Ethereum (ETH) is gradually approaching the psychological level of $4,000. However, selling pressure makes this goal still difficult to achieve.

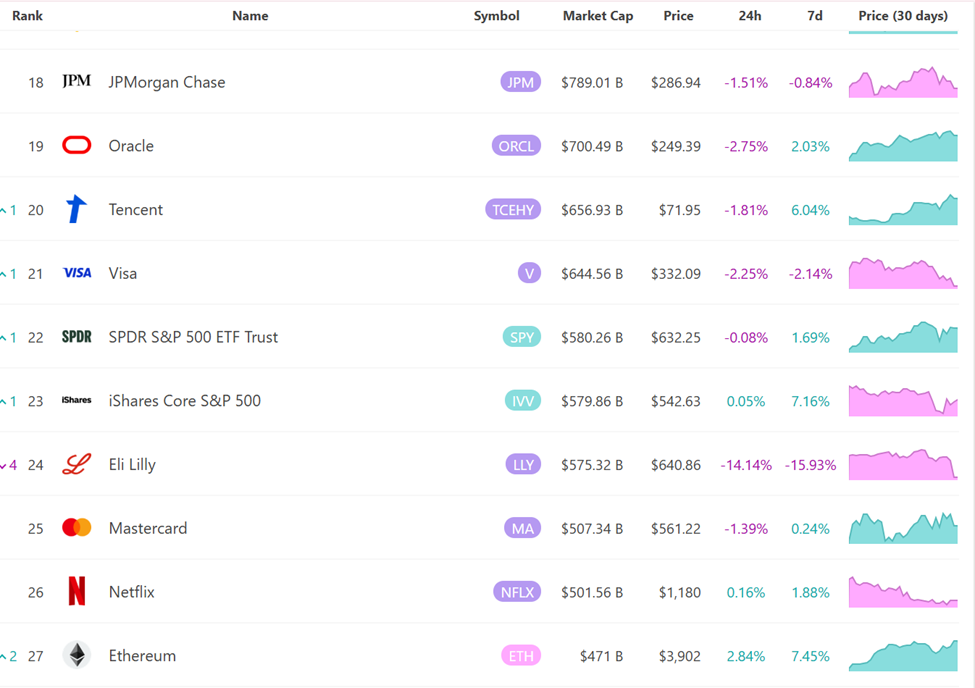

Nevertheless, the recent institutional enthusiasm for Ethereum has lifted the largest altcoin by market capitalization to 27th place among global assets.

Why are Whale Investors Selling Tokens During Ethereum's Strength?

Ethereum's market capitalization has surged to $471 billion, surpassing major global companies and ranking 27th among all assets.

Meanwhile, amid the surge, another force is pulling in the opposite direction. Traders, whales, and observers are warning about large-scale selling and market manipulation suspicions.

This opposing force is emerging at a point when $ETH is prepared to recover its all-time high.

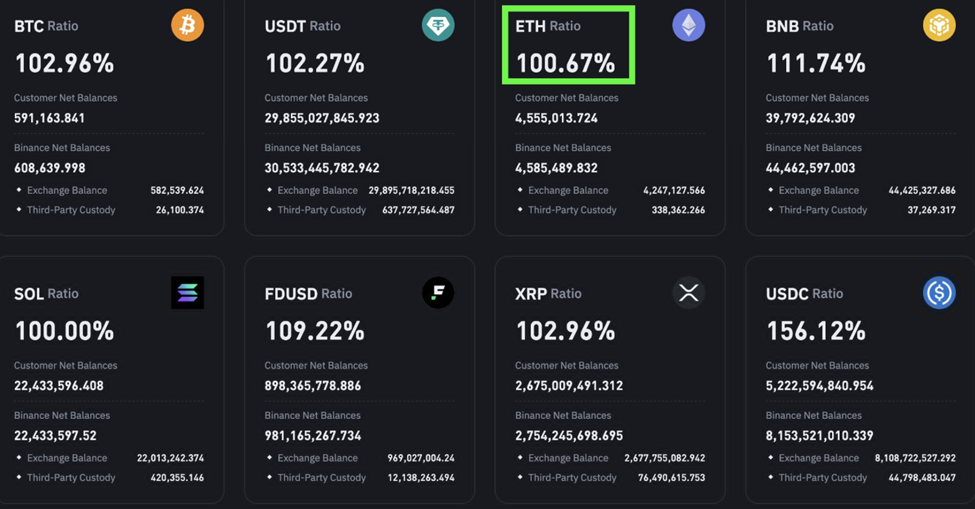

According to analysts and on-chain data, whales are liquidating large positions, with Binance exchange appearing as a common denominator.

Ted Pillows, an investor and Key Opinion Leader (KOL) on X (social media), claims that Binance is dumping millions of ETH to manipulate Ethereum's price.

Last hour $ETH is going down again.

— Ted (@TedPillows) August 8, 2025

Binance is dumping millions of Ethereum to push the price down 🚨

This has to end. pic.twitter.com/1W7FRTZrLL

In a subsequent post, Ted claims that Binance is moving ETH to multiple market-making accounts despite having no additional ETH known beyond customer deposits.

"Hate to say it, but Binance is manipulating ETH and the entire altcoin market... How can they move so much Ethereum to these accounts when they have no additional ETH beyond customer funds?" he wrote.

These claims suggest that organized selling pressure might be weakening institutional demand. Meanwhile, Binance did not immediately respond to BeInCrypto's request for comment.

The exchange had not publicly responded to these allegations at the time of reporting.

Major on-chain events are supporting these concerns alongside Ethereum's recent price increase.

One address, 0x219...C3c4F, sold 3,000 ETH, worth $11.74 million, finally crossing the break-even point after holding since the 2021 bull market. On-chain analyst Ai revealed that this wallet accumulated ETH at an average of $3,500 and endured a 70% decline, ultimately selling for a $1.24 million profit.

Another whale, after being inactive for 8 months, deposited 1,383 ETH tokens to MEXC, earning $4.32 million. This address still holds 1,384 ETH tokens, worth $5.39 million.

After an 8-month dormancy, a whale has deposited 1,383 $ETH worth 5.39M into #MEXC, making a profit of $4.32M.

— Onchain Lens (@OnchainLens) August 8, 2025

The whale initially withdrew 2,768 $ETH worth $6.45M and still holds 1,384 $ETH worth $5.39M.

Address: 0x66bEdBA9243c29beee4d85Bc6cA3b4c67b47fA0E

Data @nansen_ai pic.twitter.com/IxJ7cYumzU

This highlights a widespread pattern of profit-taking as Ethereum approaches a psychologically important level.

Not Everyone Believes the Binance Manipulation Theory

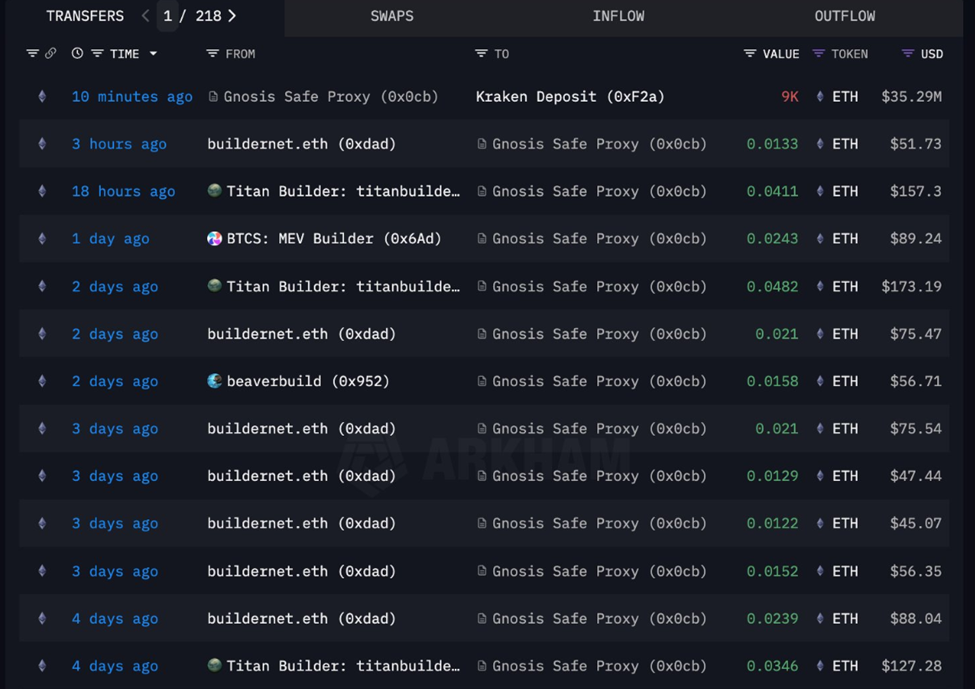

Nevertheless, the most significant warning sign could be a multi-signature wallet (0x0cb…E07e4) that recently deposited 9,000 ETH, approximately $35 million, to Kraken exchange.

This address appears to be connected to high-frequency block builders Beaver Builder and Titan Builder. According to analysts, this address still holds over 18,000 ETH, worth more than $70 million, with most still being staked.

On-chain analysts suggest this selling wave likely reflects sophisticated players moving out of liquidity. If true, they might be using centralized exchanges (CEX) like Binance and Kraken as exit points.

One whale trader reportedly completed a fourth major swing trade by selling 5,000 ETH at $3,895, earning $19.47 million.

It remains unclear whether these profits are preparing for an adjustment or are part of a larger market correction.

While Ethereum's technical indicators remain strong and institutional demand is increasing, the shadow of organized selling is obscuring the upward trend.

At the time of writing, Ethereum is trading at $3,958 per token.