In the Upbit market, when converted to Korean won, the daily trading volume from August 10th 0:00 to 6:08 PM was 3.53 trillion won, and the cumulative trading volume for the past 24 hours was 5.99 trillion won. The 24-hour trading volume increased by 63.19% compared to the previous day.

Looking at the trading flow by theme, trading volume was concentrated in the 'DeFi' and 'Infrastructure' areas.

In the DeFi sector, Ray (RAY, +10.37%) showed the strongest upward trend, while Strike (STRIKE, +5.41%) and ENA (+1.28%) also demonstrated an upward movement. In contrast, some assets like COW (–3.86%) and ONDO (–2.31%) showed weakness.

In the infrastructure theme, BSV (+4.18%) and ERA (+3.51%) stood out among rising assets, and BTC (+1.23%) also increased. However, XRP (–1.01%) and XLM (–1.46%) could not avoid a downward trend.

In the smart contract platform area, the downward trend was generally predominant. Ethereum (ETH, –1.60%) and Ethereum Classic (ETC, –2.83%) showed weakness, and XTZ (–3.52%) recorded the largest decline. However, one unconfirmed asset showed a high increase of +13.02%.

In the meme theme, Doge (DOGE, –3.32%) and some meme assets declined, but Pengu (PENGU, +0.94%) recorded a limited increase.

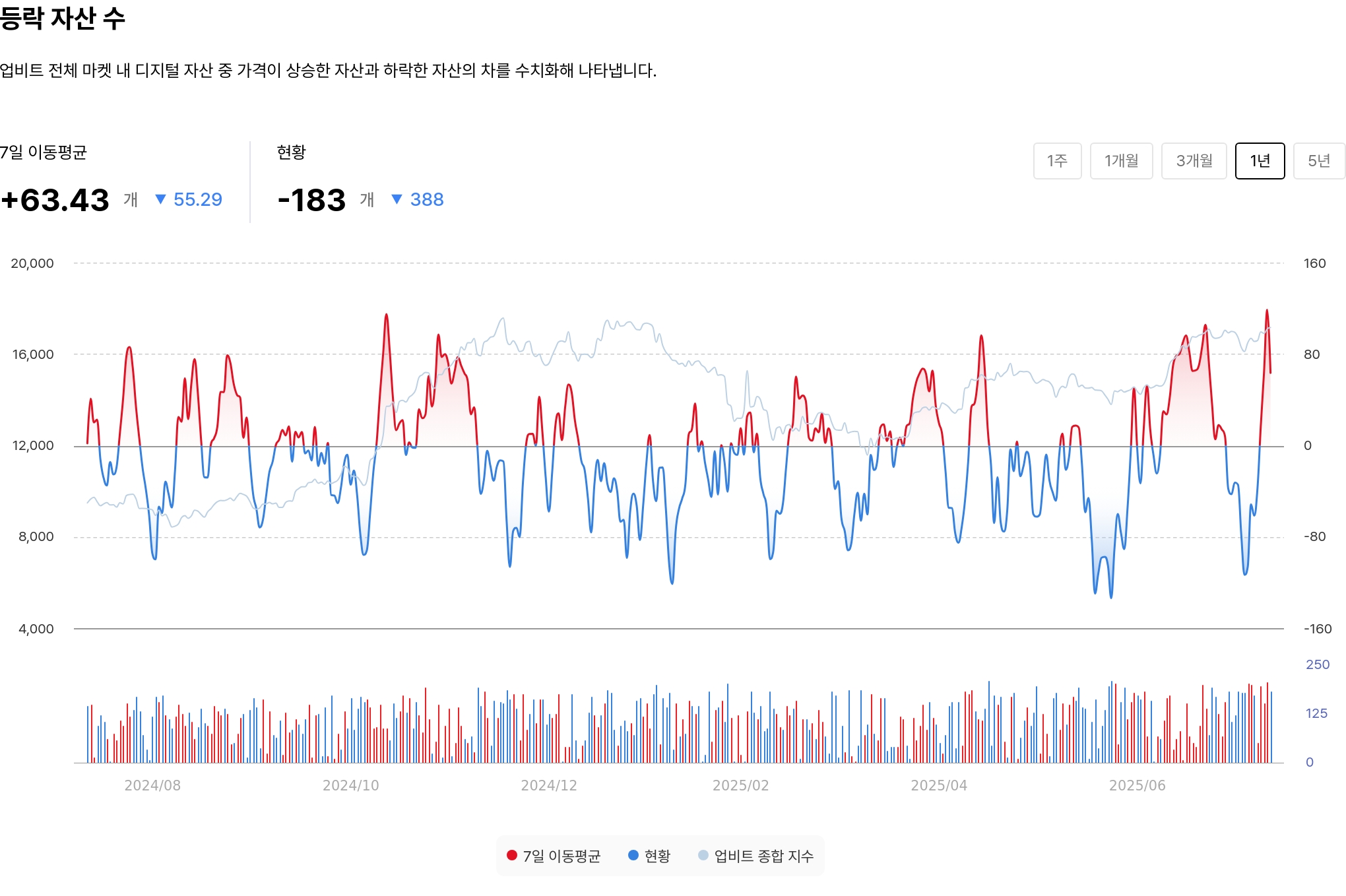

In the Upbit market, the downward trend continued to overwhelm rising assets. The number of rising and falling assets was –183, meaning there were 183 more declining assets than rising assets.

The 7-day moving average recorded +63.43, which is interpreted as reflecting a sudden market reversal on the day. Over the course of a day, 388 assets experienced expanded volatility, and a sharp contraction in investor sentiment was observed.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>