As the second week of August begins, the total cryptocurrency market capitalization has surpassed $4 trillion, reaching a new all-time high. With improved trading sentiment, the expectation of rising prices is intensifying the imbalance between long and short positions.

As a result, some altcoins may experience significant liquidations this week if prices move contrary to short-term leveraged traders' expectations.

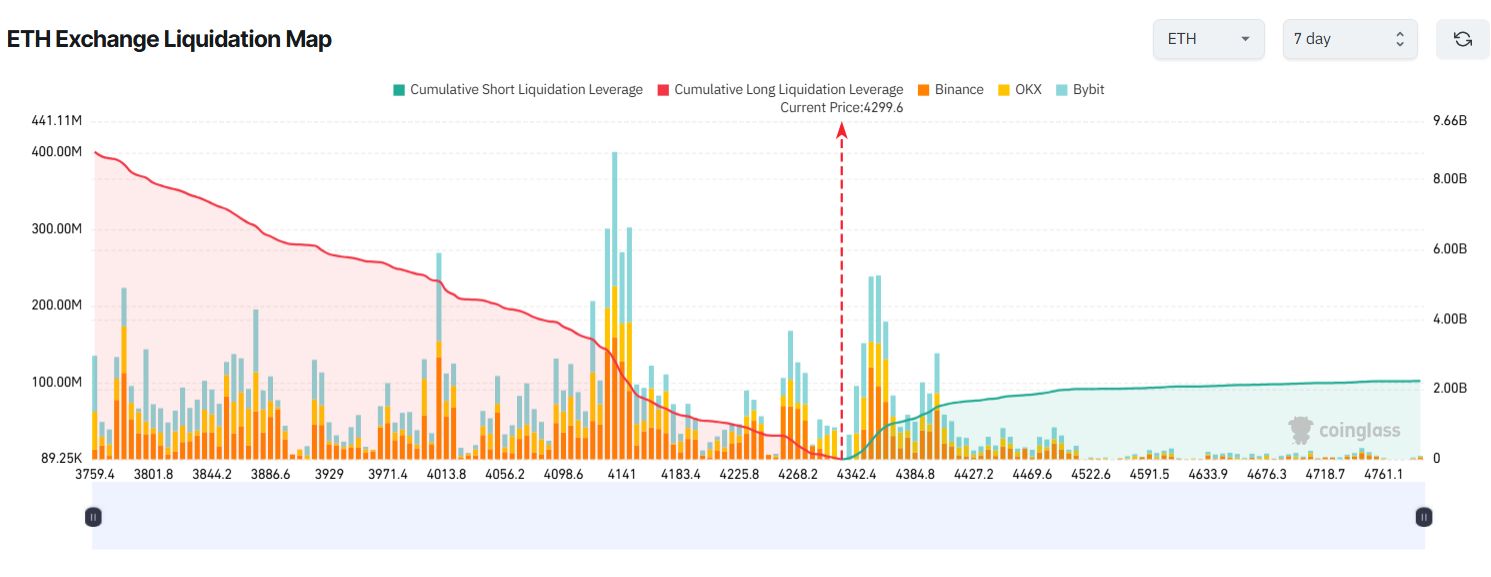

1. Ethereum (ETH)

Ethereum's 7-day liquidation map shows a significant imbalance between accumulated liquidations on long and short sides. Traders are allocating capital and leverage betting that ETH will continue to rise after breaking through $4,300.

According to Coinglass data, if ETH drops 7% this week and falls below $4,000, long positions could lose over $5 billion. Conversely, if it rises 7% and reaches $4,600, short positions would trigger $2 billion in liquidations.

Some traders are concerned that liquidity is primarily flowing into ETH while other altcoins are not seeing the same inflow. They believe that if buying pressure disappears, ETH's rally could lose its sustainability, potentially leading to up to $7 billion in long liquidations.

"If Ethereum drops to $3,600, over $7 billion in long positions will be liquidated. This is a very attractive liquidity pool for exchanges... This suggests ETH's positioning to balance the total cryptocurrency market capitalization in response to Bitcoin dominance, as liquidity is primarily flowing into ETH while other altcoins remain inactive," said investor Marzell.

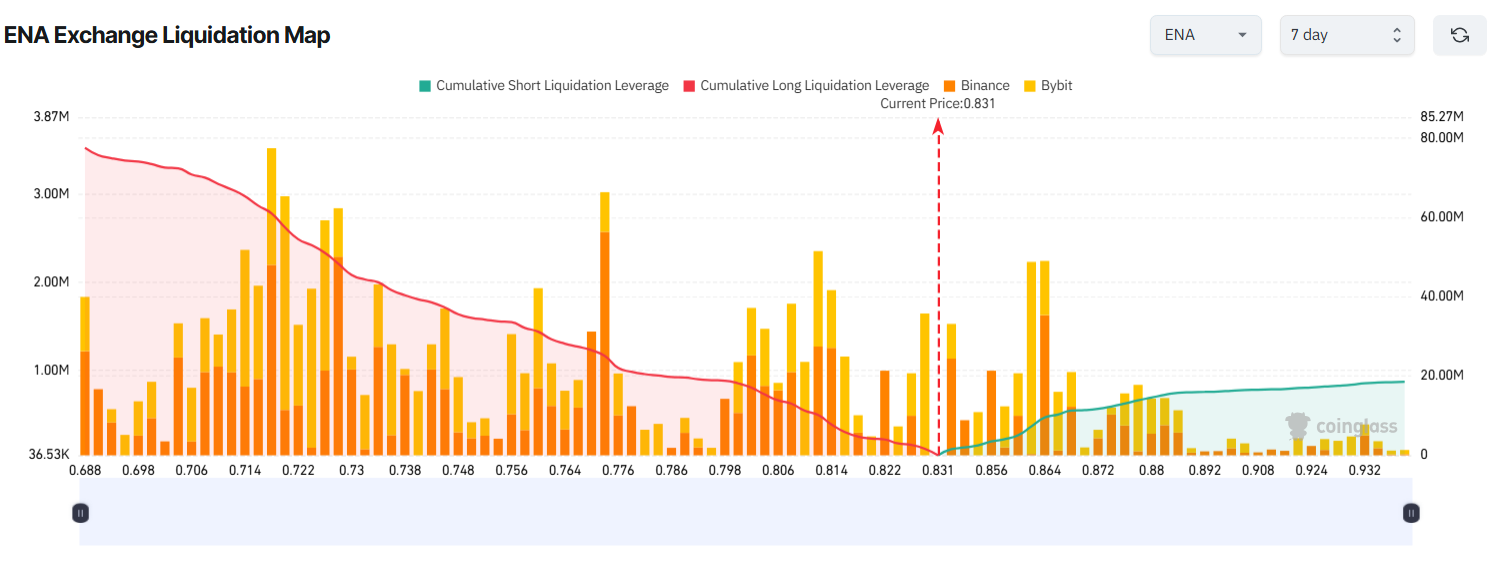

2. Ethena (ENA)

Ethena (ENA) is one of the most discussed altcoins in August. Thanks to the passage of the GENIUS bill on July 18, Ethena's USDe stablecoin has reached a $10 billion market cap, becoming the third-largest stablecoin after USDT and USDC.

Bullish sentiment for ENA has surged, with prices rising from $0.50 to over $0.80 in August. Recent Beincrypto reports indicate that whales are still accumulating ENA, and the liquidation map reflects traders expecting short-term further increases.

ENA's 7-day liquidation map shows that the total accumulated liquidations for longs are much higher than shorts.

If ENA drops to the psychological support level of $0.70 this week, long positions could lose over $70 million. Conversely, if ENA rises to $0.90, short positions would lose $16.5 million.

Some traders believe ENA could continue rising to $1.50. However, they warn it may face profit-taking pressure in the $0.80–$0.90 range.

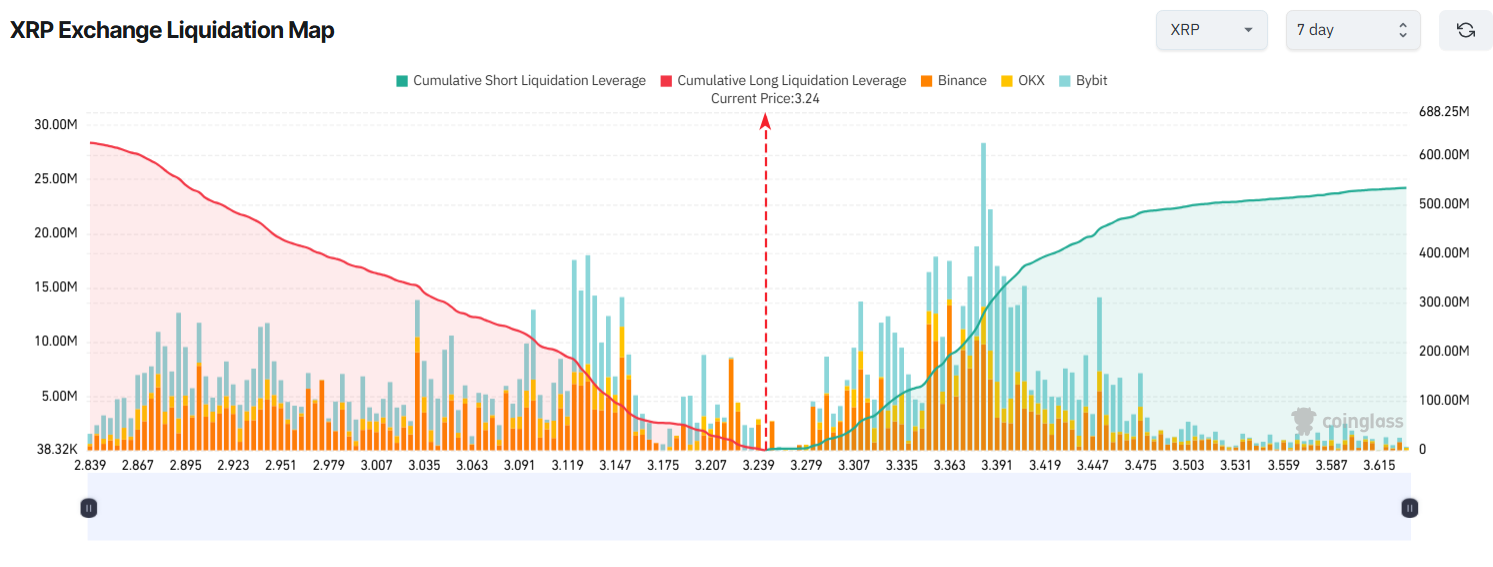

3. Ripple (XRP)

While many altcoins show liquidation map imbalances skewed towards short-term traders' rising expectations, XRP presents a different picture.

Recent Beincrypto reports indicate that Ripple has unlocked 1 billion XRP, raising concerns about downward pressure. Technical signals also suggest sellers may soon take control.

For these reasons, XRP's 7-day liquidation map shows traders are betting more money on a downward scenario.

If XRP moves contrary to these downward bets, short positions could face significant losses this week.

Specifically, if XRP rises 8% and reaches $3.50, approximately $500 million in short positions would be liquidated. Conversely, if XRP drops 8% and reaches $3.00, long positions would face around $370 million in liquidations.