In the past few days, #Bitcoin has been supported twice near 112,000, and the 4-hour structure has preliminarily shown a signal to stop falling. Especially yesterday's candlestick trend further confirmed this, combined with the return of Coinbase premium - obviously, US stock funds are coming back.

Communication+Q: 3806326575 ETH has also returned to 3700, and as a strong representative among mainstream currencies, its return often means that strong Altcoins are about to follow. This is one of the reasons why I have repeatedly emphasized "buy more when it dips".

ETH: Consolidation is about to end, 3-day line bullish signal established

ETH 3-day line focus: The previous candle formed a piercing pattern with a clear reversal signal; pullback volume is shrinking, bears are retreating; lower shadow did not break support; higher and lower points are rising, still within the upper Bollinger Band. Five out of six signals are bullish, ETH's consolidation is almost over, preparing for a breakthrough.

Altcoins: Is value investing a trap, and MEME the exit for retail investors?

Currently, Altcoins have no significant opportunities, mainly maintaining light or empty positions. But this doesn't mean there's no way out - Altcoin trends are becoming more like the stock market: only coins with clear narratives and proper sentiment can provide short-term opportunities. I'm mainly focusing on several sectors:

- AI, RWA, L2, MEME are the current mainstream speculation lines;

- Remember: Altcoins are for trading, not for belief. Catch the wave, take profits and leave, don't linger.

For example, #Bonk and #Pump on Sol are still rotating old coins, with new coins crashing after a surge. This round, #LIZARD, #Spark, #bstr, #Mad on Bonk all have short-term opportunities, but the key is to run fast. Take profits and withdraw, don't think about counterattacking. Although there's no strong MEME sentiment on the #Sei chain currently, once a coin explodes and funds flow in, tools around the Sei ecosystem will automatically "start working", somewhat like the atmosphere before LayerZero took off.

DeFi: Stablecoin data explodes, ETH breaking $4000 just the beginning?

Latest data shows that the on-chain stablecoin transaction volume in July reached 1.5 trillion, a historical high!

- ETH price is strongly rising;

- DeFi TVL rises to $179 billion;

- USDC becomes the most used stablecoin in DeFi;

- USDT lending demand has doubled.

However, USDC's safety issues have also attracted market attention. The future stablecoin battle may be the core trigger for the next DeFi ecosystem outbreak.

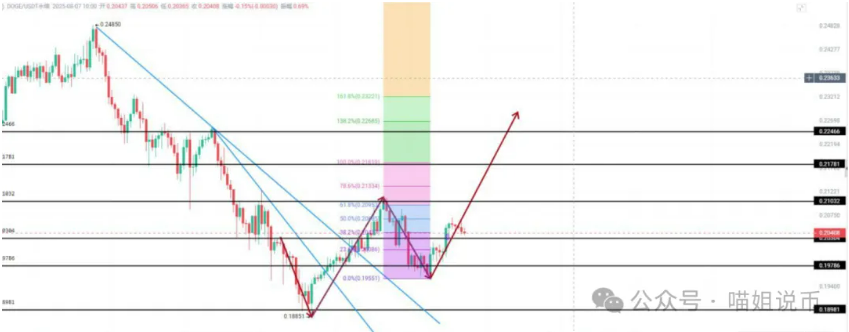

#DOGE: Currently at the 0.618 retracement support of the main uptrend, in a consolidation phase, still bullish, recommended to wait for a pullback before entering;

Communication+V: c13298103401 #PENGU (Little Penguin): 4-hour line breaks adjustment, strong short-term trend expectation, bullish if maintaining new highs;

#ADA: Three-hour golden cross, first time since August, clear short-term bullish signal, may see volume if breaking the $1 psychological level.

September FOMC to become a turning point?

According to the latest data, the probability of a September rate cut is as high as 92%. If the Fed truly cuts to 4% at the 17th FOMC meeting, it will be a real liquidity release! Historically, the start of every major trend almost always hits the "expectation gap" line. And now, we're standing on the edge of the next major uptrend.

That's it for the article! If you're lost in the crypto world, consider planning and harvesting with me! Follow the public account: Meow Sister Talks Crypto

You can join the community VX+Q group without threshold to get market analysis, Altcoin operation... V: c13298103401 or Q: 3806326575