Written by: Saurabh Deshpande, Decentralised.co

Translated by: AididiaoJP, Foresight News

In November 2023, Blackstone acquired a pet care application called Rover. Initially, Rover was used to find dog walkers or cat sitters. The pet care industry typically consists of thousands of small, mostly localized, and offline service providers. Rover integrated these suppliers into a searchable marketplace, adding review and payment features, making it the default platform for pet care services. By the time Blackstone privatized it in 2024, Rover had become the hub of demand in the field. Pet owners first think of Rover, and service providers have no choice but to list on this platform.

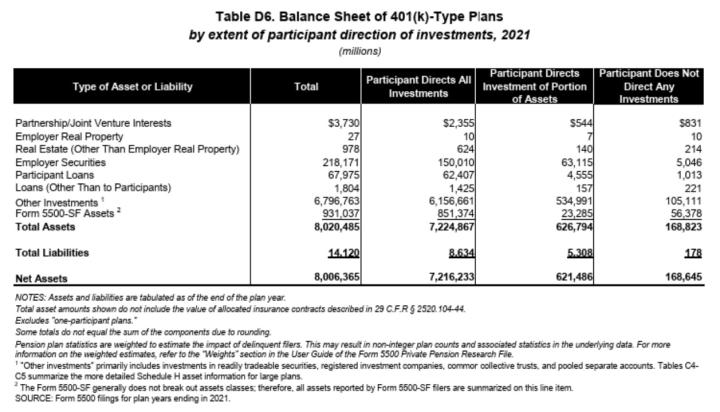

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning and tone while translating into clear, fluent English.]Apart from its own platform, Hyperliquid processed over $13 billion in trading volume through other builders last month. Phantom handled $3 billion in trading volume through its routing, earning over $1.5 million. This demonstrates Hyperliquid's current strong network effect.

Liquidity allows you to convert assets without affecting the price. In finance and DeFi, deep liquidity makes trading cheaper, lending safer, and derivatives possible. Without liquidity, even the most perfect protocol becomes a ghost town. Once established, liquidity tends to persist. Traders and applications will flow to deep pools, further increasing liquidity, narrowing spreads, and attracting more trading.

This is why protocols like Aave continue to thrive. Aave has large-scale lending pools for multiple assets, becoming the preferred choice for borrowers seeking scale and safety. As of August 6th, Aave's cross-chain total value locked exceeded $24 billion. Over the past 12 months, borrowers paid $640 million in fees, with platform revenue around $110 million.

Similarly, Jupiter, a Solana-based aggregator, evolved from a routing tool to the default entry point for trading on the network. On Ethereum, Uniswap has concentrated most spot liquidity, so aggregators like 1inch can only provide marginal improvements. On Solana, liquidity is distributed across platforms like Orca, Raydium, and Serum. Jupiter integrates them into a single routing layer, always providing the best price. Its trading volume once accounted for nearly half of Solana's total computational usage, and any delay or interruption would immediately affect the network's execution quality.

After viewing liquidity as an object to be aggregated, Jupiter's product decisions become easier to understand. Acquisitions, mobile applications, and expansion into new trading and lending products all aim to capture more order flow, maintain liquidity routing through Jupiter, and consolidate its position.

Jupiter is worth watching because it is a clear case of developing from a niche tool to a liquidity platform in DeFi. Starting with finding the best spot prices, gradually becoming the default routing for Solana liquidity, and then expanding to products that attract entirely new liquidity. Observing how it moves through these stages and reinforces each other provides a vivid case study of aggregation dynamics.

Levels of Aggregation

Three questions are a quick checklist for identifying potential aggregators:

What is the key differentiating factor of existing enterprises? Can it be digitized? In DeFi, the differentiating factor is liquidity. Deep pools provide narrower spreads and safer loans. Liquidity is already digitized, easy to read and compare.

If the differentiating factor is digitized, does competition shift to user experience? When liquidity can be accessed arbitrarily, competition revolves around execution quality: faster settlement, better routing, fewer failed trades. Products like BasedApp and Lootbase were born from this. The former encapsulates DeFi primitives into a smooth mobile experience, while the latter brings Hyperliquid's deep perpetual liquidity to mobile.

If user experience is won, can a virtuous cycle be built? Traders come for better prices, attracting more liquidity, which in turn provides better prices. When liquidity is embedded in habits and integrations, it becomes sticky.

Becoming the market's default entry point means that if suppliers cannot afford your absence, you can charge display fees or determine order flow in DeFi.

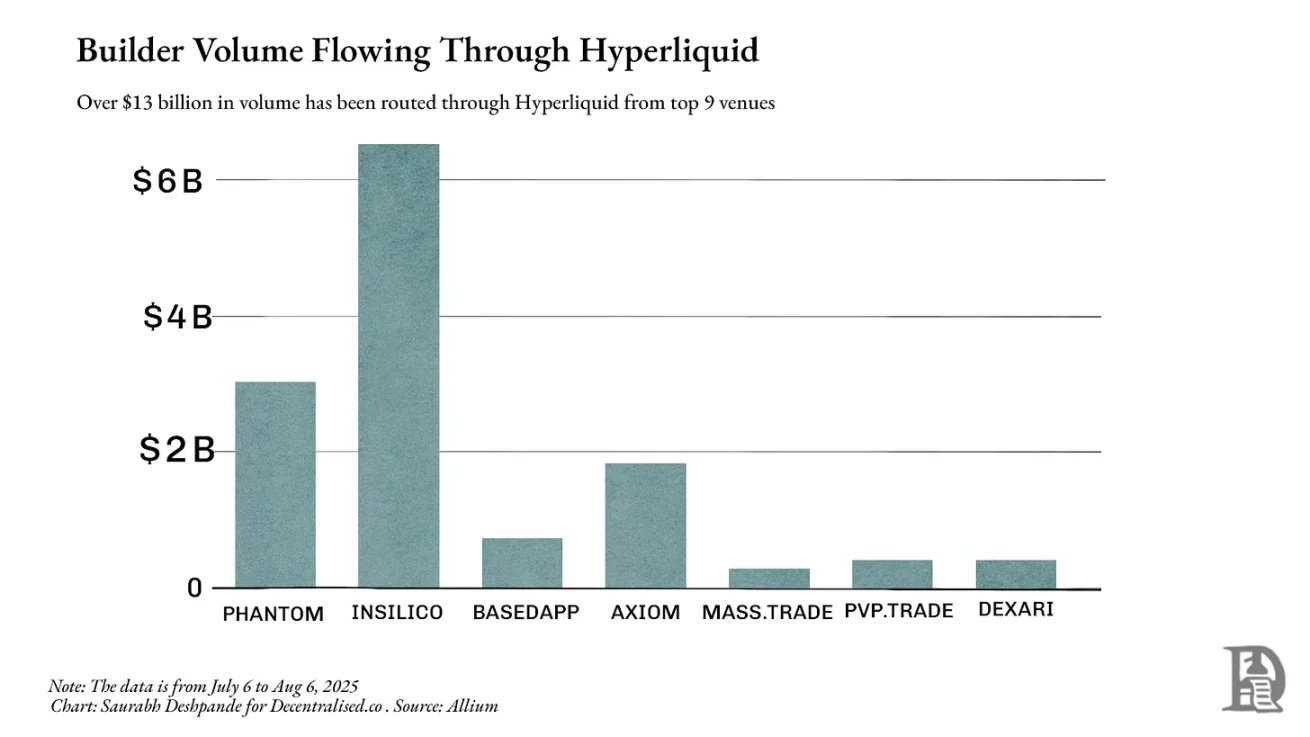

Note: The boundaries between different levels are often blurry. Classification is not precise but provides a mental model of aggregation levels.

First Level: Price Discovery

This is the most basic work: telling people where the best trade is. Kayak is used for flights, Trivago for hotels. In crypto, early DEX aggregators like 1inch or Matcha belong to this category. They check available pools, display the best exchange rates, and provide jump-off points. Price discovery is useful but fragile, as is defillama's exchange function.

If the underlying market is already concentrated (like spot trading on Uniswap), routing improvements are minimal, and users can go directly to the trading venue, making your help non-essential.

Second Level: Execution

At this point, you no longer direct users elsewhere but act on their behalf. Amazon's "one-click purchase" belongs to this level. In DeFi, Aave's lending function is at this level. Liquidity already exists in its contract when borrowing. Execution adds stickiness because the result is directly related to you: fast settlement, a good experience with no failed trades.

Third Level: Distribution Control

You become the entry point. Google Search for web pages, app stores for mobile apps, all fall into this category. In crypto, exchange tabs built into wallets can become the starting and ending point for ordinary users.

On Solana, Jupiter has reached this level. It started as a price discovery tool, transitioned to the execution layer through smart order routing, and then embedded in frontends like Phantom and Drift. A large number of Solana trades are Jupiter trades, even if users never enter "jup.ag". This is distribution control, where suppliers cannot bypass you to reach users.

Climbing Levels in DeFi

The challenge in DeFi is that liquidity can shift rapidly. Incentives can drain a liquidity pool overnight. Therefore, rising from the first level to the third level is not just about becoming the top aggregator but also creating enough reasons for liquidity and order flow to continue routing through you.

On Ethereum, 1inch mainly remains at the second level because Uniswap has already completed aggregation through concentrated liquidity. Routing is still valuable for edge cases, but improvements are limited, and many traders choose to skip. Additionally, aggregators like CowSwap and KyberSwap also occupy a significant share. Aave belongs to the second level because it controls execution in its niche, but it is infrastructure, not a starting point.

Jupiter's advantage on Solana is its ability to climb these three levels sequentially. With dispersed liquidity, the first level is significantly valuable; the routing engine is superior to manual exchange, naturally transitioning to the second level; by directly integrating wallets and dApps, it reaches the third level, completely controlling the distribution of Solana liquidity. At one point, nearly half of Solana's computational usage came from Jupiter trades because both the trader's demand side and liquidity pool supply side relied on Jupiter.

After reaching the third level, the question becomes "What else can be run through this distribution?" Amazon started with books and ended up with everything; Google started with search and now controls maps, mail, and cloud computing. For Jupiter, distribution is order flow. The obvious next step is to add products like perpetual contracts, lending, and portfolio tracking, leveraging the same liquidity relationships.

A bigger move is Jupnet. Solana has not yet matched the throughput and execution characteristics of places designed for financial-grade latency and determinism, like Hyperliquid. These characteristics are crucial for scaling the entire financial stack to real-world scale. The simpler choice would be to launch products on a chain already possessing these characteristics, but Jupiter chose the more difficult path, building Jupnet as an application-controlled, low-latency execution layer running parallel to Solana.

Jupnet aims to become shared infrastructure within the Solana ecosystem, supporting latency-sensitive trades like perpetual contracts, quote request systems, and batch auctions, ultimately settling natively on Solana. If successful, it will provide the speed and determinism expected in vertically integrated venues while maintaining user and asset retention. This is an attempt to bridge the gap between general blockchain throughput and global financial micro-latency requirements without fragmenting liquidity across chains.

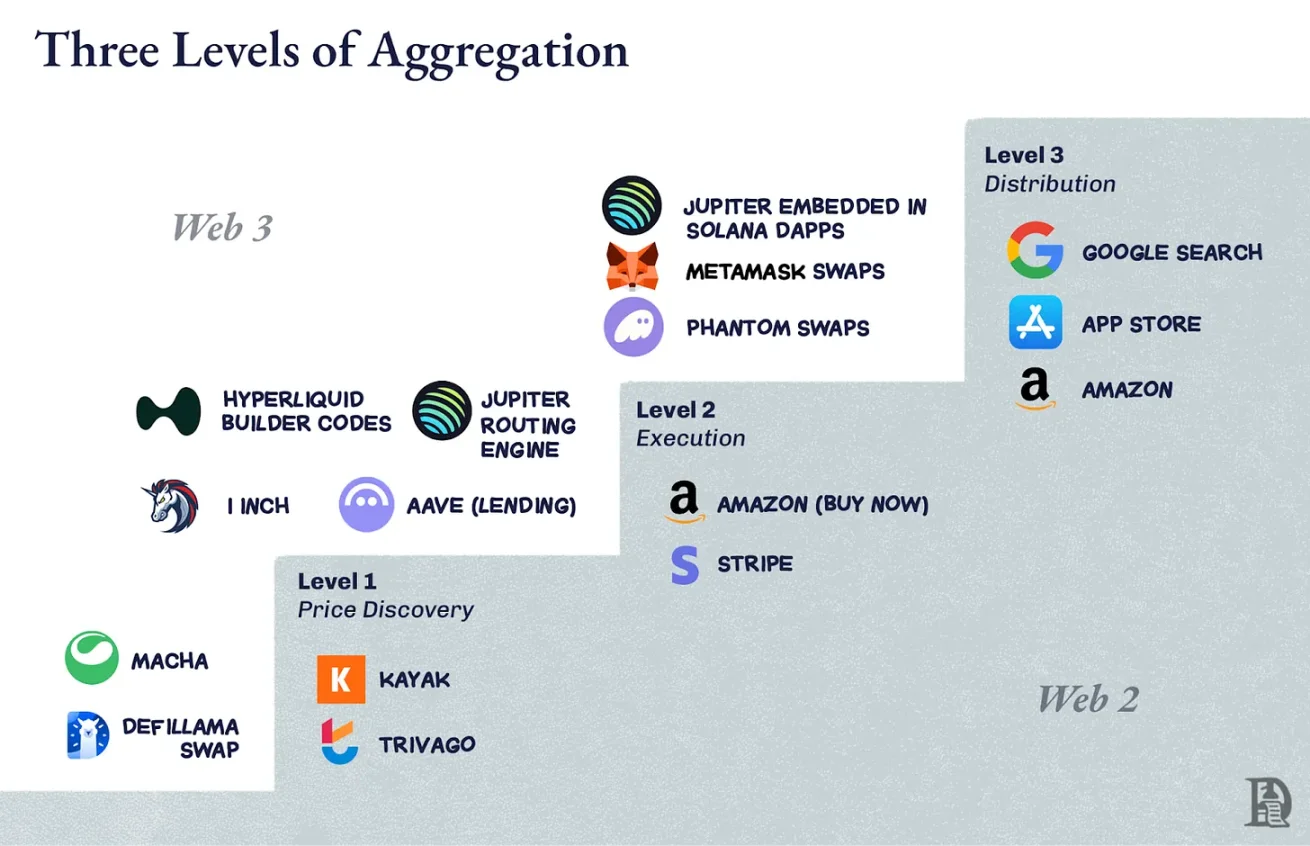

However, it's important to note: Although Jupiter dominates within Solana, the industry still faces fierce competition. In the cross-chain realm, 1inch, CoWSwap, and OKX Swap maintain significant positions. As of 2025, Jupiter averages about 55% among the top five DEX aggregators, but this share fluctuates with on-chain activity and integrations. The following image shows the dispersion of the aggregation layer outside Solana.

Clearly, Jupiter has become the aggregator in the Solana ecosystem. The flywheel has started: more traders bring more liquidity, more liquidity optimizes execution, better execution attracts more traders. At this point, you are not just a liquidity aggregator but the shelf, habit, and market entry point. So, when liquidity is no longer sufficient, how to continue growing? Jupiter's answer is to acquire projects that have already captured new user flows.

Mergers and Acquisitions as a Growth Engine

Previously, I explored two key themes of enterprise scaling: the essence of compound innovation and how companies accelerate this process through mergers and acquisitions. The former concerns building new products, features, or capabilities based on existing advantages, while the latter focuses on identifying when "buying" is faster than "building".

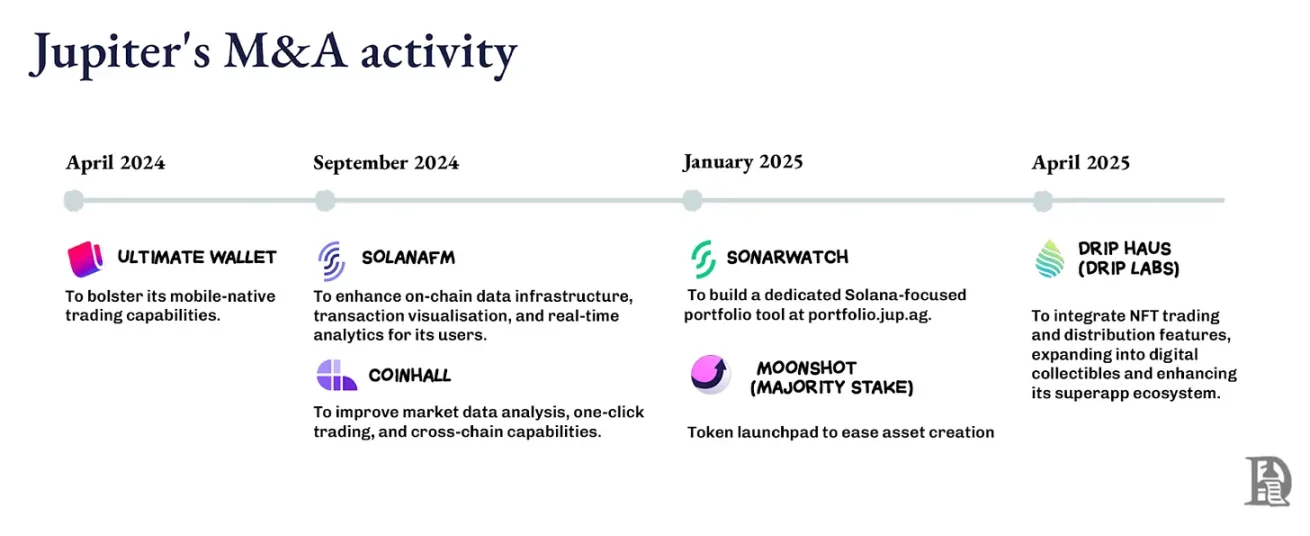

Jupiter's evolution embodies both. Its acquisition strategy is rooted in finding founding teams with genuine appeal and integrating them into an amplifying distribution network. The company seeks expert teams in vertical domains, expanding coverage without compromising the core roadmap.

This is more than just purchasing feature stacking; it's acquiring teams that already dominate Jupiter's target market segments. When these teams are integrated into Jupiter's distribution wallet interface, API, and routing, their product growth accelerates, and the generated traffic feeds back into Jupiter's core.

Moonshot brought a token launchpad, converting new token creation into direct exchanges and trading activities within the Jupiter ecosystem; DRiP added a community-driven Non-Fungible Token minting and distribution platform, attracting audiences away from trading interfaces and converting them to on-chain behaviors; Portfolio acquisition provided position management tools for active traders. Jupiter could have built these features internally at a lower cost, but its goal was to acquire founders, not just functionalities.

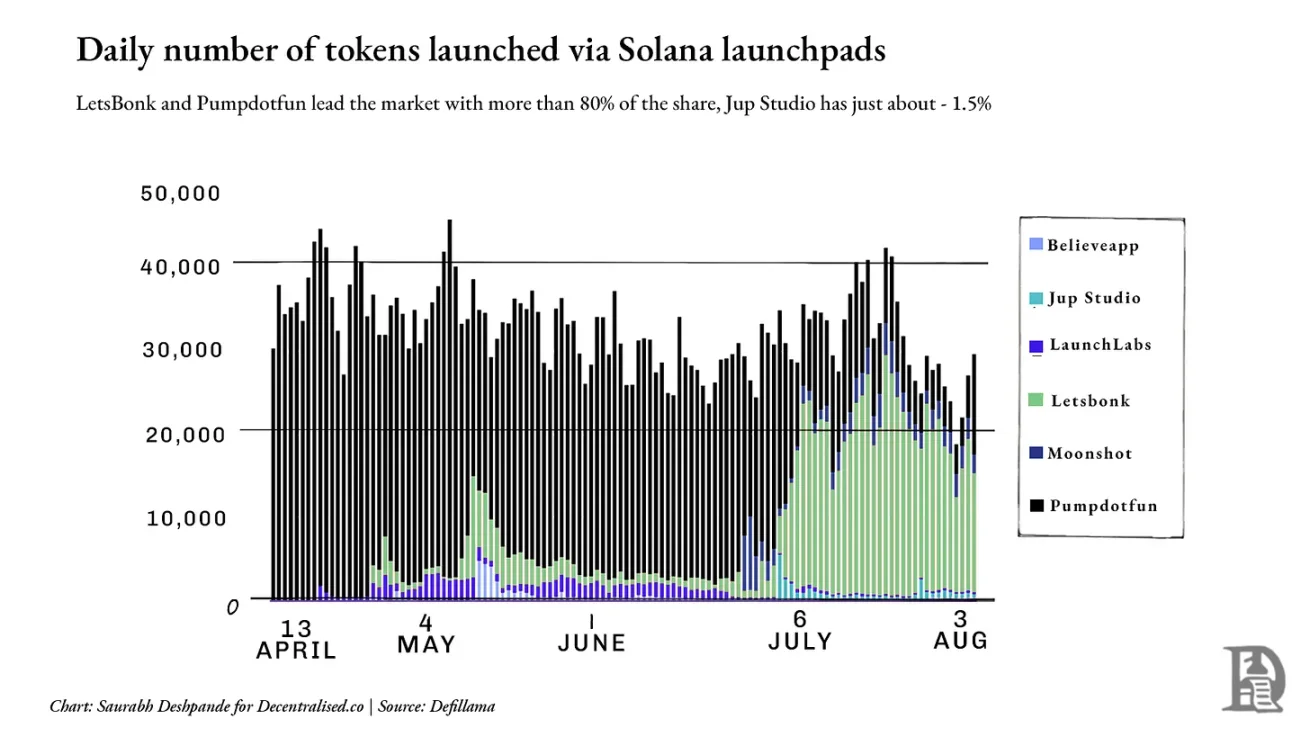

However, growth in some indicators has not yet been apparent. In the launchpad domain, for example, market leaders Pumpdotfun and LetsBonk control over 80% of daily token issuance, while Jup Studio and Moonshot combined account for less than 10%. The following chart shows the incumbents' dominance. In this situation, the default landscape may have already solidified, and Jupiter might need a radically different approach to break through.

In a sense, we are witnessing a true platform war unfolding between applications, rather than between public chains as many expected. This raises a bigger question: If Layer 2 does not control distribution, when applications on it do, where will value flow? What will happen to fat protocols?

We conclude with an unresolved question, as there is no definitive answer yet. In the future, we will bring more incisive perspectives, new data points, and more stories and analogies to clarify the direction of this matter.