Cryptocurrency Market Performance

Currently, the total cryptocurrency market value is $3.86 trillion, with BTC accounting for 60% at $2.3 trillion. Stablecoin market value is $269.8 billion, with a 7-day increase of 1.04%, of which USDT accounts for 61.21%.

Among the top 200 projects on CoinMarketCap, most are up with a few down, including: MNT with a 7-day increase of 41.91%, Pendle with a 7-day increase of 31.81%, PUMP with a 7-day increase of 29.16%, MYX with a 7-day increase of 1420.3%, and TOSHI with a 7-day increase of 22.52%.

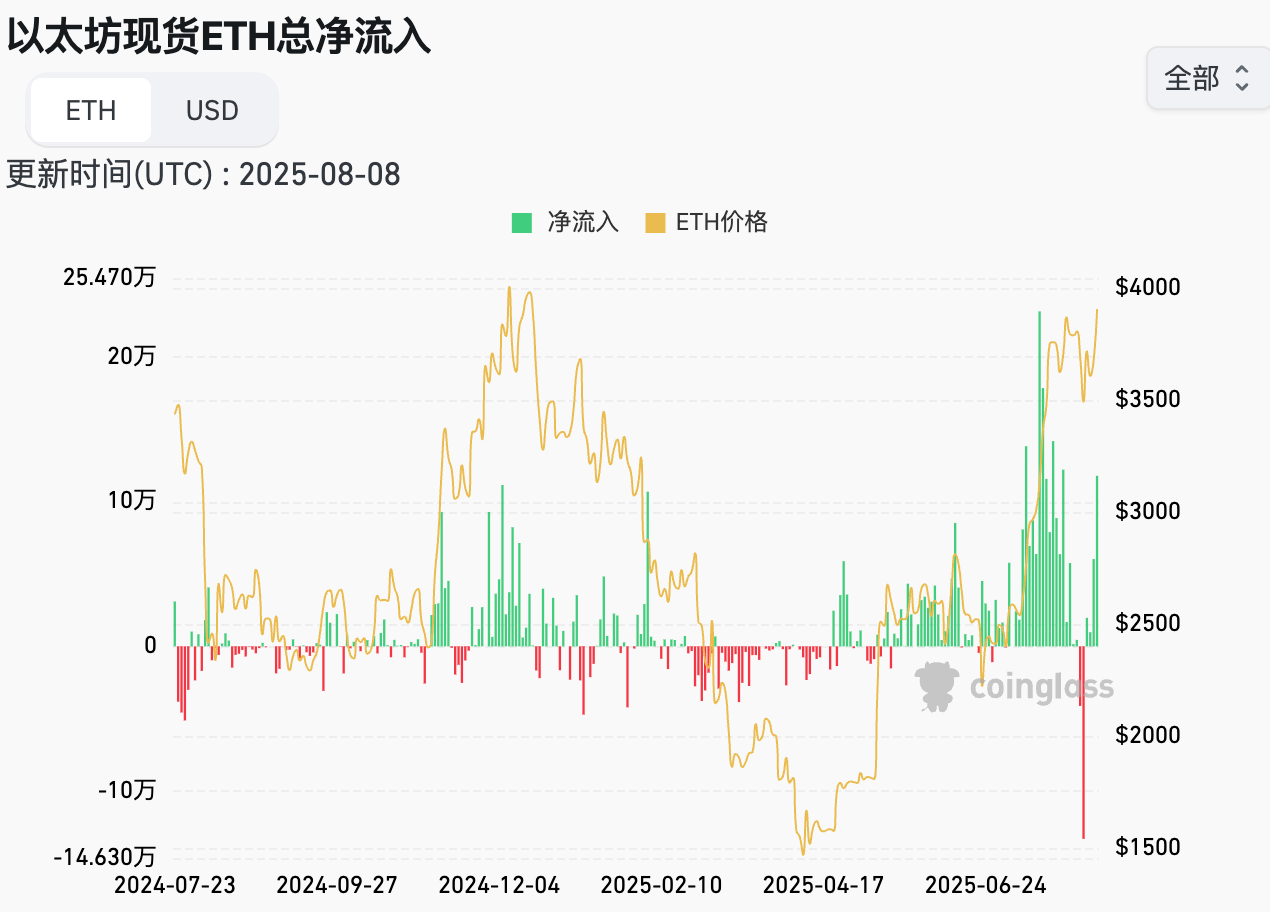

This week, US Bitcoin spot ETF net inflow: $253.6 million; US Ethereum spot ETF net inflow: $326.4 million.

Market Forecast (August 11-August 15):

This week, stablecoins continued to be issued, with US Bitcoin and Ethereum spot ETFs showing continuous net inflows, and Ethereum breaking through $4,000, performing impressively. The RSI index is 62.75, indicating overbought. The Fear and Greed Index is 68 (higher than last week).

BTC: Highly likely to oscillate in the $114,500-$118,500 range, with the breakthrough direction dependent on US CPI data. If the data supports rate cut expectations, it may test $120,000; if the data is strong, it might fall back to the $112,500 support;

ETH: Performance may continue to outperform BTC, with the main fluctuation range between $3,750-$4,200. Any positive signals from the SEC regarding spot ETFs could drive ETH to continue breaking through.

Short-term investors: Can adopt range trading strategies, buying near support levels and partially taking profits near resistance levels.

Medium to long-term investors: Should use potential pullback opportunities to build positions in batches, focusing on strong support areas around BTC $112,500 and ETH $3,300.

Understanding Now

Weekly Event Review

1. On August 6, the US Securities and Exchange Commission issued a statement on liquidity staking activities, stating that liquidity staking is not considered a security;

2. On August 6, Base released an incident report, experiencing a 33-minute block generation interruption on August 5 due to switching to a backup sequencer that was not correctly set up to handle transactions;

3. On August 5, JD.com's JD Chain stated that it has noted market rumors and is preparing for a Hong Kong stablecoin license application;

4. On August 7, according to Etherscan data, Ethereum network daily transactions rose to 1.87 million, close to the historical high of 1.96 million on January 14, 2024;

5. On August 6, Cboe BZX, owned by the Chicago Options Exchange (CBOE), submitted a 19b-4 filing to the SEC, requesting permission for VanEck's Ethereum ETF to stake ETH through trusted staking providers to earn rewards as income;

6. On August 6, the SEC and Ripple formally ended their 4-year legal battle, maintaining the first-instance ruling;

7. On August 8, Trump announced the nomination of "crypto-friendly" official Stephen Miran as a Federal Reserve Board member.

Macroeconomics

1. On August 6, the White House stated that Trump signed an executive order imposing an additional 25% tariff on goods from India in response to India's continued purchase of Russian oil. Oil prices rose shortly after Trump's new tariffs, touching the day's high;

2. On August 7, the Bank of England cut rates by 25 basis points, lowering the base rate from 4.25% to 4%, marking the fifth rate cut in this cycle, in line with market expectations;

3. On August 7, US initial jobless claims for the week ending August 2 were 226,000, compared to the expected 221,000;

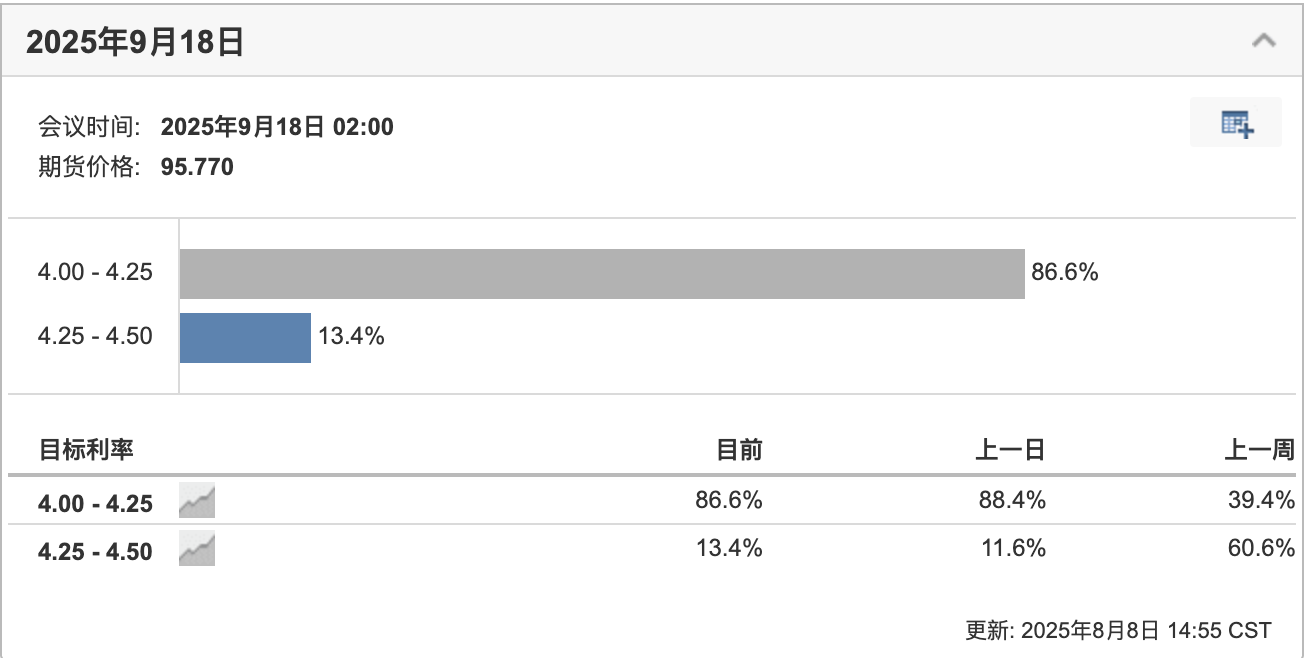

4. On August 8, according to CME "Fed Watch", the probability of a 25 basis point rate cut in September is 92.7%, with a 7.3% chance of maintaining current rates.

ETF

According to statistics, from August 4 to August 8, US Bitcoin spot ETF net inflow: $253.6 million; as of August 8, GBTC (Grayscale) has outflowed a total of $23.662 billion, currently holding $21.058 billion, IBIT (BlackRock) currently holding $85.956 billion. The total market value of US Bitcoin spot ETFs is: $152.024 billion.

US Ethereum Spot ETF Net Inflow: $326.4 million.

Foresee the Future

Event Announcement

1. Coinfest Asia 2025 will be held from August 21 to 22 in Bali, Indonesia;

2. WebX Asia 2025 will be held from August 25 to 26 in Tokyo, Japan;

3. Bitcoin Asia 2025 will be held from August 28 to 29 at the Hong Kong Convention and Exhibition Centre.

Important Events

1. On August 12 at 12:30, the Australian Central Bank will announce its interest rate decision;

2. On August 12 at 20:30, the US will release the July unadjusted CPI (year-on-year);

3. On August 14 at 20:30, the US will release the seasonally adjusted initial jobless claims (in thousands) for the previous week (up to 0809).

Token Unlocks

1. Aptos (APT) will unlock 11.3 million tokens on August 12, valued at $53.04 million, representing 2.2% of circulating supply;

2. Avalanche (AVAX) will unlock 1.67 million tokens on August 15, valued at approximately $39.14 million, representing 0.33% of circulating supply;

3. Starknet (STRK) will unlock 126 million tokens on August 15, valued at $16.18 million, representing 5.98% of circulating supply;

4. Sei (SEI) will unlock 55.56 million tokens on August 15, valued at approximately $17.12 million, representing 1.21% of circulating supply;

5. Arbitrum (ARB) will unlock 92.63 million tokens on August 16, valued at approximately $39.11 million, representing 2.04% of circulating supply.