitcoin in 2017, I saw it as the moment Wall Street would eventually recognize its importance... I think Ethereum is having its 2017 moment now because this is when Wall Street is taking tokenization seriously, and it's happening on Ethereum. I think this is the biggest macro trade over the next 10 years," Lee mentioned.

The BitMain executive also argued that risks associated with Ethereum are minimal compared to vulnerabilities in traditional financial systems. He pointed out that major institutions like JP Morgan also face questionable transactions. In this context, Ethereum provides superior security and resilience.

If he had to choose between BTC and ETH for investment over the next 10 years, Lee said:

"Because I'm the chairman of BitMain and operating the Ethereum treasury, I will naturally choose Ethereum."

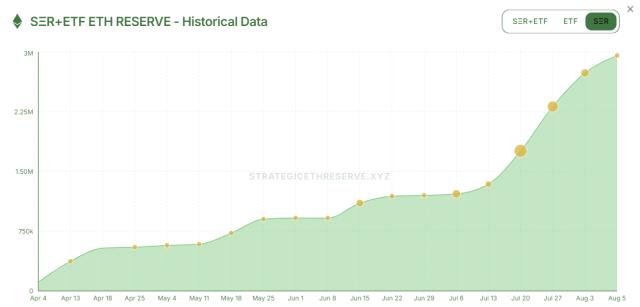

This statement came as BitMain continues to strengthen its ETH investment. BeInCrypto reported that the company's holdings exceeded 833,000 ETH early this week, becoming the largest corporate ETH treasury.

Meanwhile, Lee and BitMain are not the only ones with a positive outlook on Ethereum. Bill Zielke, BitPay's Chief Revenue Officer, recently emphasized Ethereum's continued adoption in an exclusive interview with BeInCrypto.

"Among BitPay users and merchants, Ethereum has consistently established itself as the third most popular blockchain in crypto payments. And regarding stablecoins, which have seen a surge in usage over recent quarters, Ethereum occupies a larger proportion. By 2025, payments and transfers on Ethereum will account for 95% of BitPay's stablecoin transaction volume," Zielke mentioned.

He noted that Ethereum is maturing into a scalable and modular ecosystem that balances decentralization and performance. These developments are crucial in opening up a wider range of use cases.

These include micro-transactions, enterprise-scale payment infrastructure, and further solidify Ethereum's position in the changing digital economy.