The report from Pantera Capital shows that 9.6% of crypto asset professionals currently receive salaries in stablecoins, with USDC capturing 63% market share, signaling the maturity of on-chain financial infrastructure.

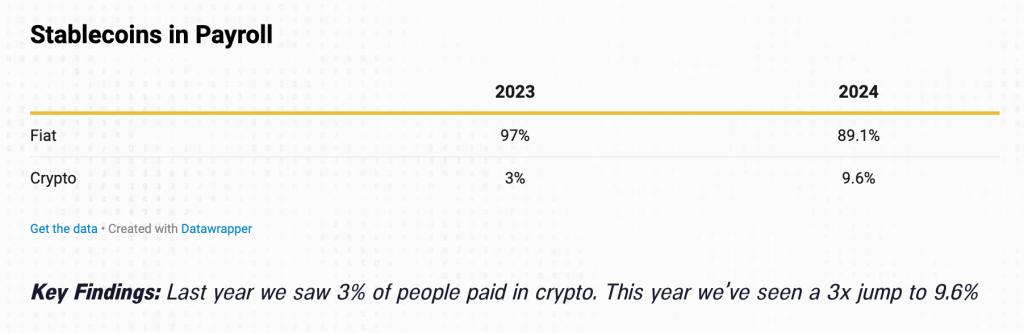

A quiet but breakthrough transformation is reshaping financial operations in the crypto asset industry. According to the latest report published by venture investment firm Pantera Capital, the number of professionals receiving salaries in digital assets has tripled in the past year, reaching 9.6% of total workforce in this field.

Data collected from over 1,600 professionals across 77 countries reveals a clear shift towards pure blockchain payroll systems and the consolidation of stablecoins as a reliable corporate payment tool. This phenomenon not only reflects the growing acceptance of digital assets but also demonstrates the maturation of decentralized financial infrastructure.

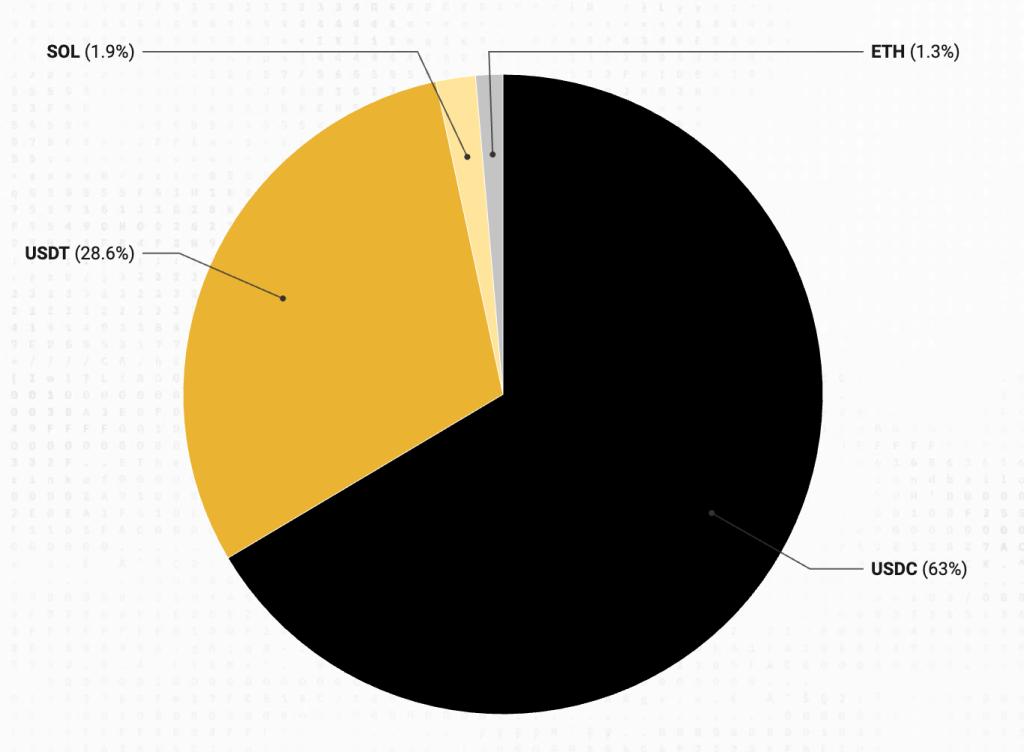

In-depth analysis from the report reveals a strategic competition shaping the stablecoin market. Despite USDT's dominance in global trading volume with a market capitalization exceeding $140 billion, Circle's USDC captures 63% of total crypto asset salary payment values.

The primary reason for this dominance lies in infrastructure and regulatory compliance. The Pantera report indicates that top payroll service providers like Deel, Remote, and Rippling currently do not support USDT payments, creating a natural competitive advantage for USDC. This inadvertently makes USDC the default choice for corporate financial activities, emphasizing the importance of partner ecosystems in technology adoption.

USDC's dominance in the salary payment segment reflects Circle's long-term strategy to position the stablecoin as a core tool for organizational payments and B2B financial infrastructure, rather than just a trading asset. Circle's recent moves, from strategic partnerships with Intercontinental Exchange to applying for a federal banking license in the US, demonstrate ambitions to build a fully compliant payment, custody, and settlement system.

The legal landscape is also facilitating this trend. The emergence of the GENIUS Act in the US, considered beneficial for regulated stablecoin issuers like Circle, further strengthens USDC's position in enterprise applications. This creates a positive cycle where legal compliance leads to broader adoption, thereby reinforcing market position.

The report also reveals other trends showing increasing professionalization of the industry. Nearly 88% of token allocation schedules are now set within a 4-year timeframe, a standard aimed at retaining talent and creating long-term commitment, similar to equity vesting models in traditional tech industries. This reflects a shift from short-term speculation to sustainable development strategies.

Notably, the data shows that practical experience is being valued more than academic credentials in this industry. Professionals with bachelor's degrees receive average salaries higher than those with master's or doctoral degrees, reflecting the high-application nature and rapid development speed of blockchain technology. This trend reinforces the view that the crypto asset sector is shaping a new value system where practical skills and adaptability are prioritized over formal academic qualifications.