In the cryptocurrency market over the past 24 hours, approximately $380 million (about 555 billion won) worth of leverage positions have been liquidated.

According to the currently aggregated data, long positions dominated the liquidated positions, with long position liquidations of major coins being particularly prominent.

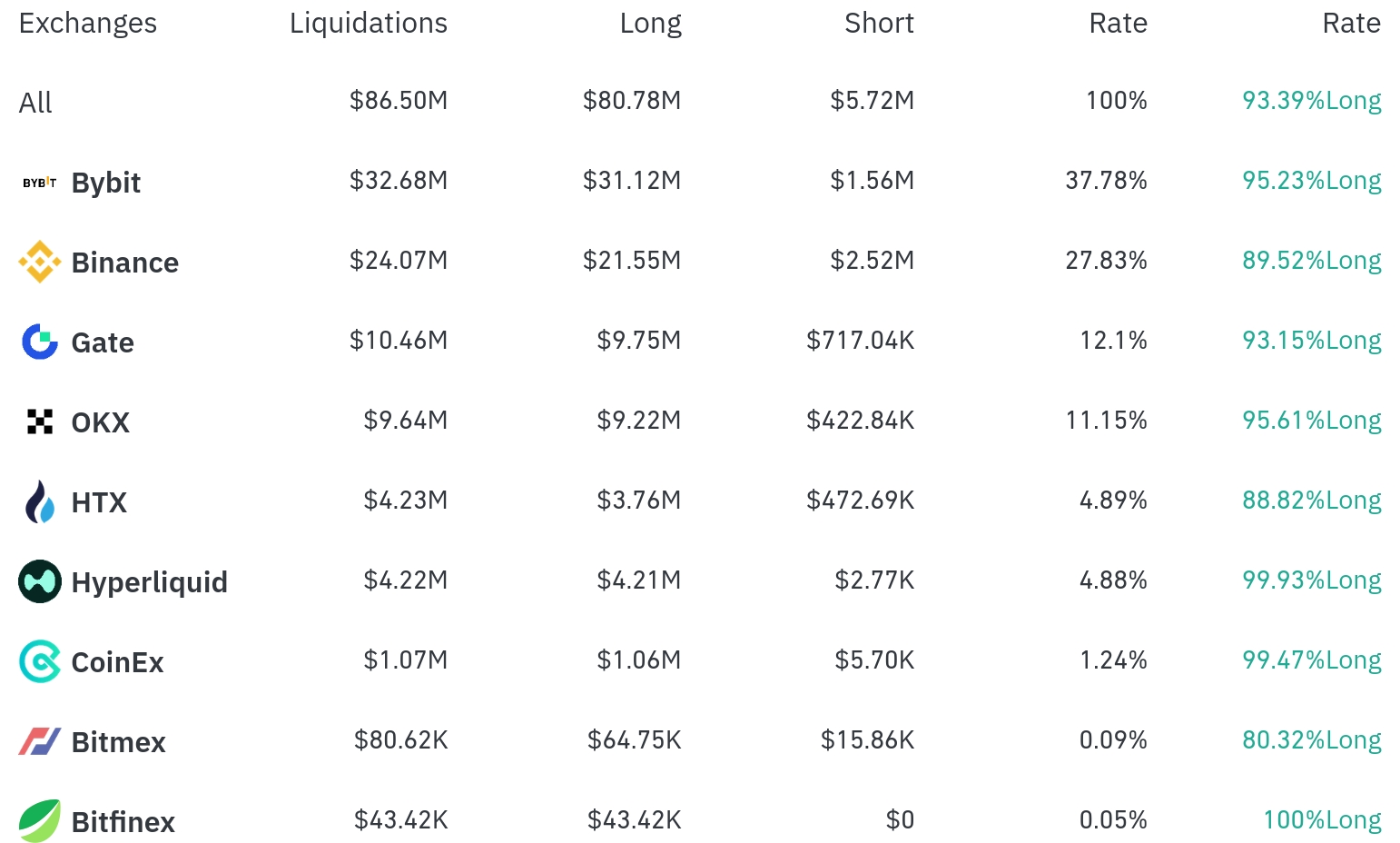

Bybit saw the most position liquidations over the past 4 hours, with a total of $32.68 million (37.78% of the total) liquidated. Among these, long positions accounted for $31.12 million, or 95.23%.

Binance was the second-highest exchange with liquidations, with $24.07 million (27.83%) of positions liquidated, of which long positions were $21.55 million (89.52%).

Gate and OKX recorded liquidations of $10.46 million (12.10%) and $9.64 million (11.15%) respectively, with long position ratios of 93.15% and 95.61%.

Hyperliquid exchange showed a notable characteristic with 99.93% of liquidations being long positions.

By coin, BTC and ETH recorded the most liquidations. Over 24 hours, approximately $146.07 million in BTC positions and $149.97 million in ETH positions were liquidated.

For BTC, $53.28 million was liquidated from long positions and $0.32 million from short positions in 4 hours. For ETH, $77.66 million was liquidated from long positions and $1.89 million from short positions during the same period.

SOL was liquidated for approximately $20.56 million over 24 hours, with its current price at $175.99, down 3.67% in 24 hours.

XRP and Doge also saw significant liquidations of $20.98 million and $12.39 million respectively. Particularly, Doge saw a 2.83% price drop with $10.05 million in long positions liquidated over 4 hours.

Notably, FARTCO Token showed a significant price drop of 11.42% over 24 hours, with $4.15 million in long positions liquidated over 4 hours. Additionally, 1000PEI Token dropped 5.06% with $5.48 million in liquidations during the same period.

This large-scale liquidation, primarily focused on long positions, shows that despite market participants' high expectations for price increases, some coins experienced price corrections. The adjustment was particularly noticeable in the altcoin market.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>