Summary

Digital Asset Treasury (DAT) as an on-chain "enthusiast" financial institution, what are these companies becoming?

- Not just a vault reserve, but also a programmable capital structure;

- Not just a balance sheet, but a liquidity engine;

- Not only holders of cryptocurrency, but builders of a crypto-native financial ecosystem.

The corporate finance departments of the 2020s will no longer resemble traditional CFO offices, but more like a real-time, blockchain-driven hedge fund equipped with APIs, vaults, and validators.

They will handle cross-border payments through stablecoins. Invest funds into ecosystems they help govern. Issue tokens, establish special purpose vehicles (SPVs), and conduct macro hedging - all completed on-chain.

Yesterday's DAT held Bitcoin. Today's DAT operates a flywheel. Tomorrow's DAT will control a programmable capital machine.

They will issue stocks to buy ETH. They will perform yield farming with nine-digit balance sheets. They will stake governance tokens to shape ecosystems while also reporting to Wall Street quarterly. They will blur the lines between treasury, venture capital funds, and protocol operators until only yield curve printing remains.

Welcome to the new era of capital formation, nurtured by cryptocurrency, presented in equity form, and jointly managed by spreadsheets and smart contracts.

In this corporate performance summer, spreadsheets gather dust while balance sheets undergo digital transformation. Listed companies worldwide are abandoning mundane capital plans, boldly venturing into cryptocurrency gambles - a scene worthy of an opera.

Forget R&D fever or flashy product launches. This season's heavyweight event is not a new gadget or service - but financing, directly depositing proceeds into cryptocurrency wallets and letting the market work its magic. From French chip manufacturers to Texan electric bicycle startups, the lineup is diverse. This is your front-row ticket to experiencing corporate cryptocurrency frenzy.

Stage One - Accumulation Era

"A fallen cowboy once wandered in the DeFi wilderness; now, Wall Street suits have entered the same realm."

What happened:

- Since June, nearly 100 listed companies have initiated token purchase activities, raising over $43 billion - twice the total IPO funding in the US for 2025.

- MicroStrategy leads with 607,770 Bit coins on its books (approximately $43 billion); Trump Media has invested $2 billion in Bit coin and its derivatives.

- Special Purpose Acquisition Companies (SPACs) have evolved into "cryptocurrency vaults" (like ReserveOne, Bitcoin Standard), offering cutting-edge investment opportunities for retail investors.

Why it's important:

- This is more than fund management; it's performance art narrated through stock tickers.

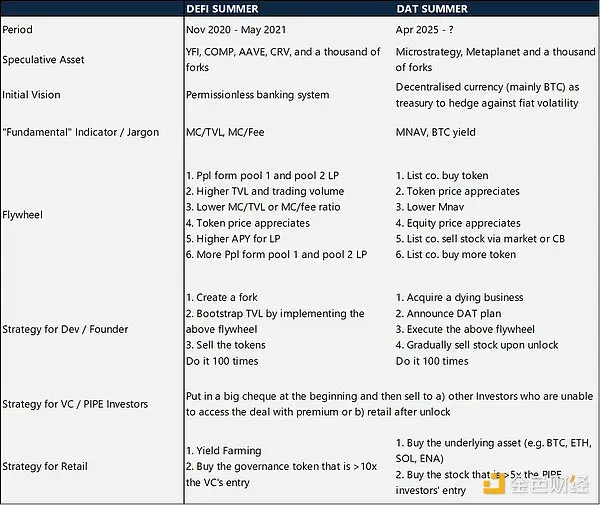

- What was initially a marginal experiment (like the "DeFi Summer" of 2021) has transformed into mainstream finance wearing a tailcoat.

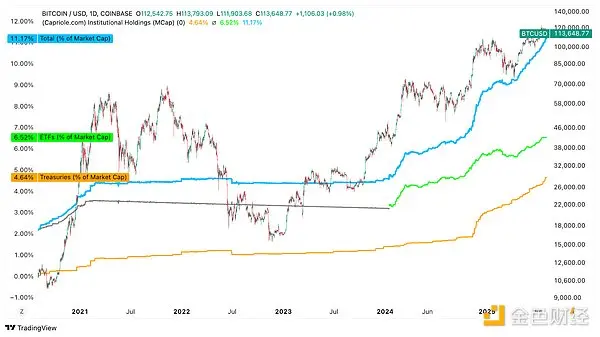

This chart vividly demonstrates the institutional transformation occurring in the Bit coin market, the core argument of the DAT summer. Currently, over 11.17% of Bit coin's market cap is held by institutions, with Exchange Traded Funds (ETFs) accounting for 6.52% and corporate treasuries for 4.64%. Starting from the first stage of sporadic accumulation by a few bold companies, this trend has evolved into a fully operational flywheel, especially after 2023, with the surge of ETF fund inflows and Bit coin price appreciation. This transformation reflects the "launch" of the second stage, where structured funds raised by Wall Street through ETFs and financing are driving liquidity, momentum, and narrative. The significant growth in ETF and corporate treasury holdings is more than a financial activity; it marks the institutionalization of Bit coin as a balance sheet asset and capital market tool. In short, this chart is the clearest evidence yet: Bit coin has become a corporate asset class.

Stage Two - Generating Engineering Revenue from Dormant Reserves

"Buying Bitcoin is stage one. The real excitement begins when you put it to work." — Steve Kurz, Galaxy Digital

Revenue Generation Strategies:

- Staking and DeFi Liquidity: Various companies are investing ETH and other tokens into DeFi protocols.

- Structured Products and Options: Capital market professionals are implementing layered options coverage and basis trading on crypto positions.

- Governance Handbook: Voting in Decentralized Autonomous Organizations (DAOs) and staking governance tokens to influence protocol roadmaps.

- On-chain Ecosystem: Creating products that integrate enterprise fund management into practical application scenarios.

New Flywheel:

- Public companies purchase tokens.

- Token prices rise.

- Stock prices surge due to increased net asset value.

- Issue new stocks or convertible bonds.

- Earnings are redistributed to more tokens.

- Continuously repeat this process.

What Makes It Different:

- This is a combination of traditional capital markets and crypto innovation, fully regulated and highly liquid.

- Companies like Galaxy Digital have helped raise $4 billion for crypto acquisitions, including custody, risk management, and revenue infrastructure.

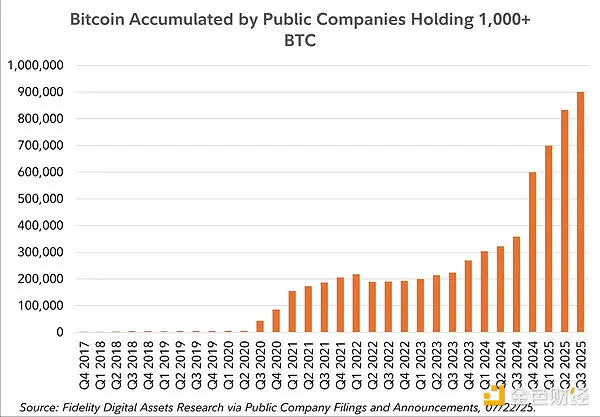

Public companies currently hold nearly 900,000 Bitcoins, growing by 35% in just one quarter.

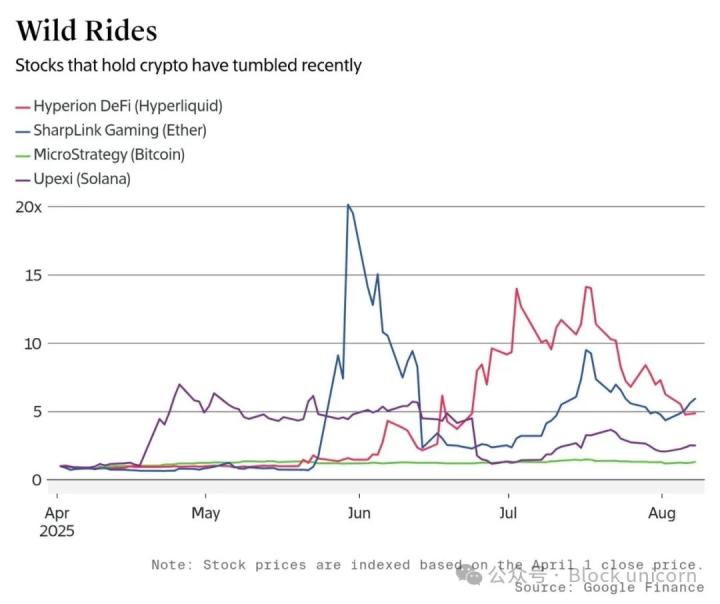

A Familiar Sense of Doubt, Disbelief, and Disruption

Some of the smartest people in the room are rolling their eyes:

- "This is a bubble."

- "ETH has no real demand - why choose SBET?"

- "If the flywheel stops spinning, these crypto vault companies are done."

Fair points. But remember: prices change perspectives, and time will prove everything.

The same occurred with DeFi tokens, Non-Fungible Tokens, and even Bitcoin itself. If irrational enthusiasm builds genuine infrastructure, it won't perish - it will continue to evolve.

Stage Three - Quality Traps and Quality Rewards

"Not everyone will get the same premium. Act early, don't repeat." — Galaxy Digital

Quality Phenomena:

- Companies with large crypto reserve assets trade at an average of 73% higher than their on-chain assets.

- But saturation risks can erode profits - if you're the tenth to enter the market, it will remain indifferent.

Regulatory and Market Changes:

GENIUS & CLARITY Act: Stimulating stablecoin competition; impacting Circle's valuation before the second quarter financial report on August 12.

ETH as Enterprise Strategy: SharpLink Gaming's 360,807 ETH reserves, up 110% this month, signaling a new on-chain treasury model.

Circle Declining While Galaxy Rises

Analysts call it an "integrated supplier" for institutions, surpassing single-service companies like FalconX and NYDIG.

The GENIUS and CLARITY Acts provide support for Galaxy's stablecoin custody, issuance, and AI data center businesses.

Currently, over two-thirds of Galaxy's value comes from its infrastructure, such as the Helios facility (formerly Argo Blockchain), which currently hosts CoreWeave's AI and high-performance computing business.

DAT meets computation, creating a vertically integrated architecture.

[The rest of the text continues in the same professional translation style]