Original Title: Can Tokenized Pre-IPO Stocks Break Barriers in the Private Equity Market?

Source: Tiger Research

Translated by: AididiaoJP, Foresight News

Abstract

· Although the private equity market offers high returns, it remains primarily accessible to institutional investors and high-net-worth individuals, with ordinary investors finding it difficult to participate.

· Tokenization can address the limitations of traditional financial systems in liquidity, accessibility, and convenience, but still faces significant legal and technical barriers.

· Projects like Ventuals, Jarsy, and PreStocks are exploring different approaches to tokenizing private equity. While these attempts are still in early stages, they have shown potential to reduce market structural barriers.

Private Equity is Highly Attractive, but Ordinary Investors Cannot Participate

How can ordinary people invest in SpaceX or OpenAI? As non-listed companies, they are out of reach for most investors. Ordinary investors have almost zero opportunity to participate, as investment opportunities typically only arise after a company goes public.

The core issue is that ordinary investors are excluded from the high returns created by the private market. The value created in the private market over the past 25 years is approximately three times that of the public market.

This structural barrier stems from two core factors. First, the financing process for private companies is highly sensitive, and regardless of investor qualifications, transactions are usually only open to well-known institutional investors. Second, the growth of the private capital market provides more financing options for enterprises, with many companies now able to raise billions of dollars without going public.

OpenAI is a typical example of these dynamics. In October 2024, it raised $6.6 billion from major investors including Thrive Capital, Microsoft, NVIDIA, and SoftBank. By March 2025, it raised $40 billion in a funding round led by SoftBank, with participation from Microsoft, Coatue, and Altimeter, becoming the largest private financing in history.

This phenomenon reveals a reality: only a few institutional investors can participate in the private market, and mature private equity infrastructure provides these companies with financing options beyond going public.

Therefore, today's investment environment is becoming increasingly closed, exacerbating inequality in high-growth opportunity allocation.

Equal Access: Can Tokenization Solve Structural Barriers?

Can tokenization truly solve the structural inequality in the private equity market?

On the surface, this model is quite attractive: real-world assets are converted into digital tokens, achieving fragmented ownership and supporting 24/7 trading in global markets. However, essentially, tokenization is just repackaging existing assets like Pre-IPO equity into a new form. Traditional finance already has solutions to improve accessibility.

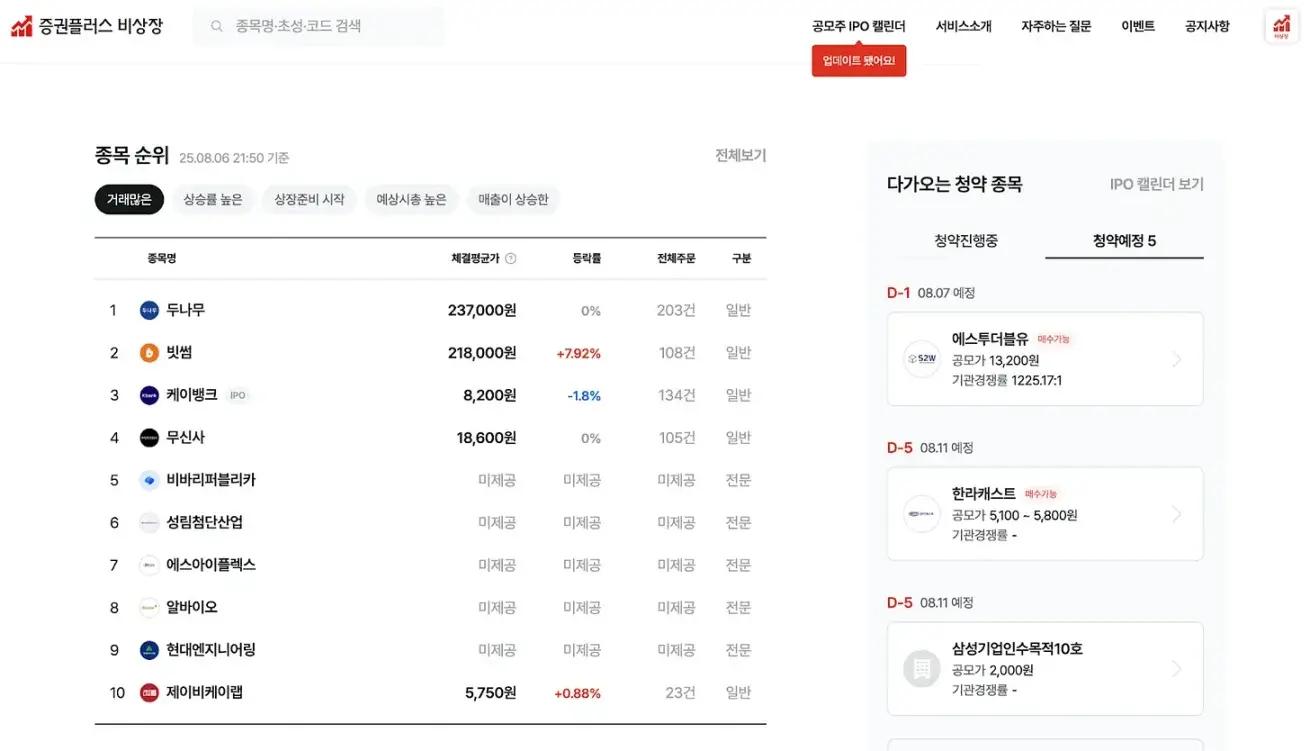

Source: ustockplus

For example, platforms like Dunamu's Ustockplus in Korea, Forge, and EquityZen in the United States allow ordinary investors to trade private stocks within existing regulatory frameworks.

So, what makes tokenization unique?

The key lies in market structure. Traditional platforms use a peer-to-peer (P2P) matching model, where buyers must wait for sellers to list. If there's no counterparty, the transaction cannot be completed. This model suffers from low liquidity, limited price discovery, and unpredictable execution times.

Tokenization promises to solve these structural limitations. If tokenized assets are listed on centralized exchanges (CEX) or decentralized exchanges (DEX), liquidity pools or market makers can provide continuous counterparties, thereby improving execution efficiency and pricing accuracy. Beyond reducing friction, this approach can redefine market architecture.

Moreover, tokenization can enable functions that traditional financial systems cannot support. Smart contracts can automatically distribute dividends, execute conditional trades, or implement programmable governance rights. These functions provide possibilities for the birth of new financial instruments that are designed to be both flexible and transparent.

Projects Attempting to Tokenize Pre-IPO Equity

(The rest of the translation follows the same professional and accurate approach, maintaining the original structure and terminology.)PreStocks is built on the Solana blockchain, enabling trading through integration with Jupiter and Meteora. It provides round-the-clock trading and instant settlement without management fees. There is no minimum investment requirement, and anyone with a Solana-compatible wallet can participate, further lowering the entry barrier.

However, the platform has some limitations, with users from the United States and other major jurisdictions unable to access it. Although all tokens are allegedly fully collateralized by underlying stocks, PreStocks has not yet publicly disclosed detailed holding verification documents. The team states they will regularly release external audit reports and offer paid individual verification services upon request.

Compared to Jarsy, PreStocks has tighter integration with decentralized exchanges (DEX), which may support broader secondary use cases such as token lending. Within the Solana ecosystem, tokenized public stocks (like xStock) are already actively used, and PreStocks may benefit from ecosystem-level synergies.

Unresolved Obstacles in Pre-IPO Stock Tokenization

The tokenized stock market is in its early stages. Although platforms like Ventuals, Jarsy, and PreStocks show early development momentum, significant structural challenges remain.

First, regulatory uncertainty is the most fundamental barrier. Most jurisdictions still lack clear legal frameworks for tokenized securities. Therefore, many platforms operate in regulatory gray areas, actively leveraging judicial arbitrage without direct compliance.

Second, resistance from private companies remains a key obstacle. In June 2025, Robinhood announced a new service for EU clients offering tokenized investment exposure to companies like OpenAI and SpaceX. OpenAI immediately publicly opposed this, stating: "These tokens do not represent OpenAI's equity, and we have no partnership with Robinhood." This response highlights private companies' reluctance to relinquish control over equity structures and investor management, which are core functions they closely guard.

Third, technological and operational complexity cannot be overlooked. Maintaining reliable connections between real-world assets and tokens, handling cross-border compliance issues, addressing tax implications, and executing shareholder rights are non-trivial challenges. These issues could significantly limit user experience and scalability.

Despite these limitations, market participants continue actively seeking solutions. For example, Robinhood plans to expand its token products to thousands of assets by year-end, despite facing numerous challenges in the public market. Platforms like Ventuals, Jarsy, and PreStocks continue to advance by differentiating tokenized equity access methods.

In short, tokenization offers a promising path to improving private equity market accessibility, but this field remains in its infancy. Current limitations are real, but the crypto industry's history demonstrates that technological breakthroughs and rapid market adaptation can, and often do, redefine possibilities.