Author: By Joe Light – BARRONS

Original Title: Everyone Is Along for the Crypto Ride Now, Even if It Ends Badly

Compiled and Organized: BitpushNews

A year ago, it was hard to imagine holding such a crypto summit in the White House office.

On July 30, 2025, executives from dozens of crypto companies, including Coinbase, Kraken, and Ripple Labs, gathered in the lavishly decorated "Indian Treaty Room" of the Eisenhower Executive Office Building, listening to Trump administration officials rallying support for the 160-page "Crypto National Roadmap".

"It's magical, those who were afraid of regulators 12 months ago are now celebrating the actions of this administration," said a crypto executive in attendance. "We won."

Trump's "Face Change" Leads Wall Street to Place Bets

The Trump administration's shift in attitude towards crypto not only lifted industry restrictions but also gradually led mainstream financial institutions to accept this asset class once viewed as "marginal speculation". Banks previously prohibited from collaborating with crypto companies are now encouraged to actively participate. Companies once sued by the SEC are being guided to integrate into Americans' payment and financial infrastructure.

However, unlike the FTX collapse in 2022, which had almost no substantial impact on the economy, the next crypto market crash might not be so fortunate.

"All the guardrails have been removed overnight," warns Lee Reiners from Duke University's Financial Research Center. "When the next downturn comes, the market will face real pain."

Crypto Assets Surge, Wall Street and Trump "Win-Win"

Since Trump's election, Bitcoin has risen 71% to $116,600; Ethereum has increased by 56%. Coinbase stock has surged 50%, and Robinhood's stock has tripled to $101.

In July, Cantor Fitzgerald analysts wrote in a report: "As Bitcoin believers, we are thrilled to see the industry reach this point."

The rapid rise of crypto power in Washington is also surprising. Trump had previously publicly stated that crypto was "worthless" and told media in 2021 that it was "like a scam". However, after 2022, he earned millions through "Trump Digital Trading Cards" (Non-Fungible Token), dramatically changing his stance. His family has also ventured into founding crypto enterprises, launching lending platforms; the Trump Media Group, controlled by his family, disclosed in August holding $2 billion in Bitcoin and related securities.

During the 2024 election, the crypto industry became one of the main political donors, not only helping Trump win but also supporting bipartisan lawmakers who promised to support industry legislation.

Upon taking office, the Trump administration quickly delivered "policy returns": the SEC withdrew charges against Coinbase, Kraken, Robinhood, and even attempted to revoke the court ruling against Ripple (but was rejected by the judge).

Financial System is Becoming "On-Chain"

Regulators are not just "loosening restrictions" but actively promoting traditional finance to embrace crypto more deeply. In April, banking regulators revoked the Biden-era guidelines requiring banks to "report" before engaging with crypto and encouraged banks to resume services for crypto companies.

Wall Street quickly followed: Bank of America and Citigroup CEOs stated on earnings calls that they are considering issuing dollar stablecoins; JPMorgan Chase CEO Jamie Dimon, who once called Bitcoin a "Ponzi scheme", now says he "doesn't want to miss out". Some banks have started accepting loans collateralized by Bitcoin ETFs.

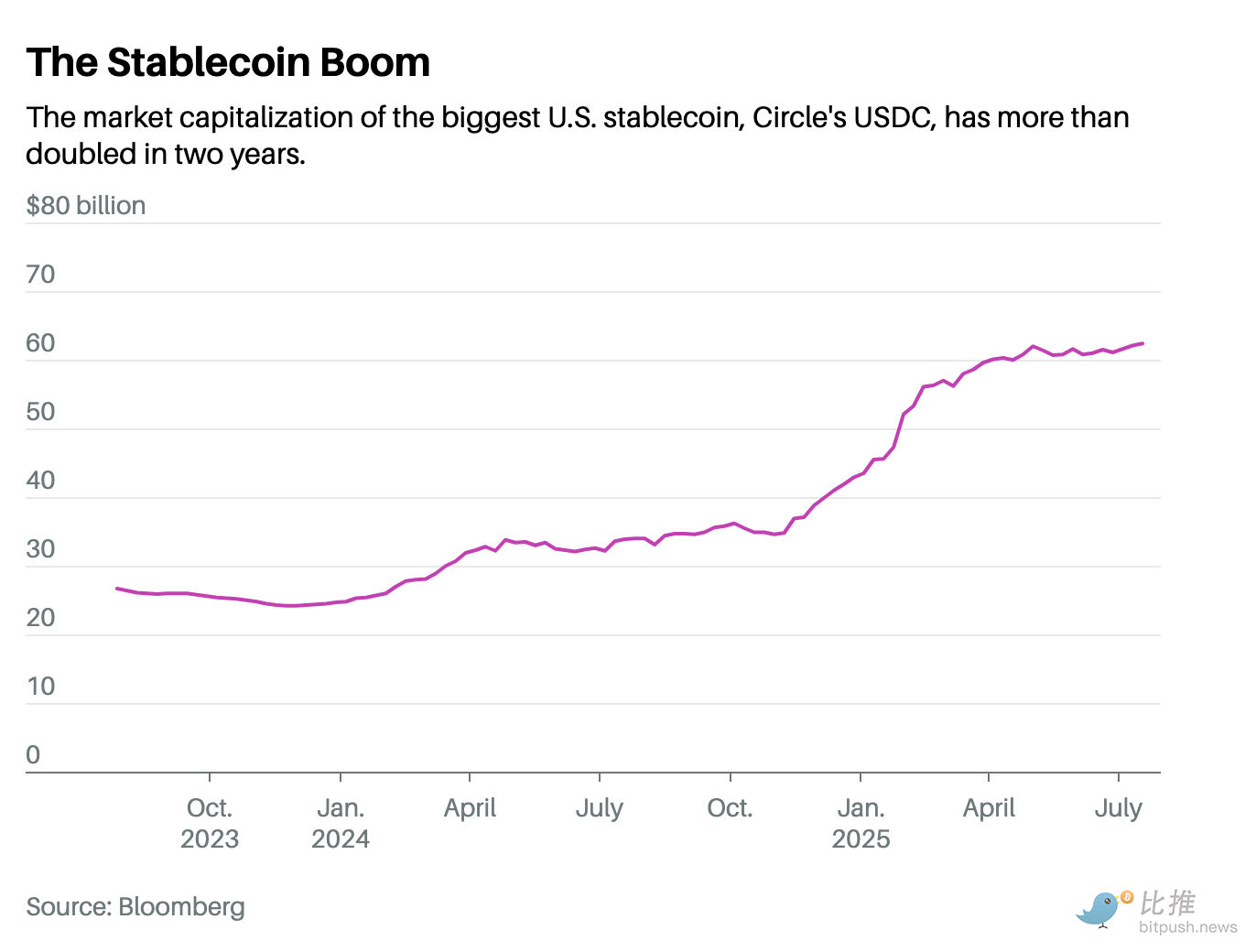

In July, the "Stablecoin Act" signed by Trump went into effect, requiring stablecoins to be backed by safe assets (such as Treasury bonds, bank deposits, money market funds) and allowing their widespread use in payment systems.

However, former SEC official Amanda Fischer warns that the vulnerability of stablecoins during crises cannot be ignored. For example, the 2023 USDC "de-pegging" incident, when Circle disclosed that part of its reserves were in the failed Silicon Valley Bank, causing USDC to drop to 88 cents. Although the government ultimately guaranteed depositor funds and USDC stabilized, the consequences could have been unimaginable if the coin had been widely used for daily payments.

She warns: "If you're a grocery store owner, do you want to hang a stablecoin exchange rate chart on the wall?" If stablecoins collapse, "the government's bailout pressure will be unprecedented."

From Retirement Funds to Housing Loans, Crypto is Penetrating Traditional Finance

The Trump administration is also abolishing Biden-era policies restricting crypto from entering retirement accounts. In May, the Labor Department withdrew its warning about 401(k) crypto investments. In June, the housing finance regulator FHFA asked Fannie Mae and Freddie Mac to investigate whether to allow mortgage applicants to include crypto assets in their lendable assets. This sparked collective opposition from Democratic senators, who fear this move could shake the entire housing finance system.

The crypto industry's next target is the stock market. The SEC says it is studying how to allow companies to issue "tokenized securities", enabling 24/7 trading on the blockchain. Kraken has announced launching tokenized stocks of companies like Apple and Tesla in markets outside the U.S. Coinbase is also calling on the SEC to allow quick listing of such products, claiming they will significantly reduce trading costs and increase transparency.

Traditional financial institutions are issuing warnings. The Securities Industry and Financial Markets Association (SIFMA), representing brokers and asset management companies, noted in a letter to the SEC that these tokenized securities "might bypass existing rules and harm investor protection". The Healthy Markets Association, which includes members like the California Public Employees' Retirement Fund, also stated that relaxing regulations on such new products could repeat the Archegos collapse or the 2010 "Flash Crash" tragedy.

However, Kraken supports the SEC's exploration of tokenization innovation.

White House: This is the "Irreversible Future" of the Financial System

Coinbase Chief Legal Officer Paul Grewal points out that Bitcoin and Ethereum crashes have never caused systemic crises and "never required a bailout". He believes that compared to the crisis roots of traditional finance's "leverage + opacity", the crypto industry is actually safer.

White House officials say that not establishing specific regulations is more dangerous. For example, the newly passed stablecoin act requires issuers to maintain 1:1 reserves, undergo audits, and comply with anti-money laundering requirements. "This technology will be one of the foundations of the future financial system. Shouldn't we establish consumer protection mechanisms?"

The Trump administration's "Crypto National Plan" has just begun. The roadmap suggests the Commodity Futures Trading Commission (CFTC) issue guidelines on digital assets as derivative collateral and establish a "regulatory sandbox" to allow projects to pilot without regulatory burdens. SEC Chairman Paul Atkins also states he will initiate institutional reforms to "help the U.S. financial markets truly go on-chain".

"If you've already won to the point of boredom, then be patient, because we're just getting started," says Treasury Secretary Scott Bessent to the crypto industry.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG Community: https://t.me/BitPushCommunity

BitPush TG Subscription: https://t.me/bitpush