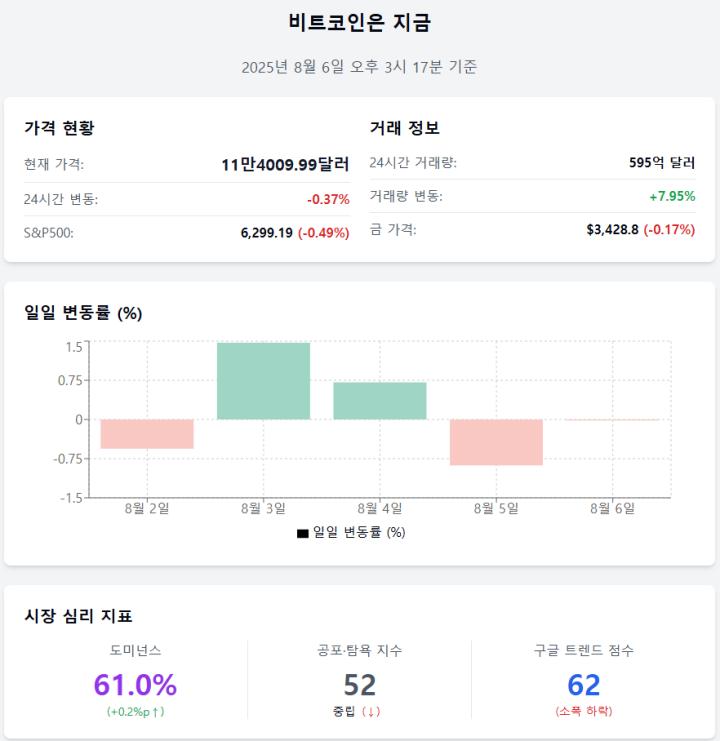

In the first week of August, the cryptocurrency market is showing an interesting aspect. While the total market capitalization is stagnating in the 3.6-3.8 trillion dollar range, looking inside reveals two completely different markets coexisting.

Individual investors are gradually withdrawing from major coins. As Bit continues to touch the 50-day moving average around $114,550, 'fatigue' has accumulated. FxPro analyst Alex Kuptsikevich interpreted that "this phenomenon shows short-term investors are moving to microcap tokens after realizing profits in search of higher returns".

In contrast, institutions see this as a 'bargain' opportunity. Game company SharpLink alone added Ethereum worth $264.5 million just last week. Currently, 64 companies hold 2.96 million Ethereum, accounting for 2.45% of total supply. Bit was also additionally purchased by institutions at 26,700 in July, reaching a total holding of 1.35 million (6% of circulation).

Signals of this 'smart money' judgment also appeared in the ETF market. Funds that had flowed out in 4 days returned, with $91.5 million net inflow to Bit ETF and $35.12 million to Ethereum ETF. BlackRock's IBIT leading with $42 million inflow signifies restoration of trust from major institutions.

Even more noteworthy is the explosive growth of the stablecoin market. Ethena's USDe surged 75% since mid-July, rising to the third-largest stablecoin at $9.5 billion, and the entire stablecoin market is growing for 7 consecutive months, approaching $275 billion. This means both institutions and general investors are still moving funds into the cryptocurrency market.

Ultimately, the current situation is interpreted as a 'market maturation' process. While individuals are searching for speculative assets, institutions are betting on verified digital assets. Although it's a summer adjustment phase, steady inflow of institutional funds increases the likelihood of a full-scale market recovery in the second half of the year.