Written by: Duo Nine⚡YCC

Translated by: Saoirse, Foresight News

Once short sellers return, Ethena and Fluid will severely impact the cryptocurrency market.

This is certain, and I will explain how it will happen in the following text.

The mechanism currently driving Ethena's USDe market value surge will also be the culprit of its eventual collapse.

Where have we seen this situation before?

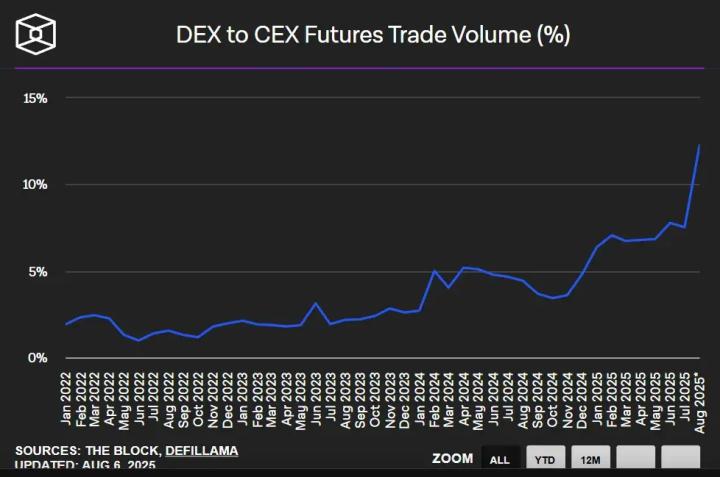

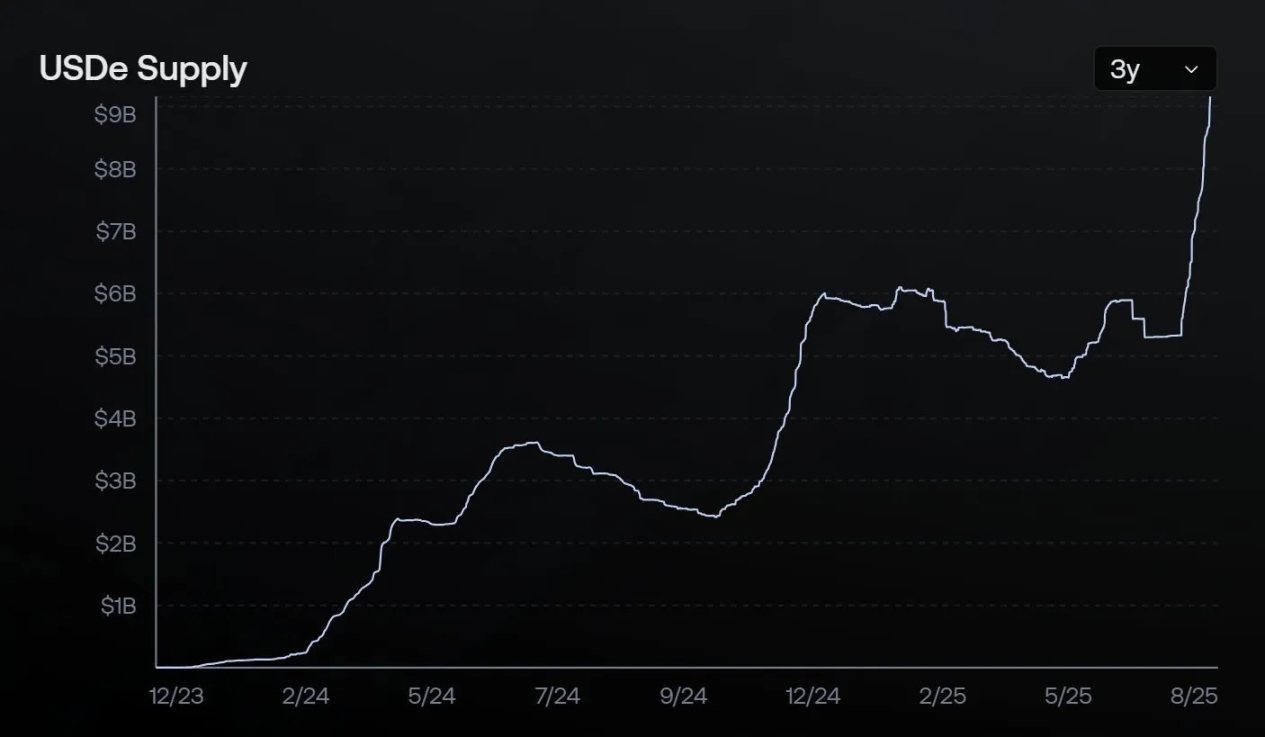

At the time of writing, Ethena's USDe stablecoin market value is approaching $10 billion, becoming the third-largest stablecoin. This should not excite you, but rather make you cautious. Because this growth is mostly not based on solid foundations, but more like a castle in the air.

In short: Leverage cycles are breeding this bubble!

Formation of the Bubble

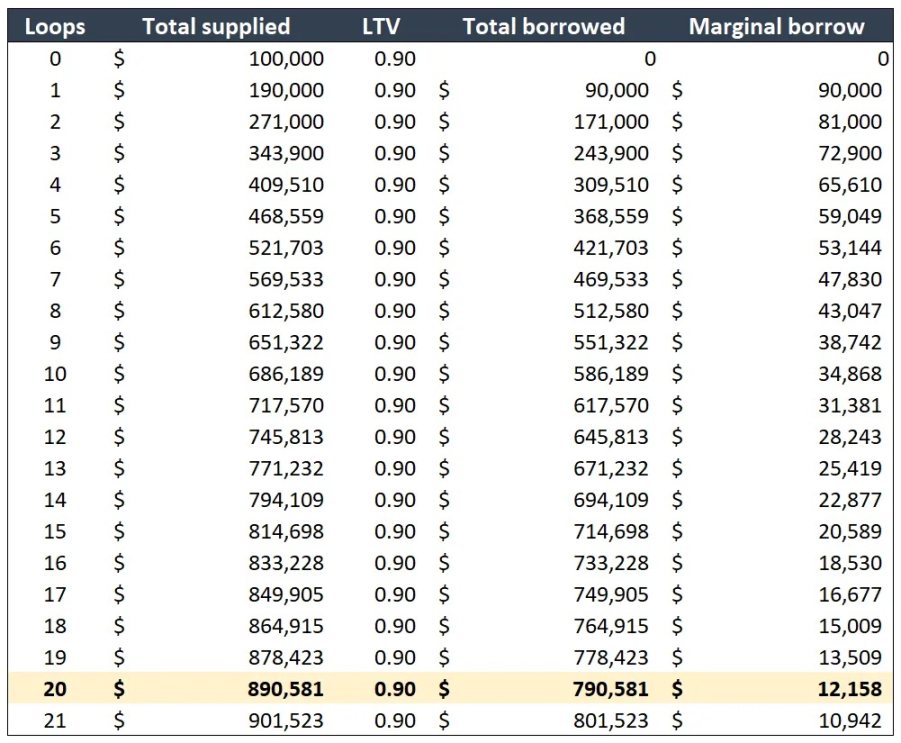

With just $100,000, you can build a position with a total value of $1.7 million through this operation. Moreover, on the Fluid protocol, you can complete this with a single click of the "leverage" button. They are exaggerating the total locked value (TVL) in this way.

(Note: The article refers to a nominal asset scale of $1.7 million, not the actual net funds. It is the sum of total collateral in the table below. Essentially, it amplifies the scale of liabilities and collateral through leverage cycles, not truly "creating" $1.7 million in value.)

You take out $100,000 and convert it to USDe, then deposit it as collateral in Fluid's stablecoin pool (such as USDT-USDC pool). Then, you borrow $90,000 USDT and convert it to $90,000 USDe.

Deposit these $90,000 USDe as collateral again, borrow $81,000 USDT, and convert it to USDe. Repeat this exchange and lending process 20 times. After 20 cycles, your remaining borrowing limit is $10,000. Congratulations, you've created "magical network currency".

Chart One

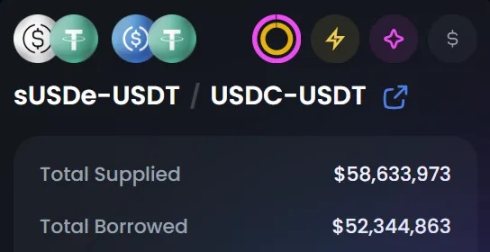

With protocols like Fluid, such operations have become extremely simple. Looking at Fluid's stablecoin pools reveals that almost all pools are nearly full.

For example, the USDe-USDT/USDC-USDT pool's lending ratio has reached 89.2%, with a maximum collateralization rate of 90%. Liquidation will be triggered once it reaches 92%.

What will happen if USDe depegs 2% relative to USDT/USDC? The following will explain in detail.

Why Are People Rushing to Buy USDe?

Because it offers the highest returns!

Currently, the $1.7 million position built with $100,000 initial capital can generate $30,000 in annual revenue. After deducting borrowing costs (collateral annual 8% - debt annual 5%, see Chart One), the actual annual yield is still around 30%.

(Note: Annual yield = (Collateral revenue - Borrowing cost) / Initial capital, calculated based on total collateral and total borrowed amount from 20 cycles in Chart One, approximately 31.717%)

If sUSDe basis trade yield further increases, the annual yield for the same principal could even reach 50% or 100%. Sounds wise, doesn't it?

But it's only wise if you "exit before the music stops". As history has shown, there's no free lunch. Someone will always pay the price, and you must ensure you're not the one paying the bill.

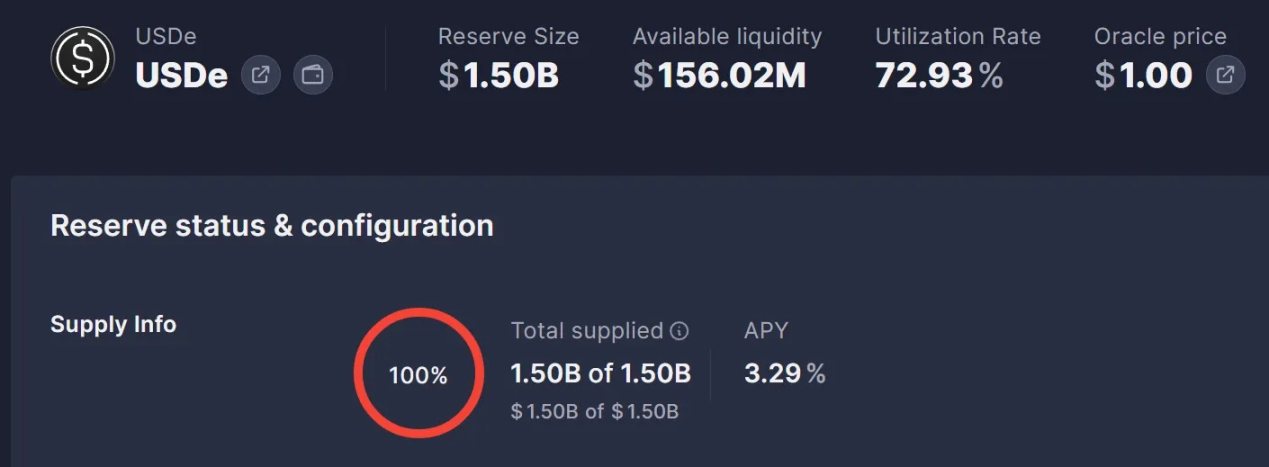

Otherwise, your entire principal might evaporate overnight, especially when you reinvest your earnings into this cycle. At the time of writing, AAVE's $1.5 billion USDe supply on the Ethereum network has reached its limit, and people are pushing this leveraged operation to the extreme.

Before the bubble bursts, USDe's market value will continue to break records. When its daily growth reaches around $1 billion, make sure to exit completely. The top is near, and someone will always pay for this feast.

Ensure that person is not you!

The Inevitability of Collapse

At this moment, it can be certain that a collapse will occur. Why such a definitive statement?

Because the larger USDe's market value becomes, the greater the pressure of the bubble bursting when the "music stops".

Essentially, when short sellers return, the higher USDe's market value, the faster and larger its depeg will be. A mere 2% depeg is enough to trigger massive liquidations on Fluid, thereby intensifying the crisis.

⚠️ USDe's depeg is the "safety valve" of this huge bubble!

At that time, all users performing leverage cycle operations on Fluid and other protocols will face liquidation. Hundreds of millions of USDe will suddenly flood the open market for sale.

As the liquidation chain reaction starts, USDe might depeg by 5% or more. Countless people will be left with nothing, potentially causing systemic risk and impacting the entire decentralized finance ecosystem. The situation could turn dire quickly.

Moreover, the trigger for the collapse could also be market demand exhaustion: When USDe basis trade yield continues to decline (even turning negative), until leverage cycle operations lose profitability, with borrowing costs exceeding returns, the crisis will erupt.

This will first lead to liquidation notices for leveraged users on Fluid. If it triggers a chain of liquidations, USDe's pegging mechanism will completely collapse. No one can predict the exact time, but at the current pace of development, this day will surely come.

Only users with no liquidation points or extremely low liquidation thresholds will survive. After leverage is completely cleared, USDe might restore its peg.

The ideal scenario to mitigate the crisis is a slow and orderly deflation of the USDe bubble, but this is almost impossible in the current market environment. Especially for a bubble over $10 billion, market reversals are often extremely violent.

History Always Repeats

This is no exception. This is identical to every cycle I've experienced. Ethena, Fluid, and many protocols are actively creating conditions for this collapse.

No one is discussing this issue because it's not "sexy".

Ethena is happy to see this, as USDe's market value surge means a surge in revenue; Fluid is also happy, as the total locked value explosion brings revenue growth. But note: they are not the ones paying the bill; they are the restaurant owners.

This is the root of cyclical fluctuations in the cryptocurrency market!

Bear markets are cycles of leverage clearing, while bull markets are cycles of leverage breeding bubbles.

There's nothing new under the sun.

Personal Opinion

I've participated in Ethena's yield farming since its early days, and their achievements so far are impressive. But I currently hold no USDe and have no plans to do so in the future, as the risk is too high.

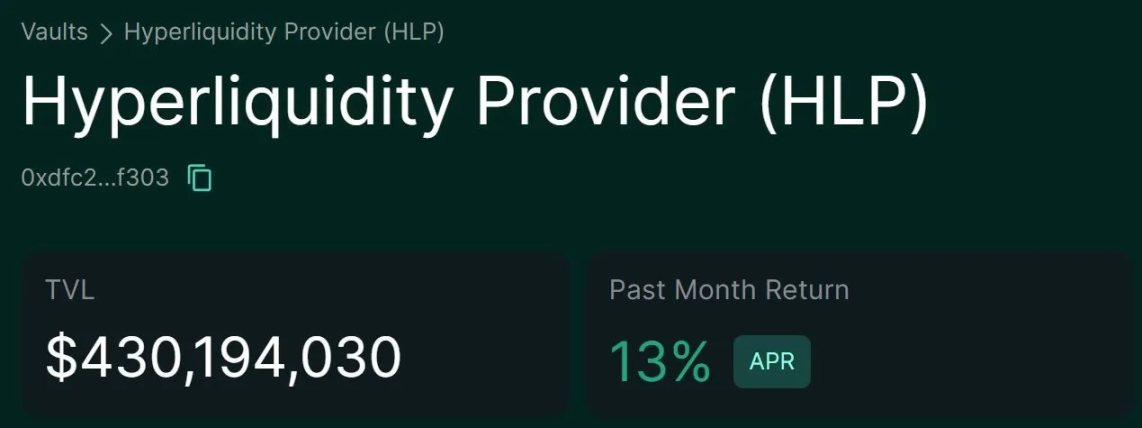

There are better protocols in the market that can provide equivalent or higher annual yields with lower risk. For example, Resolv's USR/RLP or Hyperliquid's HLP vault. HLP does not support leverage cycle operations, which is precisely its advantage.

As for Fluid, they have indeed innovated: allowing users to obtain higher yields on stablecoins and simplifying leverage cycle operations to be accessible to everyone. Based on their growth scale, this model has undoubtedly been successful.

However, these two protocols and all projects built on Ethena or Fluid are collectively inflating a huge bubble. I issue this warning because such scenarios have been seen too many times.

I have no bias towards these protocols; they are merely the biggest drivers in the current bubble, with followers increasingly growing in number.

Lastly, I want to say that Bitcoin is the final source of liquidity in the cryptocurrency market. This means that when a crisis erupts, Bitcoin will absorb the impact, and its price will bear pressure, providing a buffer for people in the bubble they have created. Also, please pay attention to Saylor and the dynamics of his MSTR bubble.

Each cycle brings new players, but the plot has never changed.