Wall Street Runs Away, Smart Money Buying the Dips? Where is ETH's "Big Opportunity"?

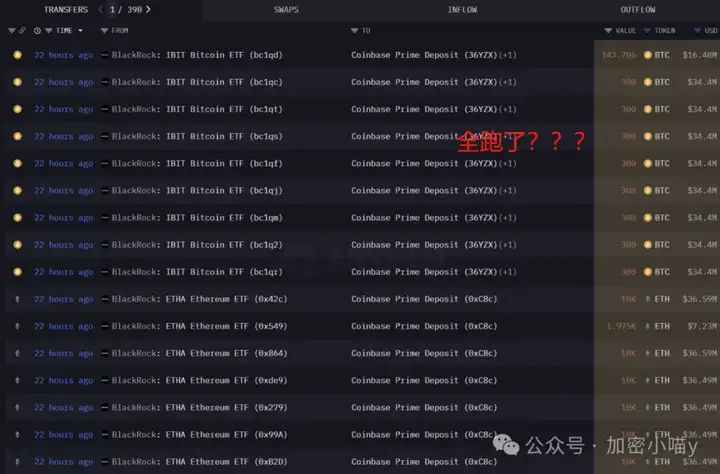

Looking at the on-chain liquidity data these days, BlackRock is reducing positions, and Fidelity and Vanguard have also left, with institutions collectively running away. Does this mean the bull market is over?

But in my view, this pullback is actually an opportunity - what else is this if not a mid-market break? Smart money never waits for market highs to enter, they always layout in advance. Communication + Q: 3806326575

Market Trend: Bitcoin Not Done Falling, ETH Opportunity Getting Closer?

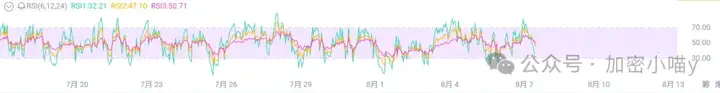

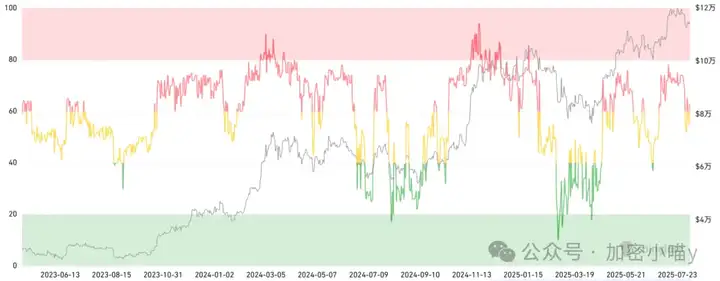

First, the conclusion: BTC will likely pullback 5%-10%, while Ethereum may be the first to stop falling. The reasons are straightforward, five key indicators: ① RSI: Daily level has not yet reached oversold zone, pullback space still exists.

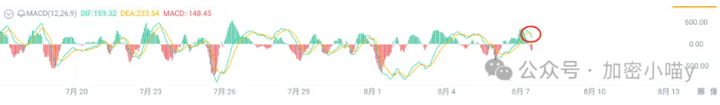

② MACD: Death cross continues, to truly reverse, at least wait for daily golden cross, most likely will retest support at 10.8k.

③ Sentiment Indicator: Greed and Fear index is still "neutral", market is far from desperate, also means bottom has not yet arrived.

④ Funding Rate: Still positive? Indicates bulls have not surrendered, bottom not yet formed.

⑤ Volume Divergence: Trading volume significantly declined at high levels, typical top signal, difficult to maintain strength.

So this is a continuous downward consolidation cycle, most likely to continue until the end of August. Don't rush, the market hasn't been fully cleared out.

Where are the Buy the Dips Signals?

When these signals are all in place, I will consider entering with heavy positions:

- RSI drops below 30 (oversold)

- MACD golden cross

- Greed and Fear falls to "extreme fear"

- Funding rate turns negative (short sellers' feast)

- BTC falls back to 10.8k, key trading dense area

In this round, I suggested taking profits at short from 11.9k, attempting rebound at 11.3k, and continuing to short at 11.6k, with precise entry points. This is based on experience and practical review, not mysticism.

September, October: ETH's Home Ground?

Although the market is still grinding at the bottom, ETH's confidence is growing stronger. Why?

- Multiple "MicroStrategy-style" listed companies are frantically building ETH positions

- Fundamental raised $200 million, with the goal of acquiring 10% of ETH supply

- 180 Life also raised $425 million for ETH ETF related assets

- In October, Ethereum "staking spot ETF" approval probability is very high

The essence of these events is: Traditional whales are quietly laying out Ethereum, while retail investors are panicking and cutting losses.

That's not all, there's another "almost certain" super positive in September: Federal Reserve will start a rate cut cycle! High probability of consecutive three to four rate cuts. Remember the rebounds before August last year and March this year when rates were cut, familiar?

So don't underestimate this pullback, this might be the most tempting entry opportunity in the mid-bull market.

Summary:

- #BTC not yet at bottom, target support around 10.8k

- #ETH stronger than BTC, poised to break through 4000

- Triple positive convergence of funds, policy, and narrative, October might be the key turning point

- Before all bottom signals appear simultaneously, I will remain cautiously optimistic, but once the "bottom" arrives, I will decisively All in

The real wealth opportunity is always hidden in the market's emotional low point. See you at the peak!

That's the article! If you're lost in the crypto world, consider joining my community to layout and harvest from market makers! Can join community WeChat/QQ group for market analysis, altcoin operations... WeChat: c13298103401 or QQ: 3806326575