Rumors of a Japanese XRP ETF have hit the crypto community following a new report from SBI Holdings. Citing changes in regulatory policies, the company presented theoretical plans for a new cryptocurrency ETF.

However, they will not make any official moves until the legal situation improves. Nevertheless, SBI Holdings has well-documented interest in XRP. As a leading candidate to drive the ETF competition in Japan, they are an excellent prospect.

New XRP ETF Rumors

One of the continuously interesting topics in cryptocurrency is the XRP ETF. This product started trading in Brazil in April and was launched in Canada in June, but US regulatory authorities continue to delay.

Thanks to recent developments, social media rumors suggest that Japan might be the next country to launch this product.

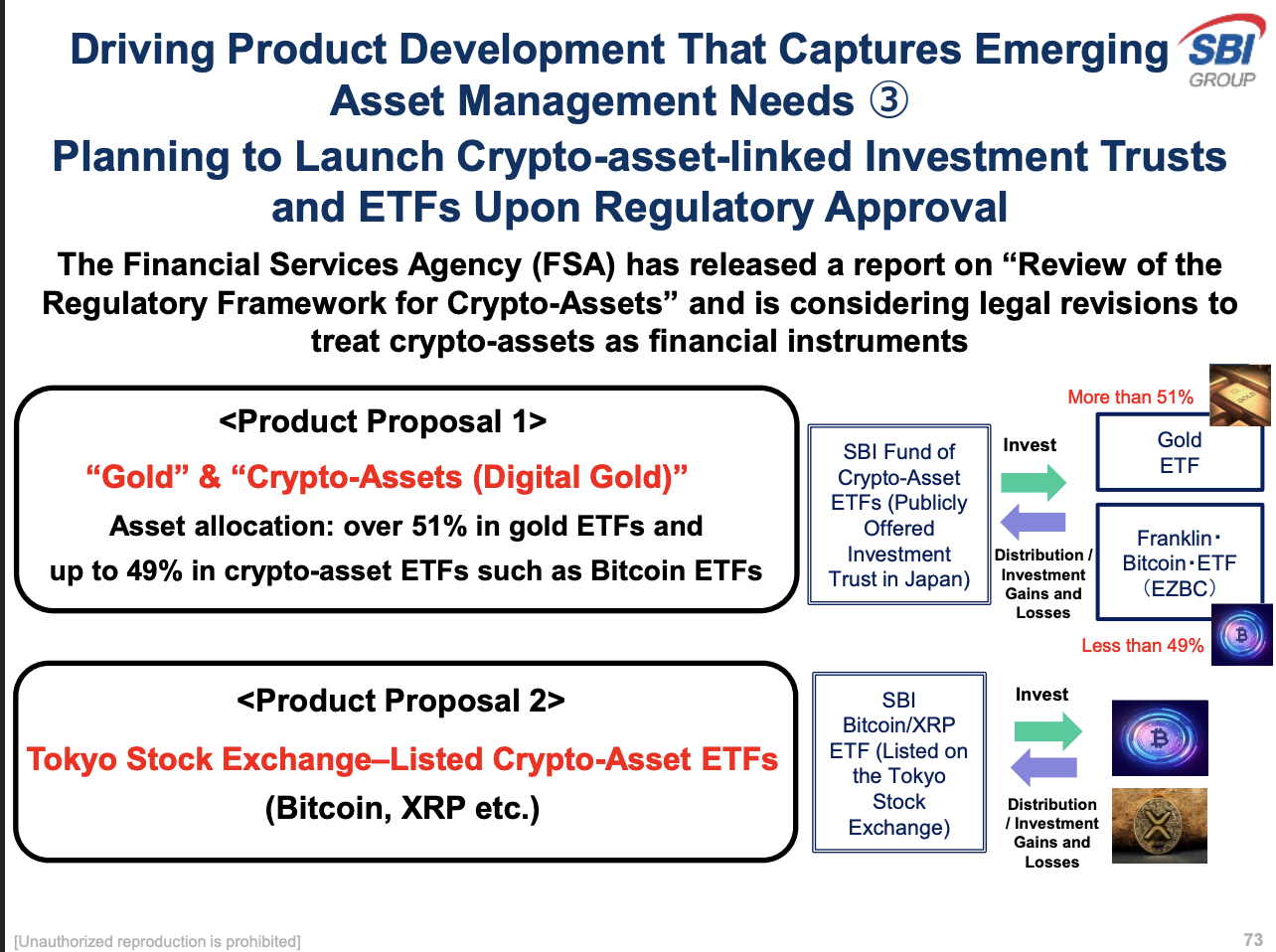

Why is this? SBI Holdings, a major financial corporation in Japan, recently announced its 2025 second-quarter financial results. Among various topics, they mentioned the country's regulatory developments, which could enable the creation of a new token-based ETF.

One of the ETF proposals focused on indirect cryptocurrency exposure, and another included XRP:

High Interest, Credible?

SBI has strong reasons to establish an XRP ETF.

First, the company has an established history with Ripple and is currently one of XRP's largest users. They also allow customers to acquire XRP through credit card points.

However, social media rumors have incorrectly implied or falsely claimed that SBI has already applied for an XRP ETF. Unfortunately, this is exaggerated.

At least Japan is taking cryptocurrency regulation seriously. One of the main financial regulatory bodies recently began operating a working group on web3 policies. This signal encouraged SBI to prepare such virtual products.

Nevertheless, SBI will not move until it receives clearer guidelines from the authorities. Also, the advertised product is not actually an XRP ETF. It will be a basket product combining XRP and several other major tokens.

In fact, the United States has already approved such products but faces several obstacles before market access.

Still, SBI has a definite history of partnership with Ripple and interest in XRP. If anyone were to launch an XRP ETF in Japan, they would be a strong candidate.

However, for now, like most XRP fans worldwide, they must wait for regulatory approval.