The Smarter Web Company, a listed company in the UK, has completed a capital raising of 21 million USD through Bitcoin-denominated bonds, initiating a breakthrough funding model.

The Smarter Web Company, a company listed in the UK pursuing a Bitcoin accumulation strategy, has taken an important step in the London capital market. The company has completed raising 21 million USD (equivalent to 15.8 million pounds) through the issuance of a bond with a structure fully denominated in Bitcoin – a pioneering and rare financial product in the market.

The issuance achieved a 100% subscription rate with primary underwriting from the French asset management group Tobam. Collaborating with Tobam – an organization managing over 2 billion USD in assets and with experience in digital assets since 2017 – has reinforced the credibility of this issuance.

The product named "Smarter Convert" is designed to create long-term benefit linkages between investors and the issuing company. CEO Andrew Webley notes this is a structure appearing for the first time in the UK capital market and expects to open up a new capital segment for the company.

The bond's operating mechanism demonstrates a sophisticated combination of traditional finance and digital assets. This instrument has a 12-month term, denominated in Bitcoin and the ability to convert into company shares with a 5% insurance fee compared to the reference closing price. This structure allows the company to raise capital with a share dilution rate approximately 5% lower than direct share issuance.

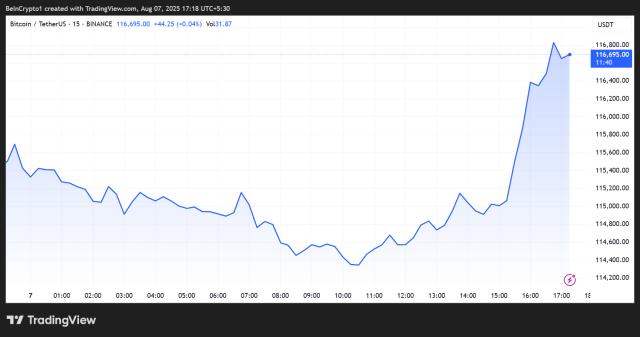

In the event that bondholders do not exercise the conversion right, the company will pay 98% of the par value in Bitcoin at maturity, with the value adjusted according to the current BTC exchange rate. Notably, the company retains the right to force conversion when share prices rise significantly. This structure not only optimizes capital raising efficiency but also supports the company in increasing Bitcoin reserves on its balance sheet.

This move occurs simultaneously with the company actively expanding its Bitcoin portfolio, raising total holdings to 2,050 BTC, valued at approximately 234 million USD, confirming its position among companies with a clear Bitcoin strategy on the stock market.