Welcome to the Asia-Pacific Morning Brief—an essential summary of overnight cryptocurrency developments that shape regional markets and global sentiment. Monday Edition is provided by Paul Kim, with a summary of last week and predictions for this week. Prepare your green tea and stay tuned to this space.

As the U.S. employment situation rapidly deteriorates, tensions are escalating between the Trump administration and the Federal Reserve regarding interest rate cuts. The interest rate outlook for the next three months is changing daily based on inflation and employment indicator announcements. The market is showing extreme sensitivity.U.S. Stagflation Concerns

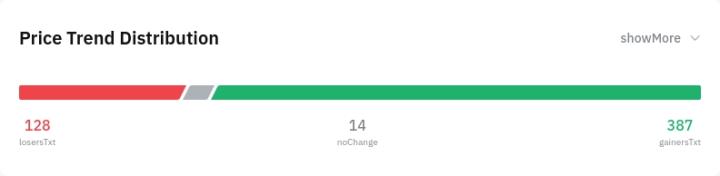

Last week's cryptocurrency market volatility began with the ISM Services PMI released on Tuesday. This index indicated a slowdown in the U.S. service sector. It also reported rising prices and decreased employment in the service sector, the first such occurrence since the start of Trump's "trade war" in April. Rising prices coupled with employment decline represent stagflation, one of the most challenging economic crises that can prevent central banks from lowering or raising interest rates. Market concerns are growing that the Trump administration's tariff policies are pushing the U.S. toward stagflation. Simultaneously, the possibility of three interest rate cuts this year has been reduced to two. Last week, prices of most market liquidity-sensitive risk assets, including cryptocurrencies, fluctuated. Prices dropped when there was a possibility of two rate cuts within the year and rose when it changed to three. By the end of the weekend, Steven Miran was appointed to fill the vacancy of Federal Reserve Board member Adriana Kugler. Miran is one of Trump's closest economic advisors. The market interpreted this appointment as a signal that President Trump is strongly pushing for interest rate cuts. The U.S. stock market closed with expectations of three rate cuts this year.Ethereum, BlackRock Outflow Recovery

During the weekend, an unexpected statement by Federal Reserve Vice Chair Michelle Bowman triggered a surprise surge in Ethereum. In a speech at the Kansas Bankers Association, Bowman firmly stated that "three rate cuts are necessary" and emphasized that recent employment data requires proactive measures to prevent further weakening of economic activity and employment conditions. Subsequently, Ethereum's price temporarily exceeded $4,300. In contrast, BlackRock made a significantly unexpected move. A major player in the U.S. spot ETF industry, BlackRock withdrew substantial funds from its Bitcoin spot ETF (IBIT) and Ethereum spot ETF (ETHA) on Monday, injecting uncertainty into the market. That day, IBIT experienced a net outflow of $292.21 million, the largest single-day outflow since May 30. Market analysts began speculating that Bitcoin prices could drop again to around $111,000. The Ethereum spot ETF, ETHA, recorded a net outflow of $375 million, representing a 3% decrease in BlackRock's Ethereum holdings in just one day. The massive outflow from BlackRock's ETFs interrupted the 21-day consecutive net inflow record of the Ethereum spot ETF.Tom Lee, 'Buy Ethereum... Most Important Trade in Next 10 Years'

Fortunately, the net outflow of ETF funds stopped after two days. Of the two major cryptocurrencies, Ethereum showed faster recovery. Strategic ETH purchases by U.S. listed companies catalyzed Ethereum's price recovery. Bitmain renewed its record as the world's largest Ethereum-holding listed company, holding over 830,000 ETH. Famous Wall Street investment expert Tom Lee emphasized, "Buying Ethereum will be the most important trade in the next 10 years." Standard Chartered Bank's Digital Assets Research Head Jeff Kendrick explained, "Stocks of companies purchasing Ethereum could be a more attractive investment than Ethereum spot ETFs." It was a week when President Trump signed a new executive order to prevent de-banking of legitimate cryptocurrency businesses and open the retirement pension market. Ethereum's weekly price rose 25.01%, while Bitcoin only increased 5.44% despite recovering to $119,000 over the weekend. Solana (SOL), with a lower market cap than ETH, rose 15.04%. It was a week that demonstrated Ethereum's clear presence.Market Strength Depends on Low CPI

This week is expected to follow a similar pattern to last week. Market attention is focused on whether the Federal Reserve will implement three rate cuts this year and if a definitive rate cut will be announced at the September Federal Open Market Committee (FOMC) meeting. [Table remains the same] In this context, the U.S. July Consumer Price Index (CPI) data to be released on Tuesday is crucial. If the actual CPI figure significantly exceeds market expectations, the prospects for rate cuts in the second half of the year will become uncertain again. In such a case, cryptocurrency prices will likely enter another adjustment phase.The Producer Price Index (PPI) on Thursday night and the US July industrial production and retail sales figures on Friday are also worth noting. These will provide evidence to confirm whether the US economy is contracting.

Statements by Federal Reserve officials, which will have a significant impact on the September FOMC interest rate decision, are also important. On Wednesday, Chicago Federal Reserve Bank President Austan Goolsbee will attend a monetary policy luncheon hosted by the Springfield Chamber of Commerce. Remarks about the current economic outlook or future interest rate direction could affect the market.

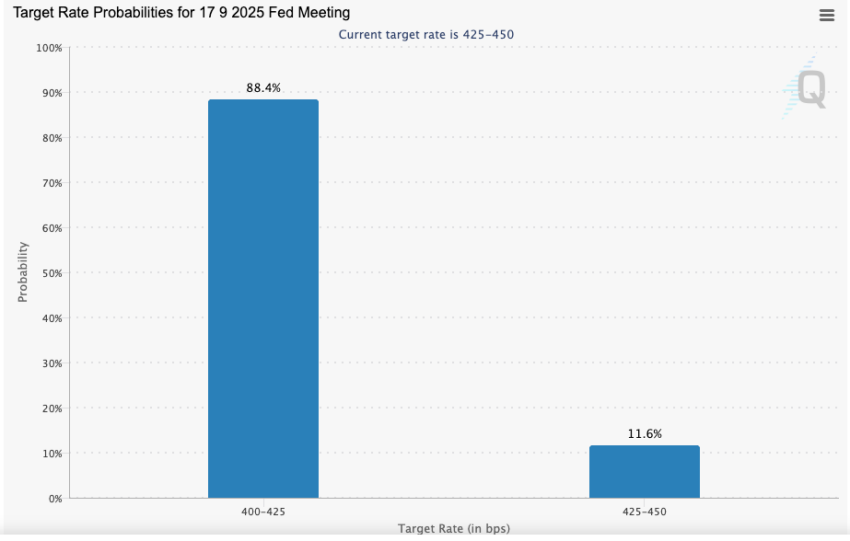

According to FedWatch data, as of Monday morning, the probability of a 0.25% rate cut at the September FOMC meeting is 88.4%. After Vice Chair Bowman's weekend remarks, the benchmark interest rate futures market may slightly increase this probability. However, it is difficult to confirm whether this probability will be maintained until the weekend.

We wish all readers successful investments this week.