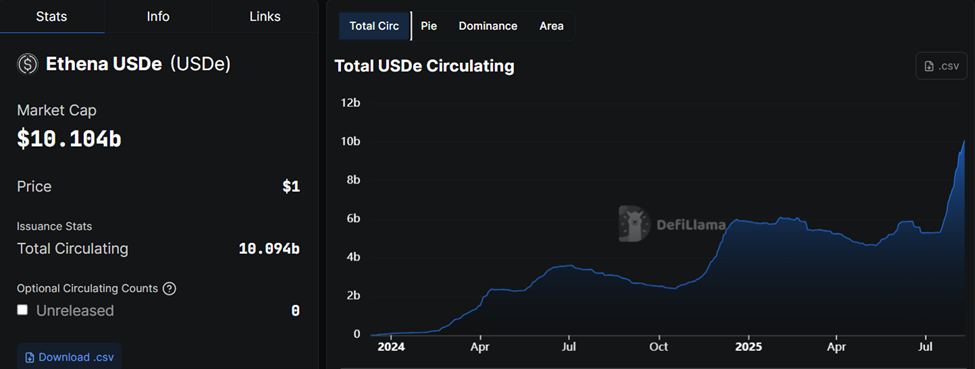

Ethena's synthetic dollar, USDe, has achieved a market capitalization of $10 billion within 500 days. This movement firmly establishes its position as one of the fastest-growing stablecoins in cryptocurrency history.

However, skepticism about USDe remains, with some analysts suggesting it could be the UST of this cycle.

Ethena and USDe Stablecoin Reach $1 Billion... Preparing for the Next Growth Stage

Ethena broke through a total value locked (TVL) of $10 billion on Sunday, nearly doubling in less than a month. Last week was one of Ethena's highest fee-generating weeks, with the protocol generating over $475 million in fees.

Supply has doubled over the past month, and investors are watching for an explosive next stage.

According to analyst Crypto Stream, Ethena's governance and protocol token ENA is on the verge of unlocking a powerful new revenue engine. Four out of five governance conditions to activate the fee switch have already been met.

Ethena's governance framework presents strict criteria for fee distribution activation:

- USDe supply over $8 billion — Met.

- Protocol revenue over $25 million — Met, currently over $43 million.

- Reserves at minimum 1% of supply — Met.

- sUSDe APY spread within 5.0-7.5% range — Met, currently around 10%.

- USDe integrated into 3 of top 5 derivatives exchanges — Not yet met.

Analysts say this will open the way to distribute protocol revenue to ENA holders. The final hurdle is listing on Binance or OKX exchange.

"Fee switch is on: Ethena is a revenue monster. At some point, revenues will flow into ENA," Crypto Stream posted, calling ENA their largest spot position.

OKX and Binance exchanges remain unintegrated. Binance initially blocked USDe listing due to regulatory issues under the EU's MiCA (Crypto Asset Market) framework.

Details on the missing Binance integration:

— Crypto Stream (@CryptoStreamHub) August 10, 2025

USDE was not integrated into Binance due to a regulatory issue in Germany regarding MICA compliance.

The bad news is that: It seems the issue cannot be resolved, so USDE will not be able to operate in the EU market in the foreseeable…

However, EU user offboarding earlier this month could pave the way for global USDe listing.

Converge, Transforming into Ethena's Revenue Champion

While the fee switch will be a major milestone, some expect greater rewards. Analyst Jacob Canfield pointed out Ethena's long-term plan to launch blockchain Converge with ENA as the protocol token.

Introducing @convergeonchain: The settlement network for traditional finance and digital dollars, powered by @ethena_labs and @Securitize

— Ethena Labs (@ethena_labs) March 17, 2025

Our vision is to provide the first purpose built settlement layer where TradFi will merge with DeFi, centered on USDe & USDtb and secured by… https://t.co/BdOMMflqNl pic.twitter.com/sYxS6p9T8W

In this model, ENA holders can stake tokens to validators and earn a portion of transaction value. This will transform ENA into a revenue asset linked to network economic activity.

Meanwhile, Ethena's roadmap extends beyond pure cryptocurrency growth. Crypto Stream highlighted Stablecoin X(TCO)'s Nasdaq listing in Q4, providing institutional investors direct exposure to the Ethena ecosystem.

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation… pic.twitter.com/sgfD8P9m05

— Ethena Labs (@ethena_labs) July 21, 2025

Circle's USDC success demonstrates significant demand for regulated stablecoin instruments in traditional finance (TradFi).

Meanwhile, DeFiance Capital founder Arthur Cheng believes large funds have undervalued Ethena due to its token unlock schedule.

"You have no idea how many funds are simply ignoring $ENA for the simple reason of 'too many unlocks', overlooking the potential growth ahead," Cheng said.

However, despite this, Ethena's rapid rise is being compared to Terra's ill-fated UST, which collapsed in 2022.

USDe has become the third-largest stablecoin following the passage of the GENIUS Act. Critics warn that synthetic stablecoins inherently have vulnerabilities, especially in unstable markets.

However, Guy Young, the founder of Ethena, countered by pointing out integrated risk management and various DeFi collaterals designed to mitigate de-pegging risks.

If Binance or OKX integrate the USDe stablecoin and fee conversion is activated, with macro tailwinds aligning, Ethena can redistribute protocol revenue to ENA holders.

In such a scenario, if the Federal Reserve (Fed) rates decrease, this could increase Ethena's profitability, historically inversely proportional to cryptocurrency funding costs.

With increasing USDe adoption, growing reserves, and the upcoming Converge chain, all pieces could fall into place.

At the time of writing, Ethena is trading at $0.7759, having risen by more than 3% in the past 24 hours.