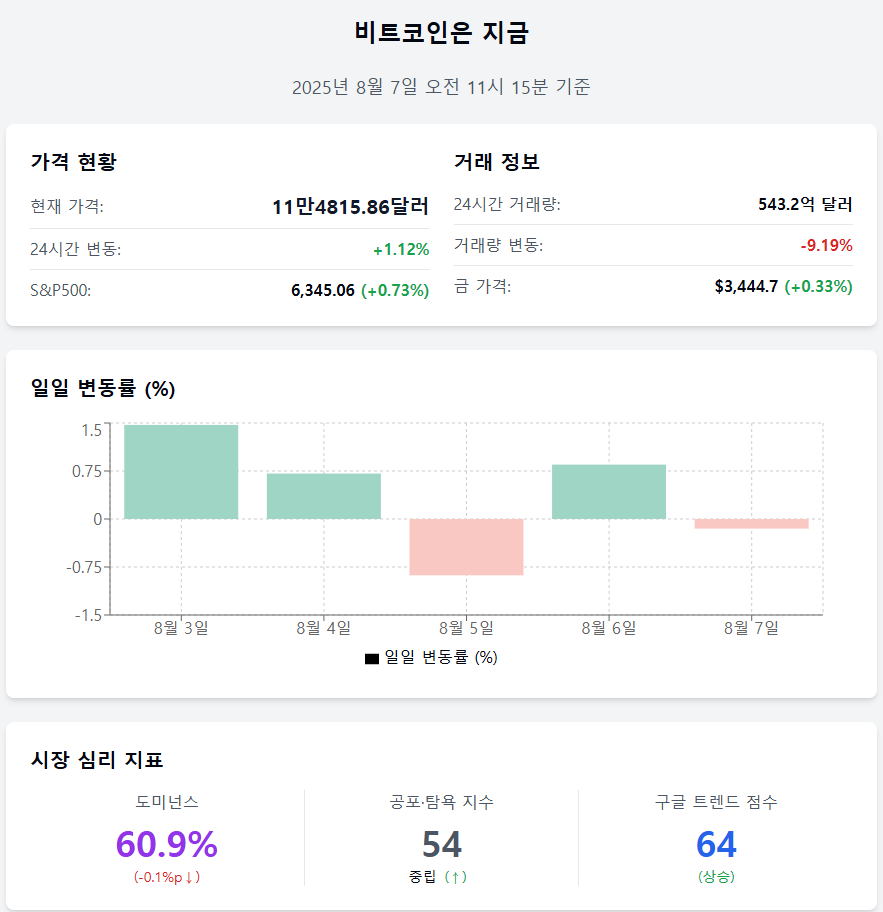

As of August 7, 2025, at 11:15 AM

The Bitcoin market maintains a strong buying basis even in a technical neutral trend, with an increase in on-chain participants and expanded exchange withdrawal tax.

📈 Price now

Price $114,815.86 (+1.12%) Bitcoin is trading at $114,815.86, up 1.12% from the previous day. After a short-term rebound, it continues to move horizontally without a strong trend.

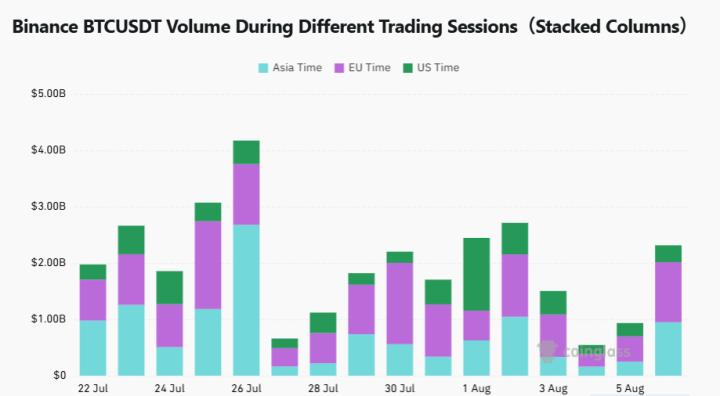

Trading volume $5.432 billion (–9.19%) The 24-hour trading volume decreased by 9.19% to $5.432 billion, maintaining buying sentiment with some short-term wait-and-see attitude.

Daily fluctuation –0.15% The daily fluctuation over the past 5 days was recorded as +1.47% (3rd), +0.71% (4th), –0.88% (5th), +0.85% (6th), –0.15% (7th). Price volatility is limited, continuing a short-term neutral trend.

Asset comparison S&P500↑ · Gold↑ The S&P500 index rose 0.73% to 6,345.06, and gold price increased 0.33% to $3,444.7. Both risk and safe assets are showing a slight upward trend, indicating a minor improvement in market sentiment.

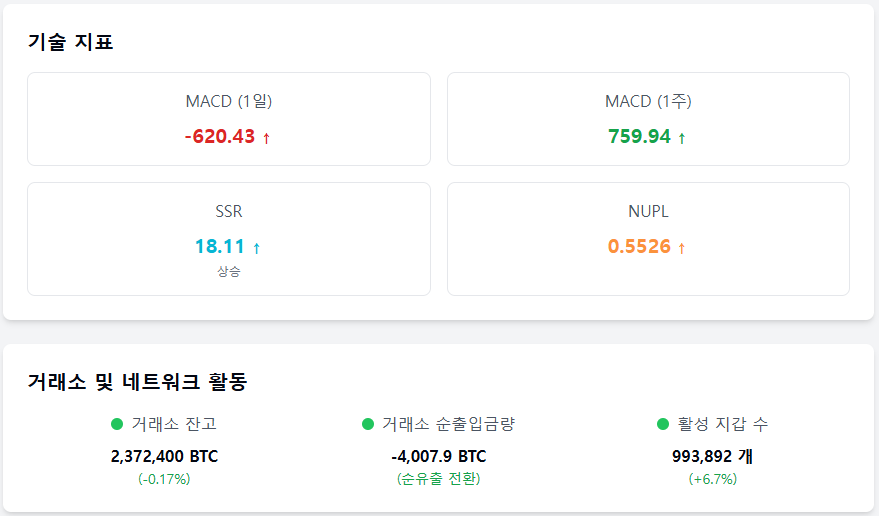

MACD –620.43 The short-term MACD is –620.43, showing a continued weak trend, but the 1-week MACD is 759.94, maintaining a medium-term upward trend.

❤️ Investment sentiment now

Dominance 60.9% (–0.1%p) Bitcoin dominance decreased by 0.1 percentage points, showing some diversification towards altcoins.

Fear & Greed Index 54 (Neutral) The Fear & Greed Index slightly increased from the previous day (52) and remains in the 'Neutral' range. Compared to last week's 'Greed' (62), the investment sentiment has entered a stabilization phase.

Google Trend score 64 The Bitcoin-related search score rose from 62 on the 6th to 64 on the 7th. Public interest shows a gentle rebound.

🧭 Market now

SSR 18.11 (+0.18) The Stablecoin Supply Ratio (SSR) increased slightly to 18.11, indicating a somewhat increased Bitcoin value compared to stablecoins and suggesting limited buying capacity in the short term.

NUPL 0.5526 (+0.0035) The Net Unrealized Profit/Loss (NUPL) rose, showing a slight expansion in the proportion of investors in the profit zone.

Exchange balance 2,372,400 BTC (–0.17%) The Bitcoin holdings on exchanges decreased by 0.17% to 2,372,400 BTC, with withdrawal tax prevailing.

Exchange net inflow –4,007.9 BTC (–8.69%) The 24-hour net inflow is –4,007.9 BTC, significantly decreased from the previous day, interpreted as a reduction in selling pressure across exchanges.

Active wallets 993,892 (+6.7%) Active wallet numbers increased by 6.7% from the previous day (931,290), showing a revival in on-chain activity.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>