After more than a decade of crypto frenzy, the wealth-creation movement driven by Bitcoin's four-year halving is no longer, replaced by intermittent liquidity from US stocks, US dollars, and US bonds, with discrete hotspots connecting each cycle, similar to Pendle's journey from fixed income, LST, BTCFi to Ethena and Boros.

The difficulty of becoming new money is less than managing old money.

Custody institutions say, whoever has money will earn money.

In the crypto world, there are truly three types of wealthy people: individual whales (BTC early miners, ETH early investors, DeFi Summer OGs), on-chain institutions (crypto-native VCs, CEXs and public chains, a few project teams), and new and old giants backed by Wall Street.

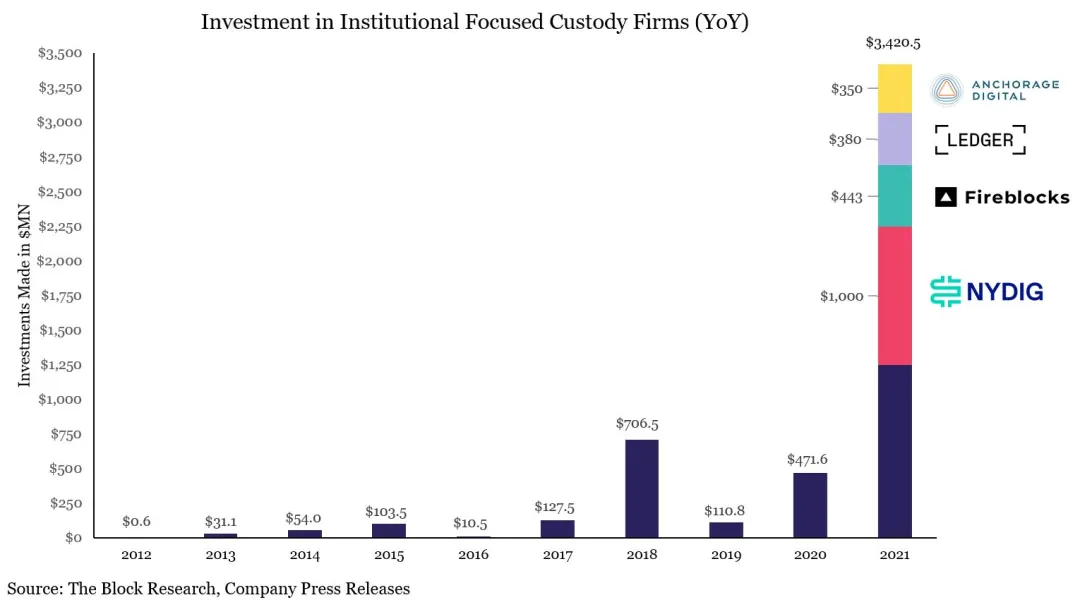

Custody institutions subsequently diverged. After $3 billion in financing in 2021 and the FTX-Celsius, 3AC-Luna-UST crashes in 2022, the crypto custody track's basic landscape was essentially determined, with examples as follows:

• Serving on-chain projects: Copper/Ceffu/Cobo

• Serving ETFs: Coinbase

• Bank-level: BNY (Bank of New York Mellon)

• Exchange: Fireblock

Especially Coinbase, which has almost captured all ETF custody shares, with over 80% of BTC and ETH ETF issuers choosing to collaborate with them. In treasury strategies, MSTR also preferentially chooses Coinbase for BTC custody.

The Era of Retail Trading Ends, the Era of Institutional Finance Begins

The way to make money in crypto changes with the times. Under the scale effect of funds, whoever has the most money can take the most profits. From miners, exchanges, to market makers, next will be custody institutions, especially as traditional financial funds enter the chain, they won't directly place funds on public chains and exchanges, but will transfer through custody institutions.

Ethereum's daily transaction volume has exceeded the DeFi Summer peak, reaching 1.74 million transactions, but this round's growth is not driven by MEME or trading activities, but by the stable coin circular lending ignited by Aave and Ethena.

Coincidentally, Aave and Plasma collaborate on stable coins for traditional finance entering the chain. Under the Genius Act restrictions, payment stable coins cannot pay interest to users, and deposited funds will have nowhere to go, becoming a dead weight for issuers.

On the other hand, as overall CEX trading volume continues to shrink, developing non-trading custody, staking, and yield will become a new business model that banks and other TradFi are eyeing, especially under rate cut expectations. How to divert liquidity safety represented by 401(k) and treasury strategies to the chain will become a new entrepreneurial trend.

The exchange cycle is entering its end, squeezed by on-chain transformation and IPO. Hyperliquid shows signs of flipping Binance, while exchanges like Kraken and Bullish challenge Coinbase's unique listed exchange status.

Overall strategy-wise, everyone is targeting post-CEX era dividend yields. For old money with massive funds, APR can be lower, but principal must be sufficiently safe. Tether is building a physical gold vault for its own gold, and on-chain vaults are also a good business.

Under ETF dominance, it will be difficult to shake Coinbase's ruling position. Each generation has its own god, and the new market landscape also gives second and third-tier players new opportunities.

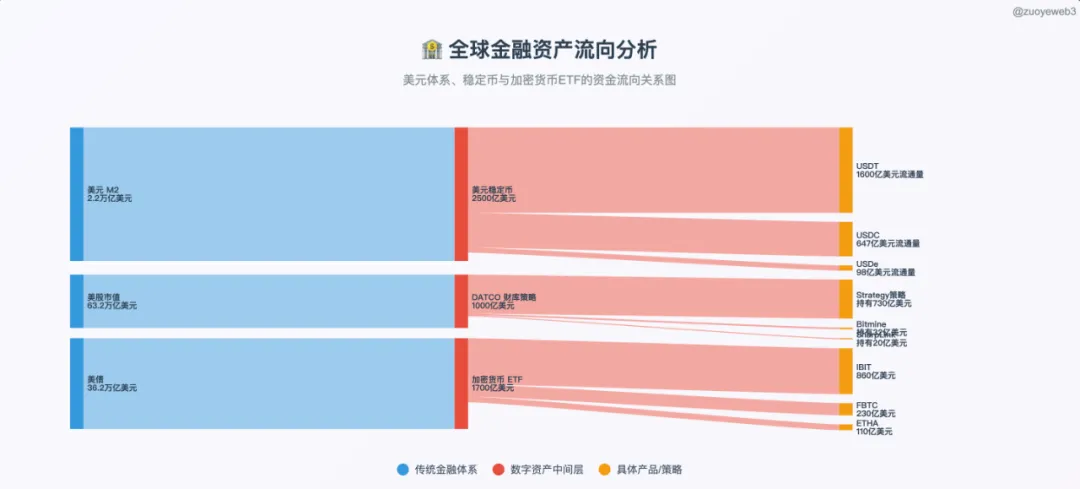

Compared to the immense wealth of US dollars, US bonds, and US stocks, currently it's still like catching wealth with a basin. Only a sufficiently safe large bathtub will allow more liquidity to flow seamlessly.

Thus, old players begin to diverge. Anchorage Digital and Galaxy Digital are undoubtedly the most representative two players.

• Serving treasury (DATCO): Galaxy

• Stable coins: Anchorage

• Emerging ETF staking: Anchorage Digital & Galaxy Digital

Outside of non-BTC and ETF spot ETFs, the two Digital entities have a consistent goal of capturing more of Coinbase's market share. We'll start from this common point.

Currently, the spot ETF market has two basic trends: first, generalization - Altcoins and MEME coins beyond BTC and ETH may directly convert to ETFs after meeting Coinbase derivative listing for 6 months; second, approval of staking ETFs, allowing ETF issuers to redeem physically and open interfaces with on-chain staking services.

To cite an example, Anchorage Digital became the exclusive custodian and staking partner for the REX-Osprey Solana staking ETF, perfectly matching the above two points. If the bull market continues, more ETF products will become Digital's custody focus.

In traditional ETFs, Anchorage has also secured collaborations with 21Shares and BlackRock. More remarkably, it has become the custodian of Trump Media Group's Bitcoin treasury, showing that there are always ways for cats to find their path - Anchorage's cold wind has indeed blown to Mar-a-Lago.

Anchorage's Stablecoin Layout and Crypto Iron Vault Dream

[The rest of the translation follows the same professional and accurate approach]By the way, Anchorage has both the OCC's federal crypto bank license and New York's Bitlicense, which can be said to have compliance credentials second only to BNY.

However, after Bryan's departure, Anchorage also had conflicts with the OCC, but fortunately, the license remained intact.

One license, benefiting for life.

With the license, Anchorage can custody everything, from stablecoin issuance reserves to cryptocurrencies, and even NFT businesses, but the crypto market crash in 2022 also gradually destabilized Anchorage, with the founders' "internal strife" being the first to bear the brunt.

Eventually, Diogo Mónica left to become a partner at Hanu Ventures, while retaining the position of Executive Chairman at Anchorage Digital, mainly responsible for recruitment and strategy. Nathan McCauley handles the main business, beginning to target BlackRock's stablecoin business.

To summarize, in ETF, Anchorage became the custodian for 21Shares' Bitcoin and Ethereum spot ETFs, as well as the exclusive custodian and staking partner for REX-Osprey Solana Staking ETF.

Beyond ETF business, Anchorage Digital has gained a lot, especially in stablecoins, not only collaborating with Visa on stablecoin payments but also introducing "compliant" stablecoins like Paypal's PYUSD for institutional investors.

More remarkably, Tether's custodian and investor Cantor Fitzgerald also reached a cooperation with Anchorage, providing custody services for Cantor Fitzgerald's Bitcoin business.

Anchorage Digital thus becomes the custodian of Tether's custodian.

Although licensed, Anchorage's business was not prominent before 2025, with a $3 billion valuation and $50 billion in managed funds, but facing Coinbase in ETF business was quite desperate. Anchorage Digital's true focus was on stablecoins.

As mentioned earlier, Anchorage Digital has a federal crypto license because its branch Anchorage Digital Bank NA (North American branch) can simultaneously accept USD and stablecoin deposits and provide custody services.

• Downstream: Anchorage collaborates with Ethena to expand USDtb issuance to meet stablecoin compliance standards under the Genius Act

• Upstream: Joining with Paxos and Kraken to form the USDG stablecoin alliance, jointly maintaining the Global Dollar Network's on-chain operations

In treasury strategy, Anchorage is not without action. Former BlackRock executive Joseph Chalom joined ETH treasury company Sharplink Gaming as co-CEO, and he was also a key driver in establishing BlackRock and Anchorage's ETF custody collaboration.

Moreover, BlackRock's BUIDL fund is closely related to Chalom, with Anchorage as its custodian, decoded as follows:

$BUIDL = BlackRock issued = Securitize (tokenization technology) + Anchorage Digital (custody) + BNY (cash services)

Further, SEC current chairman Paul Atkins holds at least $250,000 in Anchorage Digital shares, and Atkins is also a Securitize shareholder, which is a partner in Ethena's Converage issuance.

With Galaxy already listed, Anchorage Digital has long had IPO rumors, and stablecoin business expansion needs more capital inflow. Perhaps this year, we'll see the first crypto bank IPO.

Galaxy Digital Sits on the Iron Throne of the Treasury Era

Compared to Anchorage Digital, Galaxy is more eye-catching, not only being Goldman Sachs' 2022 crypto OTC test subject but also a large Bitcoin whale exit point. Additionally, Galaxy is deployed in multiple areas like Bitcoin mining, investment, and AI computing power. Its founder Mike Novogratz's network is also broader than Anchorage Digital's.

On 7.25, Galaxy helped an early miner sell about 80,000 BTC ($9 billion), though sold in stages, it still caused Bitcoin to drop nearly 4% to below $115,000 after the news.

In this massive fund transaction, there were doubts about Galaxy manipulating or disrupting the market, but Galaxy is a relatively pure institutional investor, hard to say with a motivation to actively disrupt the market. Institutions need low volatility and stability, with profit orientation driving a larger market scale.

But this isn't the key point. Galaxy's special quality is "timely" - able to keep up with each cycle and era. Its founder Mike Novogratz, an early non-technical financial professional, has always viewed cryptocurrencies not from a belief perspective, but from a how-to-make-money angle.

At a moment when retail investors are exiting and institutions are entering, its future developments are worth more attention, especially the expansion of crypto treasury strategies.

Remember the ETH treasury company Sharplink with BlackRock executives?

In June 2025, SharpLink repeatedly purchased ETH through Galaxy OTC, with at least $800 million in purchase volume. Conveniently, Galaxy is also one of SharpLink's investors - buying from myself, moving from left hand to right.

Beyond BTC and ETF, Galaxy has at least participated in funding and building Ethena's treasury Stablecoinx, and the $SUI $450 million treasury Mill City Ventures III, Ltd.

Moreover, Galaxy is expanding more OTC trading types, such as providing OTC support for Liquid Collective's LST LsETH, and Liquid Collective's SOL version lsSOL is also for institutional investors, supported by Anchorage Digital.

Once again, this world is just a huge circle.

Furthermore, GDN simultaneously captures Anchorage Digital and Galaxy Digital, and their synchronization verifies that current custodians are more collaborative than maliciously competitive.

However, compared to Anchorage Digital's enthusiasm for stablecoins based on bank licenses, Galaxy's main business expansion direction remains treasury strategy, with more non-BTC/ETH treasuries still under construction.

Utilizing its fund volume advantage, Galaxy not only holds $1.8 billion in BTC but has also strategically increased holdings of 34.4 million XRP tokens. Interestingly, Ripple announced a $200 million acquisition of Rail, a stablecoin company invested and supported by Galaxy.

Again, buying from myself, moving from left hand to right.

Based on Galaxy's report, potential future treasury or market-making focuses might be $HYPE, $SOL, and $XRP. With Ripple completely ending its litigation with SEC, it surged 10% that day, with Galaxy ahead of retail investors.

Moreover, Galaxy has already cleared out UNI and TIA tokens. The new era's train no longer has old aristocracy's status. USDG, HYPE, and XRP are newly listed - OTC foreknowledge in the spring tide.

Previously, OTC could only passively accept whale orders and could hardly directly affect secondary market changes. This was its biggest difference from market makers, but treasury strategy will change everything. Crypto, stocks, and bonds will be jointly issued, and who will control coin prices remains to be seen.

Conclusion

Custody institutions are new fund convergence points. Offline needs safe on-chain, online needs compliant off-chain. Treasury strategy will allow custody institutions to actively influence coin prices. Crypto liquidity is the most fundamental power structure, previously CEX+MM (market makers), but reality is that both are no longer glorious.

BNY has over $52 trillion in custody amount. In comparison, the entire crypto market is less than $4 trillion, with USD stablecoins + crypto ETFs + treasury companies only $520 billion. Crypto custody institutions' market influence still needs considerable time to develop.

But where the money is, where it's most profitable, is something every Founder needs to seriously consider.