Vitalik Buterin's Ethereum holdings have exceeded $1 billion. This important milestone arrives amid seemingly scarce ETH off-chain liquidity. Consequently, large traders and institutions are competing to secure supply and reevaluating Ethereum's position relative to Bitcoin.

On-chain dashboards and industry reports support both sides' claims. Additionally, a famous blockchain explorer publicly displays Buterin's portfolio. Social media posts reflect a tense atmosphere and speculation about the potential impact of scarcity on ETH price trajectory.

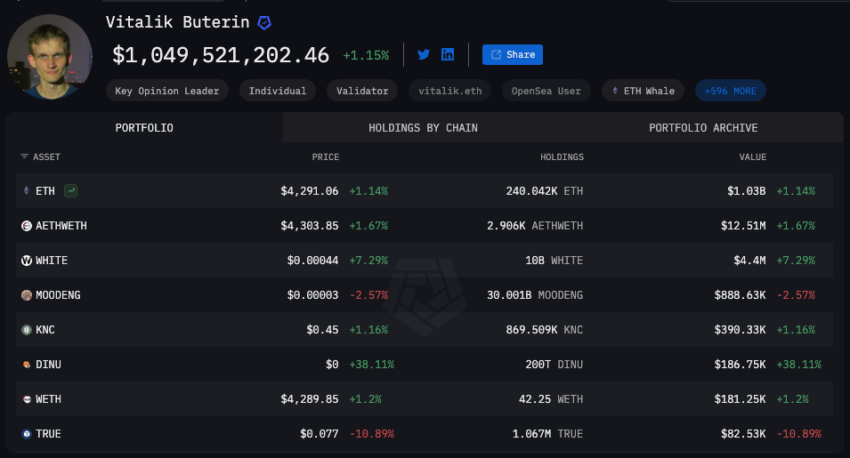

$1 Billion ETH Portfolio... Complete Transparency

As of mid-2024, Buterin's known Ethereum addresses record over $1 billion in holdings. Entity-level dashboards and public explorers list these wallets. The Arkam platform shows over 240,000 ETH, along with validator roles and transactions. Vitalik Buterin's Arkam entity data serves as a central reference for balance monitoring.

While Buterin's wealth attracts attention, a different story unfolds in off-exchange markets. The private market for large ETH trades is reportedly facing supply shortages.

"Over the past hour, Binance, Coinbase, and Bitstamp have moved approximately $160 million worth of ETH to Galaxy Digital's over-the-counter exchange. Largest single trade: 4,500 ETH ($19 million). Ethereum whales are actively moving today." – CryptosRus statement.

Large transfers reveal the scale of activity moving through off-chain channels. However, observers are also reporting shortages on active exchanges.

"Known market maker Wintermute is experiencing an Ethereum shortage on their over-the-counter exchange. This means the only way to purchase ETH is through the public market. Could Ethereum soon break $5,000?" – yourfriendSOMMI statement.

hearing there is just 42 ETH left on OTC desks

— borovik (@3orovik) August 10, 2025

if true, ETH is going straight to $80,000!!

These posts demonstrate widespread speculation. If demand persists, scarce off-market supply could redirect purchases to the public market.

ETH vs BTC Debate Reignited

The debate about Ethereum's position relative to Bitcoin frequently occurs during liquidity shortages. It also resurfaces when ETH gains market share.

Popular posts recall moments when ETH nearly caught up with Bitcoin's dominance:

"You might not know, but Ethereum almost overtook Bitcoin as the largest market cap coin on June 18, 2017. At that time, BTC held 37.8% market share, and ETH reached 31.2%. However, it ultimately didn't happen, and BTC recovered its dominance, maintaining a significant gap with ETH." – ThuanCapital statement.

That history influences current analysis. With off-market supply scarce, some market voices again mention the possibility of a temporary reversal. Meanwhile, Buterin's on-chain stake signals alignment with Ethereum's future through mainnet and third-party trackers.

As on-chain asset and off-chain channel transparency increases, interest in Ethereum continues. Ultimately, traders will assess whether scarcity and demand might challenge the current state in the coming months.