Binance Futures is listing perpetual contracts for two tokens with low market capitalization: YALA and CARV. These contracts will allow leverage up to 50x, attracting the attention of traders in this developing market.

Both assets increased in value by around 9% after the announcement. Their functions are quite different, relating to BTC and AI liquidation, respectively.

Binance's Latest Perpetual Contract List

Binance, the world's largest cryptocurrency exchange, caused market disruption by delisting MEMEFI futures yesterday.

However, in hindsight, this seems to be a way to create space for new listings. Today, Binance announced that they are listing perpetual contracts on two tokens with very low market capitalization, which may signal a new strategy:

To be clear, Binance Alpha had previously listed YALA and CARV. The development lies in the YALAUSDT and CARVUSDT perpetual futures contracts, allowing leverage up to 50x.

Low-cap tokens have been performing well in the market recently, and Binance is building another way to attract trader interest.

Explanation of Two Low-Cap Tokens

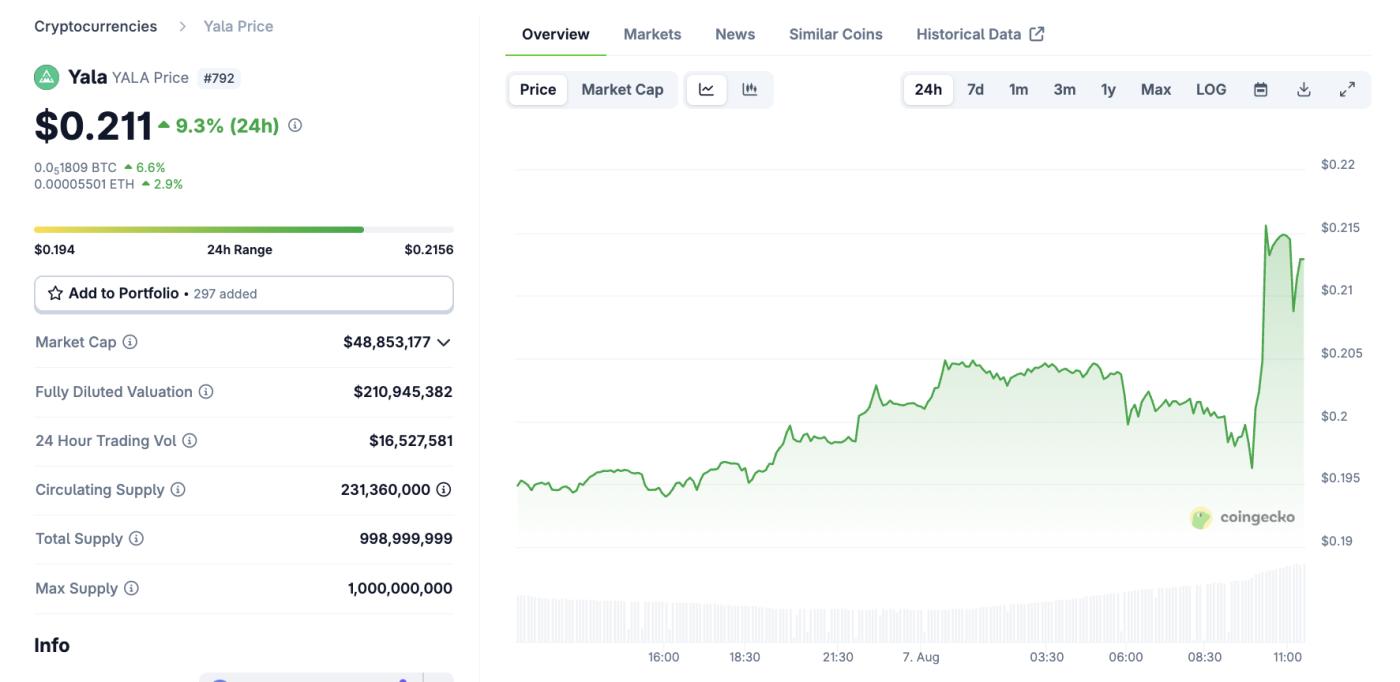

So, what are these tokens? YALA, with a market capitalization of 45 million USD before Binance's listing announcement, is a native Bitcoin liquidation protocol.

It allows users to generate profits on their BTC without selling or wrapping their tokens, and has increased by over 9% after today's development.

YALA price performance. Source: CoinGecko

YALA price performance. Source: CoinGeckoCARV's value also increased by approximately the same percentage after Binance's listing announcement, but that's where the similarity ends. With a TGE about 8 months prior and a market capitalization of 80 million USD before the announcement, it was more established.

CARV is an identity and data module designed for Web3, AI, and gaming applications. It enables human users and AI agents to manage and monetize data rights in the digital ecosystem.

Ultimately, its mission statement takes a maximalist approach to AI, seeking to promote a "new digital life form".

What Does This Mean for Binance?

Between these additions and the delisting of MEMEFI futures, this may indicate that the exchange is interested in low-cap assets.

However, Binance has recently listed a diverse collection of tokens, and this is not an exception. The performance of these new contracts may inform future strategies, but it is too early to make a definitive statement.

Nevertheless, this could be the beginning of a larger trend. Cryptocurrency enthusiasts should monitor this activity as the low-cap token market becomes increasingly popular.