Today, Bitcoin (BTC) and Ethereum (ETH) options are expiring at nearly $5 billion in size. This is an important milestone that can test market stability in the context of consistently low volatility.

Traders have differing opinions about the next move, and volatility strategies are drawing attention. All eyes are focused on key support levels, and it remains to be seen whether this expiration can awaken the market.

Bitcoin, Ethereum Options Nearing Expiration... $49.6 Billion at Risk

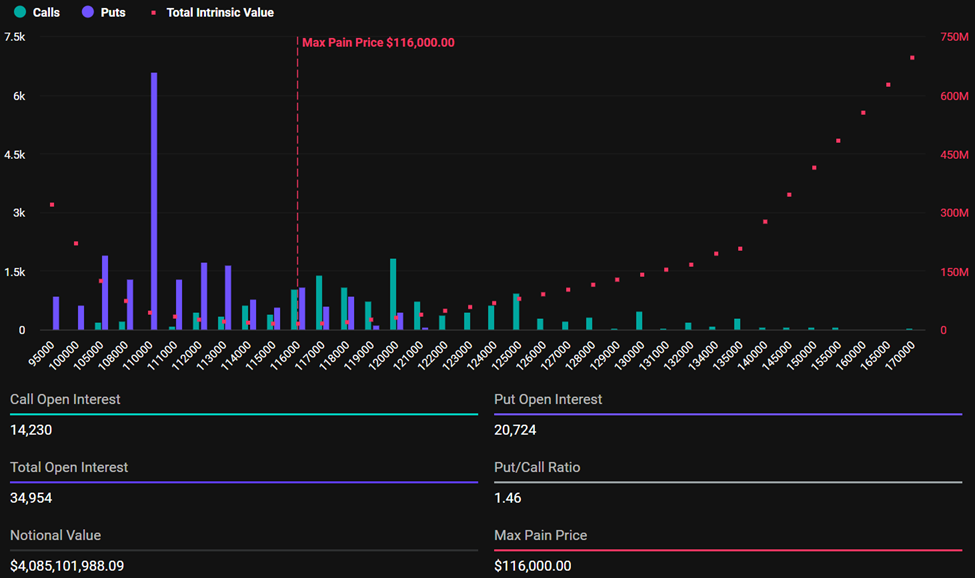

According to data from crypto derivatives exchange Deribit, Bitcoin is set to expire options contracts worth $4.09 billion. The maximum pain point, where most options expire worthless and dealers incur the least losses, is $116,000.

The total open interest (OI) for these expiring Bitcoin options is 34,954 contracts, with a put-call ratio (PCR) of 1.46.

This PCR indicates a slight downward trend, showing that put options are more numerous than call contracts.

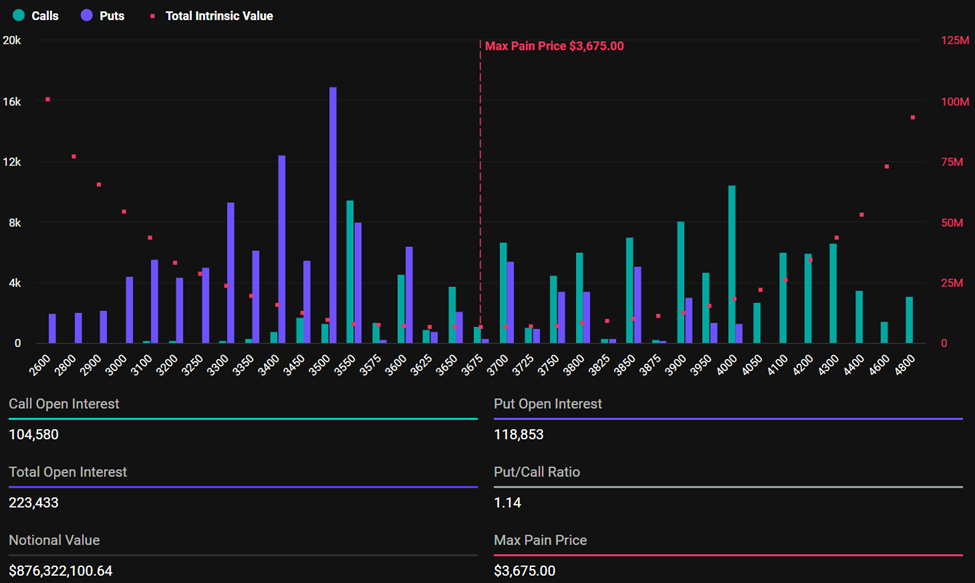

For Ethereum, the numbers are smaller but still significant. At 8:00 UTC, $876 million in Ethereum options will expire on Deribit, with 223,433 contracts remaining.

The maximum pain level is $3,675, matching the nominal value of $876.3 million, and the PCR of 1.14 indicates a more neutral sentiment compared to Bitcoin.

Deribit analysts highlighted the current open interest (OI) distribution, noting a large put position cluster below the spot and call positions stacked above.

"Does the OI distribution, with puts clustering below spot and calls stacked higher, suggest that expiration could change the situation?" Deribit analysts asked.

However, this distortion could act as gravity to keep prices within a range, until expiration on Deribit at 8:00 UTC today.

Low Volatility Dominates Market Sentiment

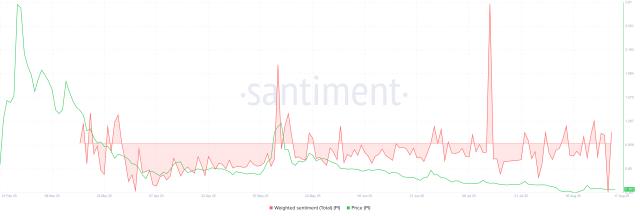

Option analysts from Greeks.live note mixed sentiment across the market, with many traders adapting to a low volatility environment.

Despite concerns about 32% implied volatility (IV), traders are actively selling puts at the BTC $112,000 strike for weekend expiration. This suggests most expect price stability or a slight increase, creating ideal conditions for premium harvesting.

"Traders are actively selling puts at the $112,000 strike for weekend expiration, despite 32% implied volatility concerns," analysts from Greeks.live said.

They also point to strong confidence in premium selling strategies, noting successful trades generate profits when the underlying asset moves favorably.

Additionally, BTC's 5-minute EMA100 is a crucial technical battlefield recently highlighted as resistance and support. Bitcoin's current position below this moving average generally indicates a short-term downward trend.

This could trigger defensive actions from put sellers. With large open interest near the $112,000 strike, traders might try to push prices up to avoid losses. This movement could increase volatility surrounding today's $5 billion option expiration.

Will expiration bring a volatility surge? That remains an open question. With so many contracts expiring, there's always a risk of sudden repositioning, especially if BTC or ETH crosses technical boundaries.

However, with most traders positioning as volatility sellers, there's still a consensus leaning towards quiet movements.

Nevertheless, if these positions are unwound, the post-expiration environment could open opportunities for new directionality, especially if macro catalysts emerge or liquidity changes.

Meanwhile, as traders move defensively and harvest what they can during a compressed volatility week, it should be noted that the situation can change at any moment.