In the cryptocurrency market over the past 24 hours, approximately $171.7 million (about 251 billion won) worth of leverage positions were liquidated.

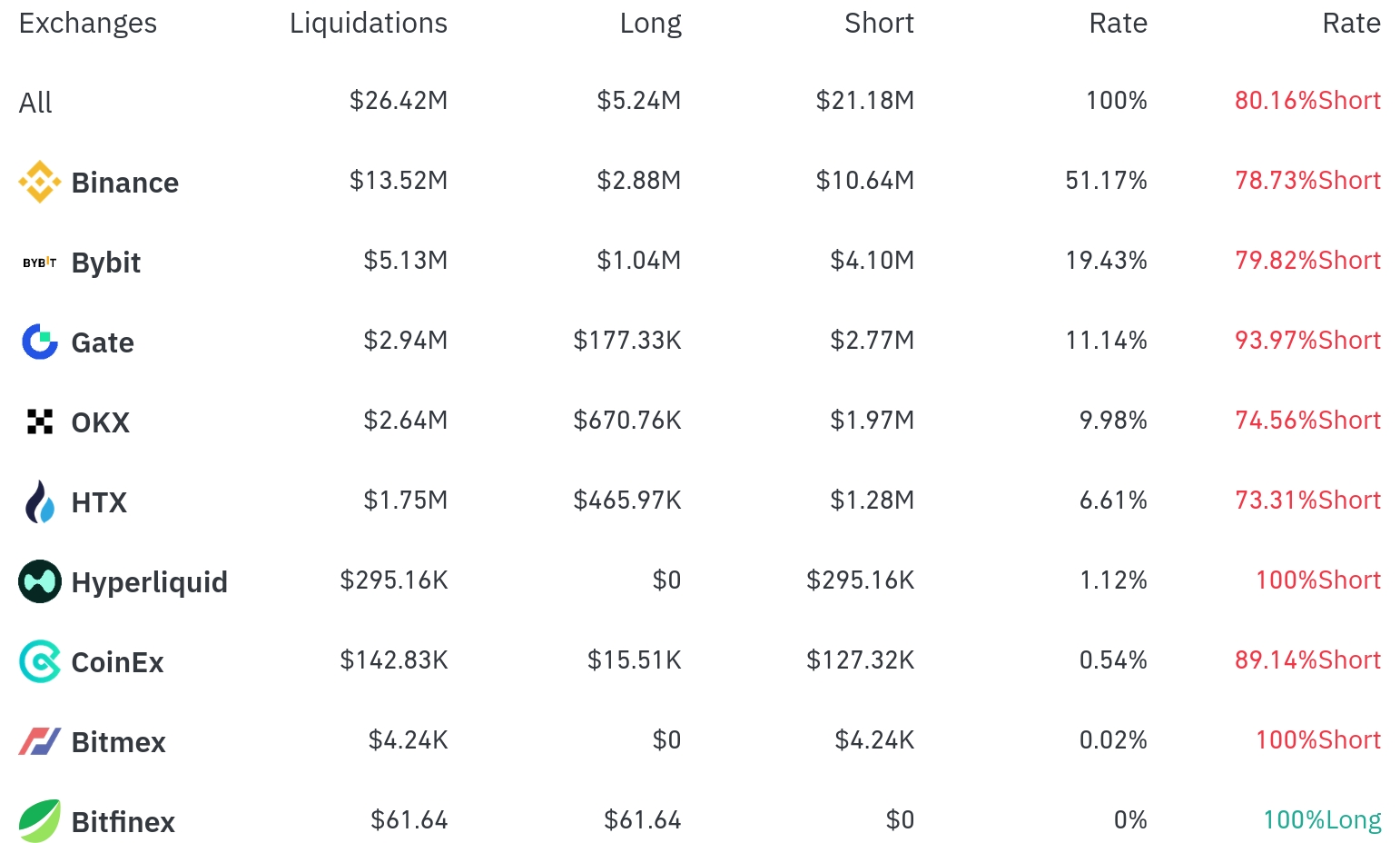

According to the currently aggregated data, short positions accounted for about 80.16% of the liquidated positions, showing an overwhelming proportion. Based on a 4-hour timeframe, the total liquidation amount was $26.36 million, with short positions at $21.18 million and long positions at $5.18 million.

Binance had the highest position liquidations over the past 4 hours, with a total of $13.52 million (51.17% of the total) liquidated. Among this, short positions accounted for $10.64 million, or 78.73%.

Bybit was the second-highest exchange, with $5.13 million (19.43%) of positions liquidated, of which short positions were $4.10 million (79.82%).

Gate.io saw approximately $2.94 million (11.14%) in liquidations, with the highest short position ratio among major exchanges at 93.97%.

Notably, Hyperliquid and BitMEX only liquidated 100% short positions, and most exchanges showed an overwhelmingly high short position liquidation rate.

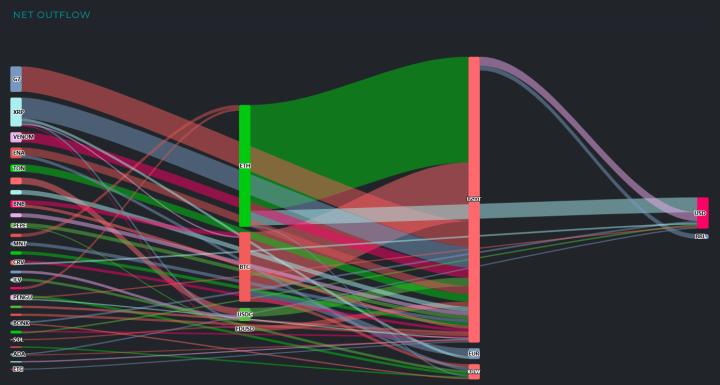

By coin, Ethereum (ETH) recorded the highest liquidations. Approximately $66.98 million in Ethereum positions were liquidated over 24 hours, and $36.81 million (long $10.72 million, short $26.09 million) over 4 hours. This is related to Ethereum's 2.79% price increase over 24 hours.

Bitcoin (BTC) had about $23.40 million in positions liquidated over 24 hours, with $8.59 million (long $3.72 million, short $4.87 million) over 4 hours. Bitcoin is currently trading at $115,007, up 1.19% over 24 hours.

Solana (SOL) saw approximately $9.06 million liquidated over 24 hours, with $5.40 million over 4 hours. Solana's price rose 3.40% to $168.05.

XRP recorded $8.01 million in liquidations over 24 hours with a 1.96% price increase, while Doge saw $4.63 million in liquidations with a 3.67% rise.

Notably, the MYX Token experienced a large-scale liquidation of $14.99 million over 24 hours, and the PROVE Token recorded $9 million in liquidations.

With most major altcoins showing price increases between 2-4%, this large-scale short position liquidation suggests the possibility of a short-term bullish trend in the cryptocurrency market. Particularly noteworthy is the massive short position liquidation alongside Ethereum's strong upward momentum.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>