summary

The global stablecoin ecosystem is moving from localized experiments to systematic reconstruction, signaling the rapid integration of a new value transmission and financial coordination mechanism into the mainstream economic structure. Not only does it establish an irreplaceable role as a clearing and storage provider within the digital asset ecosystem, it also builds a universal intermediary bridge between on-chain and off-chain, becoming an organic extension of traditional financial infrastructure.

At the current stage, the evolution of stablecoins is characterized by two major trends: first, the transformation from technical products to institutional interfaces. More and more countries and institutions have begun to promote the compliance development of stablecoins under clear regulatory boundaries and financial nesting rules; second, the expansion from single functions to multi-dimensional integration. Stablecoins have been deeply integrated into multi-layer scenarios such as payment, remittances, asset management and smart contract execution, becoming a programmatic value unit of financial activities.

Meanwhile, usage in Southeast Asia demonstrates a clear path of decentralization, scenario-driven adoption, and fundamental substitution. Stablecoins, by satisfying individual needs, are driving institutional evolution. Practices in these markets demonstrate that stablecoins have the ability to operate independently of traditional systems, establishing a cross-border, cross-platform, and cross-system financial complement.

From a global perspective, stablecoins are no longer merely innovative tools on the fringes of digital finance; they are rapidly evolving into a key variable in the international financial order. Their institutional integration paths, governance structures, and circulation logic will profoundly impact the future global internet of value and its sovereign architecture. Whoever can build a more adaptable, transparent, and interoperable stablecoin system will seize the initiative in the new round of digital financial competition.

1. Review of the Global Stablecoin Market in the First Half of 2025

1.1 Market Size and Growth Trend

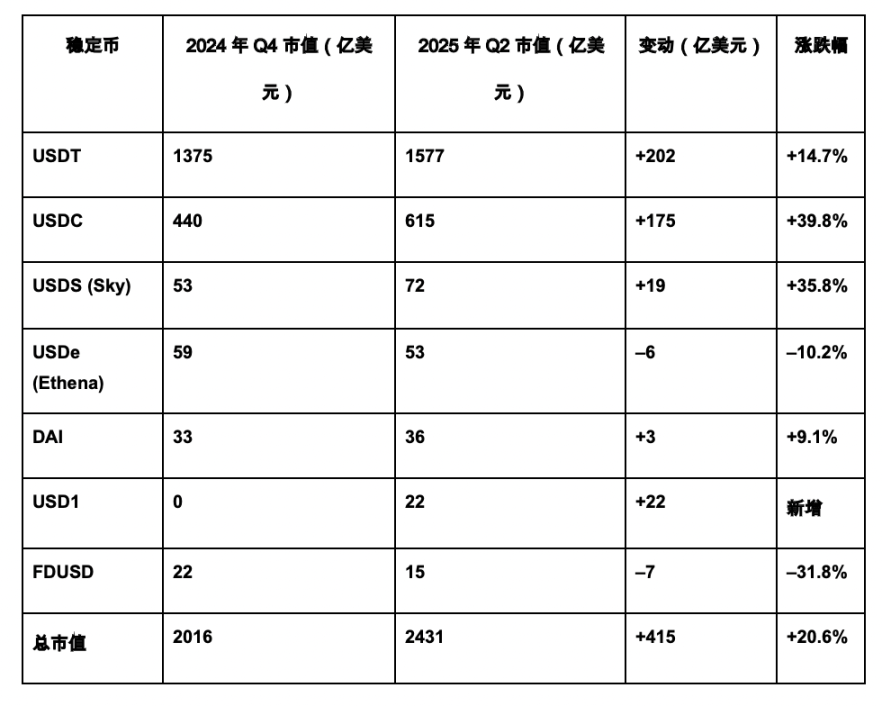

In the first half of 2025, the global stablecoin market showed significant growth, with its market capitalization rising from approximately $200 billion at the end of 2024 to approximately $243 billion, an overall increase of over 20%. This growth trend is reflected not only in the continued expansion of the market capitalization of the leading stablecoins, but also in the increasing use of stablecoins in real-world payments, settlements, and decentralized finance.

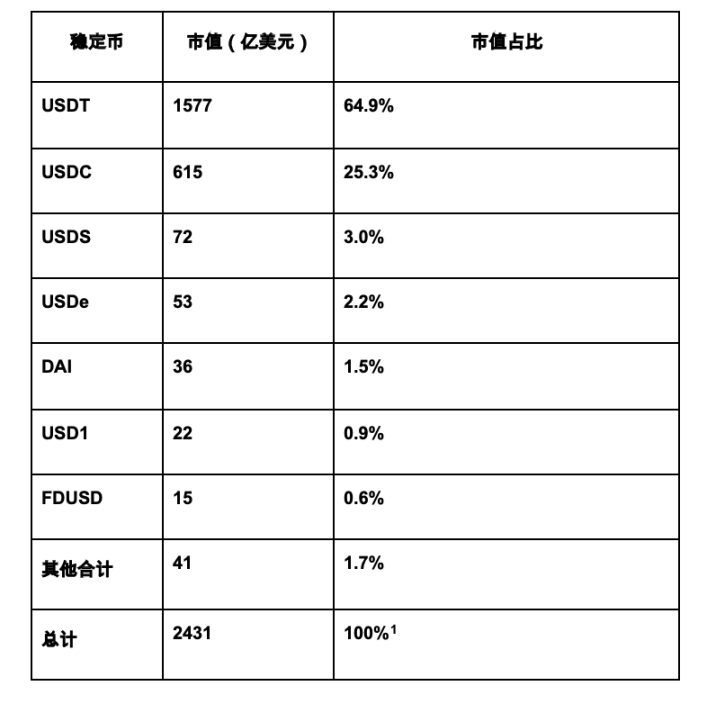

The main drivers of growth in the stablecoin market remain concentrated in two major projects: USDT and USDC, but their development paths are diverging significantly. USDT, maintaining its role as transaction layer infrastructure, holds a dominant position in global exchanges, OTC markets, and highly liquid markets. It is particularly widely used as a dollar alternative in Asia, emerging markets, and countries facing tight dollar liquidity. Its massive market capitalization and deep liquidity have made it the default settlement medium for most crypto transactions.

In contrast, USDC is increasingly becoming the preferred choice for clearing and enterprise-side interfaces. It boasts inherent advantages in audit transparency, fiat currency reserve mechanisms, and regulatory integration. Through deep integration with payment networks like Visa, Stripe, and Apple Pay, USDC has established a closed-loop, compliant payment system. Furthermore, USDC is actively expanding its multi-chain deployment, rapidly gaining traction on high-performance networks like Solana, Polygon, and Base, accelerating its adoption in enterprise payments, off-chain settlement, and Web2 scenarios. It can be said that USDT prioritizes circulation efficiency, while USDC focuses on compliance and financial integration. These divergences in application, user base, and strategic approaches are jointly supporting the dual-core structure of the stablecoin market.

Meanwhile, decentralized stablecoins are also reshaping themselves. USDS (formerly DAI, an upgrade) demonstrates strategic continuity in its governance mechanisms and modular design, while emerging projects like USDe focus on revenue-generating scenarios and liquidity integration. While the overall scale of these projects remains limited, their structures offer more experimental avenues for the DeFi ecosystem. USD1, leveraging its digital neutrality and cross-chain structure, has rapidly gained circulation, demonstrating the market's structural demand for non-platform stablecoins. Meanwhile, platform currencies like FDUSD, facing scrutiny over their reserve requirements, have exposed ecosystem-dependency risks, leading to a pullback in both market capitalization and trading momentum.

Overall, the stablecoin market is shifting from competition in terms of scale to structural differentiation and functional layout. Leading projects are continuously advancing into payment settlement, corporate accounts, and off-chain integration. Mid-tier projects are focusing on optimizing DeFi structures, while emerging projects are exploring breakthroughs in institutions and narratives. This landscape is laying the foundation for stablecoins to establish a strategic position in the global payment system. With the further integration of clearing networks, payment rails, and on-chain smart contract systems, a "functional integration phase" may begin in the second half of 2025: stablecoins will become the intermediary between the digital asset ecosystem and traditional finance, occupying a strategic position in retail payments, trade financing, B2B circulation, and digital identity binding.

Table 1: Changes in market capitalization of all major stablecoins in the first half of 2025

Table 2: Market capitalization of major global stablecoins (as of the end of the second quarter of 2025)

1.2 Major global progress

In the first half of 2025, stablecoins continued to advance institutionalization and infrastructure integration globally, demonstrating four key trends: regulatory clarity, payment system integration, cross-border clearing pilots, and integration with mainstream platforms. These developments are collectively propelling stablecoins from crypto-financial instruments to a more central role within the mainstream financial system.

On the regulatory front, several major economies (including the US, Europe, Japan, Singapore, and Hong Kong) have clarified the legal boundaries of stablecoins, issuing or implementing formal frameworks covering reserve compliance, audit mechanisms, issuance licenses, and transparency requirements. A global consensus is emerging: stablecoins must be controllable, have certainty of funding, and have compliant pathways for integration into the traditional financial system. The regulatory focus is gradually shifting from "risk prevention" to "rule design," creating institutional space for institutions to issue and use stablecoins in a compliant manner.

Cross-border payment and clearing usage continues to grow. Stablecoins have become widely embedded in personal remittances, platform settlements, and international micropayments. With their low cost, high accessibility, and programmability, stablecoins are becoming an effective alternative to traditional cross-border transfers in specific markets, gradually transitioning from an asset allocation tool to a regular medium of capital circulation and transaction.

Mainstream fintech companies continue to incorporate stablecoins into their product offerings. Visa, Stripe, PayPal, and others have opened stablecoin settlement capabilities across multiple public blockchains and account types, allowing corporate users to directly use USDC and other currencies for payments, reconciliation, and off-chain settlements. This signifies that stablecoins are no longer just "on-chain assets" but are becoming embedded in real-world business processes and financial systems.

The underlying market infrastructure is also evolving simultaneously. Stablecoins are becoming a core asset class within smart wallets, on-chain account systems, and modular payment interfaces. Infrastructure providers are launching automated settlement APIs, risk control modules, and enterprise liquidation toolkits, making stablecoins easier to deploy within traditional ERP systems, cross-border settlements, and digital financial services. Furthermore, multi-chain deployment has become the norm for stablecoin projects, significantly improving their circulation efficiency and redundancy.

Overall, the development of global stablecoins has entered a phase of "institutional integration and scenario integration." With policy boundaries becoming increasingly clear and the technology stack becoming increasingly modular, stablecoins are evolving from a "cryptoasset supplement" to a "regulatory, liquidable, and integrated financial settlement layer."

1.3 Events worth noting

Stablecoin payments are experiencing explosive growth in multiple scenarios

Stablecoin adoption continues to grow across multiple sectors. In B2B transactions, monthly transaction volume has grown from less than $100 million at the beginning of 2023 to over $3 billion by the beginning of 2025. For crypto prepaid cards, monthly transaction volume has grown from $250 million to over $1 billion, reflecting their widespread adoption in everyday payments. Meanwhile, B2C payments have also seen rapid growth, increasing from $50 million per month to over $300 million. Furthermore, growing demand for prepaid funds and cross-border payments has driven the steady expansion of related lending services. These trends demonstrate the growing importance of stablecoins in the global financial ecosystem, making them a crucial tool for everyday transactions for businesses and consumers.

Major banks have launched stablecoin and deposit token pilots

Following the clarification of US federal legislation, several financial giants, including JPMorgan, Citigroup, and Bank of America, have begun developing digital deposit tokens and stablecoin products. JPMorgan is testing a deposit token called "JPMD," which it plans to run on the Base chain and open to institutional clients. Citi is also exploring the possibility of issuing its own stablecoin. Bank of America's CEO stated that they are "actively evaluating and awaiting legal clarity." This trend demonstrates that traditional banks are shifting from a bystander role to a proactive player, actively promoting the use of stablecoins and integrating them into international payment and cross-border clearing systems, signaling a profound transformation in the financial industry.

2. Southeast Asian Market Overview and Application Trends

2.1 Regional adoption pattern

In the first half of 2025, the Southeast Asian stablecoin ecosystem exhibited a pattern of development driven by remittance demand, primarily pegged to US dollar assets, and driven by local application integration. Vietnam, the Philippines, and Indonesia comprised the three markets with the highest usage intensity, while Thailand and Singapore represented the forefront of policy-friendly and institutionalized integration. Overall, the region is transitioning from the "cryptoasset circulation" phase to the "stablecoin infrastructure" phase, with significant differences in application and positioning between countries forming.

Singapore: With stablecoins at its core, connecting cross-border settlement, daily consumption, and digital asset allocation

Singapore is promoting the expansion of stablecoin applications beyond cross-border corporate settlements to everyday scenarios like retail and tourism. USDC and XSGD have been widely integrated into enterprise APIs and payment systems, becoming the underlying tools for inter-business fund transfers. Local merchants like Metro Department Store are also accepting stablecoins like USDT and USDC through Dtcpay, providing users with a convenient, hassle-free consumer experience. New stablecoin models, such as USDG, are exploring the integration of revenue redistribution and global availability within Singapore's regulatory framework, expanding their practical applications in payments and fund management. Overall, Singapore is promoting the evolution of stablecoins from a payment medium to a multi-scenario integrated financial infrastructure.

Hong Kong: Stablecoins are widely adopted by exporters and OTC markets, forming a settlement channel outside the Hong Kong dollar system

In Hong Kong, stablecoins are becoming a popular alternative to the US dollar for exporting companies and individual users. As more and more overseas customers pay for their orders with USDT or USDC, local small and medium-sized exporters are increasingly turning to stablecoins for settlement to avoid bank transfer delays and fees. Since 2021, USDT trading volume for trade settlements by Chinese customers has increased fivefold, reflecting its rapid adoption in real-world businesses. Hong Kong also has an established OTC network consisting of over 200 brick-and-mortar stores and over 250 online service providers. Many of these stores feature professional counters, multilingual services, and real-time quote systems, allowing users to exchange or redeem stablecoins for cash. Stablecoins have become a key medium for cross-border trade and asset flows, and their systemic role is deepening.

Vietnam: Retail-led, DeFi and gray remittances develop in parallel

Vietnam has gradually developed an informal parallel financial system centered around USDT. In the absence of official support and a regulatory framework, users continue to acquire and circulate stablecoins through Binance P2P, Telegram OTC groups, and other informal channels. Stablecoins are widely used for personal fund management, small cross-border transfers, freelance income settlement, and asset preservation, becoming a key medium of exchange in daily financial activities in Vietnam. Data shows that in the first half of 2025, approximately 7.8% of international remittances in Vietnam were processed using stablecoins. Furthermore, USDT has consistently maintained a 3%–5% premium in the local trading market, fully demonstrating its role as a safe haven and store of value in an environment of restricted capital flows and exchange rate volatility.

Philippines: Payment applications mature, with remittance ecosystems deeply integrated with wallets

The Philippines boasts Southeast Asia's most diverse e-wallet ecosystem. Major platforms are rapidly integrating stablecoin and cryptocurrency functionality, fostering the formation of a local crypto-financial network centered around wallets. GCash, for example, has officially integrated USDC, enabling users to conveniently top up and make payments with stablecoins, marking the beginning of the integration of stablecoins into the country's mainstream financial infrastructure. Grab has also announced a partnership with payment service provider Triple-A and local platform PDAX to launch cryptocurrency top-up services in the Philippines, allowing users to top up their GrabPay wallets using a variety of crypto assets. These platforms are pioneering the integration of crypto-to-fiat payment networks, laying the foundation for the successful implementation of Philippine stablecoins in remittances, consumer spending, and income settlement.

Indonesia: Accelerating transformation from a safe-haven tool to a high-frequency payment asset

According to data from Indonesia's Commodity Futures Trading Regulatory Authority (Bappebti), over 60% of crypto investors are between the ages of 18 and 30, with 26.9% aged 18-24 and 35.1% aged 25-30. As younger users become the dominant force in the market, the use of stablecoins has grown significantly. As fiat-pegged, low-volatility assets, stablecoins are widely used to hedge against currency devaluation or exchange rate fluctuations, serving as a valuable tool for hedging, preserving value, and diversifying investment portfolios. Usage also exhibits regional characteristics in some regions. For example, Bali, with its concentration of digital nomads and well-developed infrastructure, has become a vibrant trading area. Stablecoins were once used for offline payments in Bali, but were later banned as a medium of exchange due to regulatory restrictions.

Thailand: With the rise of cross-border and tourism scenarios, stablecoins are rapidly penetrating as a settlement tool

Thailand is one of the most regulatory-friendly regions for digital assets. In 2024, Siam Commercial Bank launched a stablecoin-based cross-border remittance service. A report cited by Tether officials indicates that USDT is the most widely used stablecoin in Thailand, accounting for 40% of total cryptoasset trading volume. Circle has also conducted local trading activities with Bitkub, Thailand's largest regulated exchange. Some high-end hotels already accept USDT and USDC for payments, and there are also numerous private over-the-counter (OTC) merchants. While a nationwide payment network has yet to be established, stablecoins are becoming increasingly popular as an efficient alternative to the US dollar in export-oriented industries. The recent "Crypto Payment Sandbox" pilot will further expand the use cases for tourists to exchange digital assets for digital Thai baht and make purchases through QR code scanning.

Malaysia: Crypto assets enter the mainstream, and stablecoins are used as entry assets for investment and value storage

Malaysian users' awareness and usage of crypto assets have grown significantly over the past five years. Stablecoins are gradually evolving from a purely transactional medium to a primary tool for local users to allocate assets and store short-term value. By the end of 2024, the national cryptocurrency ownership rate had reached 60%. A study of 198 Malaysian users also revealed a high level of awareness and acceptance of stablecoins, with a foundation for adoption gradually building. Across payment, risk hedging, and asset allocation scenarios, users generally believe that stablecoins can effectively mitigate crypto market volatility and enhance transaction stability and convenience. Respondents' trust in stablecoins, frequency of use, and market confidence were all significantly correlated with their willingness to adopt them, demonstrating a relatively positive overall adoption trend, demonstrating the viable and viable application of stablecoins in Malaysia.

2.2 Emerging Local Stablecoins

While dollar-backed stablecoins like USDT and USDC dominate globally, there is a growing trend in Asia to develop stablecoins pegged to local currencies to enhance monetary sovereignty and reduce dependence on the US dollar.

Singapore: StraitsX's XSGD is a leading stablecoin pegged to the Singapore dollar. As of mid-2025, XSGD's market capitalization reached approximately $11 million, with cumulative trading volume exceeding $8 billion. It supports multiple blockchains, including Ethereum, Polygon, Arbitrum, and XRPL. XSGD is regulated by the Monetary Authority of Singapore (MAS) and complies with the Payment Services Act, ensuring high compliance within the region. StraitsX has also partnered with Grab, Ant International, and other institutions on cross-border payments to promote XSGD's practical application in corporate settlement and retail scenarios.

Vietnam: VNDC is Vietnam's primary local stablecoin, backed by USDT. Its market capitalization is approximately $3.32 million, with monthly trading volume exceeding $100 million. It primarily circulates on the affiliated platform ONUS and serves as a pricing and liquidation benchmark for crypto assets like ETH and BTC. While not integrated into mainstream DeFi, it has established a stable, closed-loop ecosystem for local users.

Philippines: The Philippines currently has three major local stablecoins: PHT, PHPC, and PHPX. PHT, incubated by APACX and deployed on the Ethereum, Polygon, and Tron networks, focuses on local foreign exchange, digital payments, and lightweight financial scenarios, and currently leads in terms of implementation and application. In contrast, the other two are still in the early stages: PHPC, launched by Coins.ph and deployed on the Polygon and Ronin networks, has completed central bank regulatory sandbox testing but has not yet entered full circulation. PHPX, jointly issued by UnionBank, RCBC, and other banks, runs on the Hedera network and is currently in a pilot phase, primarily used for interbank settlement and compliant cross-border transactions.

PHT, a Philippine peso-pegged stablecoin incubated by APACX, is issued using an over-collateralized mechanism and has been deployed on three major public blockchains: Ethereum, Tron, and Polygon. Its current market capitalization is approximately $5 million, with an average monthly trading volume exceeding $1 million. It is widely used in core scenarios such as OTC transactions, cross-border remittances, user wallets, merchant acquiring, and crypto card issuance. The company has also established strategic partnerships with local and regional institutions such as Moneybees, Juancash, and StraitsX to promote the deep integration of stablecoins in fiat currency redemption, payment settlement, and on-chain circulation.

Indonesia: Indonesia currently has two major local stablecoins: IDRT and XIDR. IDRT, issued by Rupiah Token and deployed on Ethereum and BNB Chain, has a market capitalization of approximately $1.7 million and is primarily used for deposits and redemptions on local exchanges. XIDR, launched by StraitsX with a market capitalization of approximately $130,000, focuses on compliant cross-border payments and DeFi scenarios, supporting chains such as Ethereum and Polygon. Both are pegged to the Indonesian rupiah, but their usage paths and ecosystem integration differ.

Malaysia: MYRC, launched by BLOX, is a stablecoin pegged to the Malaysian Ringgit (RMB) and backed 1:1 by fiat currency. As of mid-2025, MYRC has a market capitalization of approximately $730,000 USD and has been deployed on the Ethereum and Arbitrum networks. Currently in beta launch, MYRC has yet to achieve widespread adoption.

Thailand: No Thai baht-denominated stablecoins are currently circulating in the mainstream market. SCB and its subsidiary SCB 10X launched a pilot stablecoin, THBX, in 2024 and tested it in the central bank's regulatory sandbox. The project was showcased at Devcon, where users could convert USDC into THBX for on-site purchases using the "Rubie" wallet. However, since 2025, the project has seen no further progress, and its path to commercialization remains unclear.

3. Southeast Asia Regulatory Trends and Key Milestones

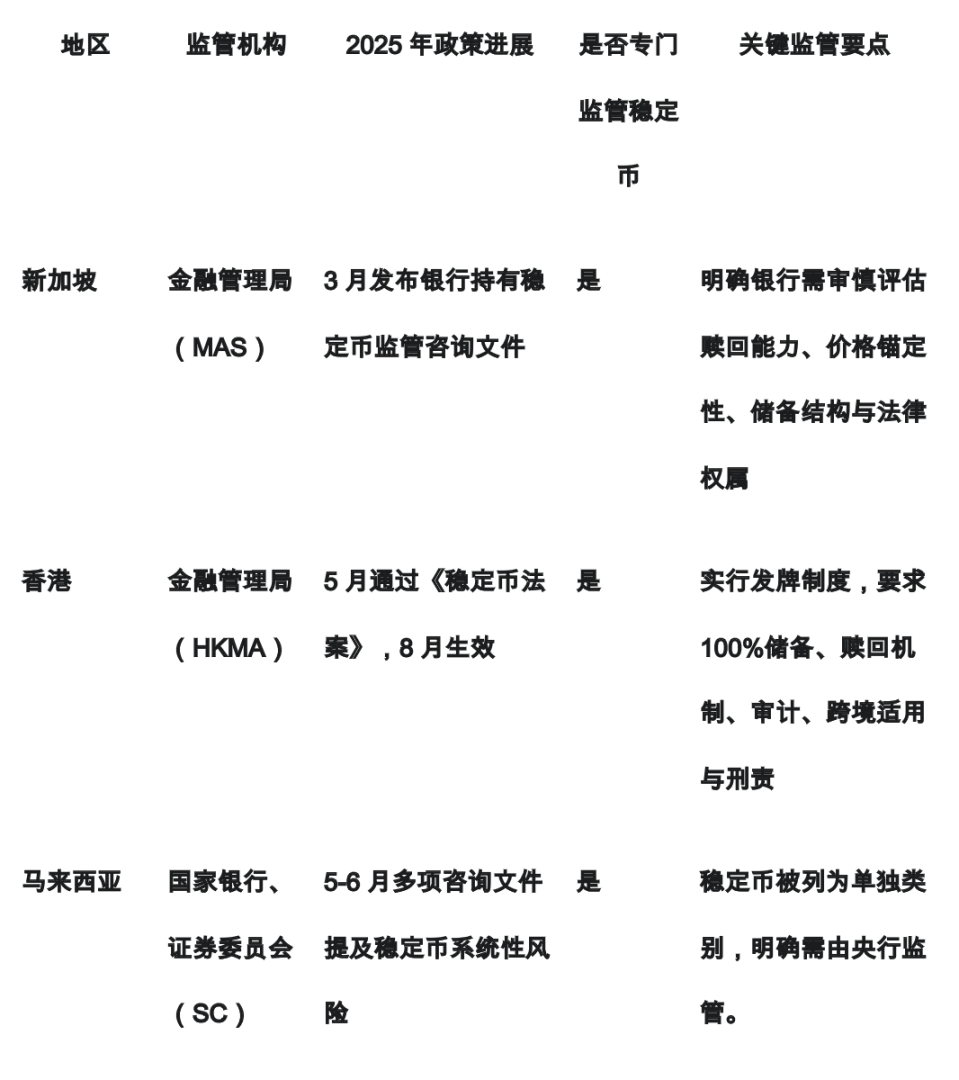

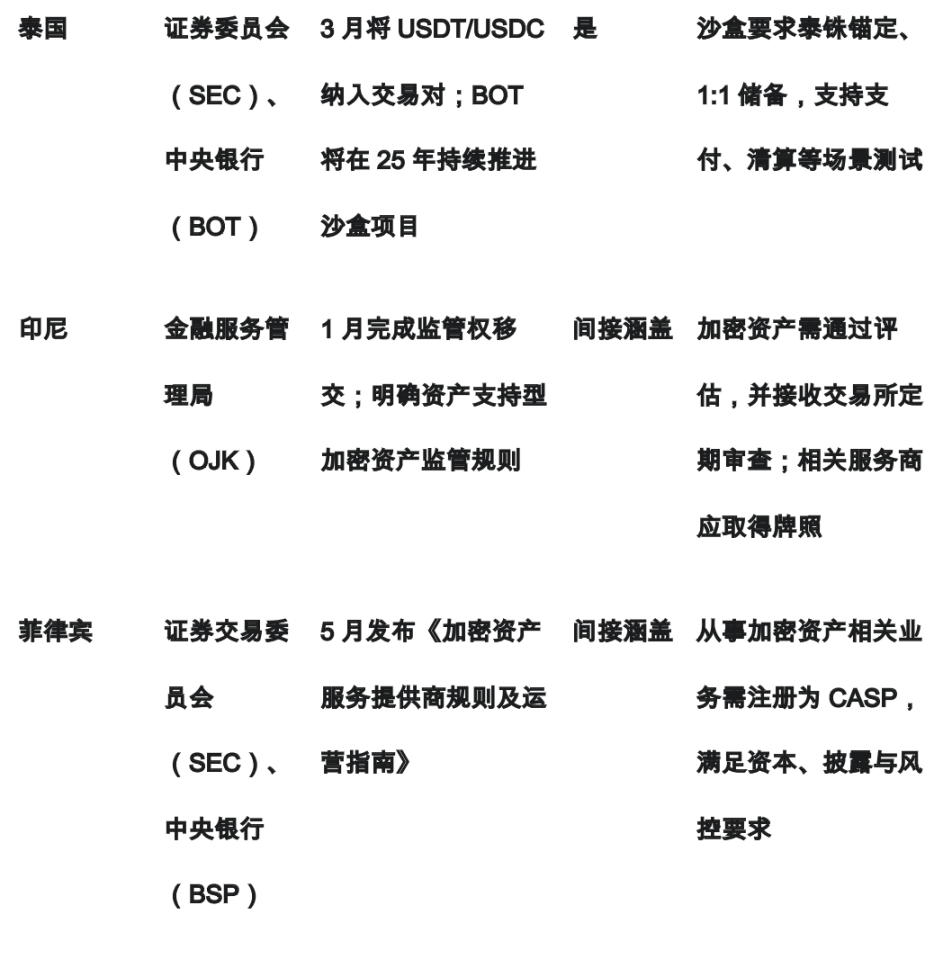

In the first half of 2025, Southeast Asia entered the substantive stage in terms of stablecoin regulation. Many countries have successively completed the drafting of systems, pilot promotion or regulatory implementation, showing a trend of transition from "policy ambiguity" to "scenario-oriented regulation."

Table 3: Key regulatory milestones in Southeast Asia in the first half of 2025

3.1 Clearly involve

Singapore: Incorporating bank capital regulations and strengthening stablecoin compliance standards

The Monetary Authority of Singapore (MAS) released the "Stablecoin Regulatory Framework" in August 2023, which applies to single-currency stablecoins (SCS) that are anchored to the Singapore dollar or G10 currencies and circulate locally, and is included in the regulatory system as a supplementary provision to the Payment Services Act.

On this basis, MAS released a new consultation document in March 2025, " Consultation Paper on Prudent Capital Treatment of Crypto-Assets and Regulatory Requirements for Category 1 and Category 2 Supplementary Capital Instruments ," which for the first time proposed prudent capital regulatory requirements for banks holding stablecoins and set more specific standards for the quality, security, and legal structure of stablecoins. This new proposal mainly targets stablecoin assets classified as Group 1b, i.e., crypto assets that are anchored to fiat currencies, have redemption mechanisms, and have been verified by authorities. Specific requirements include:

- Redemption mechanism requirements: Banks must be able to redeem stablecoins at face value from the issuer or its authorized agent, and the redemption process must be legally clear and enforceable. Banks must reassess their redemption capacity before purchase, every six months, and in response to market fluctuations.

- Reserve asset standards: Stablecoins must be fully backed by high-quality, low-risk assets, such as sovereign bonds, central bank deposits, or deposits with banks rated A- or above. The average remaining maturity must not exceed three months, and reserve assets must be held in custodial custody by an independent third party.

- Price anchor stability testing: Banks must regularly verify that the stablecoin price remains closely pegged to the reference currency. This can be done through statistical methods (e.g., the frequency of price deviations from par value of 0.5% within 30 days must not exceed 10%) or governance judgment. Test results must be documented for audit and regulatory review.

- Legal structure requirements: Banks must directly hold the rights or assets behind the stablecoin, or obtain claims on the reserves through a clear legal structure. They must not indirectly hold the underlying assets through a complex, impenetrable SPV.

- Due diligence obligations: Banks are required to conduct ongoing due diligence on the issuer's governance structure, repayment capacity, custody arrangements, reserve composition, and other factors. If a stablecoin no longer meets the above conditions, it must be immediately reclassified as a high-risk (Group 2) asset and subject to higher capital requirements.

The MAS document explicitly states that it will localize stablecoin regulations based on the Basel Committee on Banking Supervision (BCBS) capital treatment standards for crypto assets and is seeking public feedback on the proposal. Once implemented, this framework will make Singapore one of the few jurisdictions globally to include stablecoins in its bank capital regulatory regime.

Hong Kong: Establishing comprehensive regulatory regulations for stablecoins with a licensing system as the core

On May 21, 2025, the Legislative Council of Hong Kong passed the Stablecoin Bill , establishing the first stablecoin regulatory framework centered on a licensing system. The bill will officially take effect on August 1, 2025. The bill is enforced by the Hong Kong Monetary Authority and applies to local and foreign issuers that engage in stablecoin-related activities in Hong Kong or for the Hong Kong public.

The Ordinance defines a "specified stablecoin" as a virtual asset that is pegged to one or more fiat currencies and whose purpose is to maintain that peg. Individuals or entities involved in any of the following five activities must obtain a license from the HKMA to legally operate:

- Issuing or minting stablecoins;

- Redeem or destroy stablecoins;

- manage its reserve assets;

- Provide stablecoin wallet services (including custody);

- Promoting or marketing stablecoins

The Ordinance requires licensees to continuously meet the following compliance obligations:

- Redemption mechanism requirements: Licensees must ensure that users can redeem fiat currency from the issuer at the nominal value of the stablecoin. Redemption should be completed as soon as possible, with reasonable fees and no improper conditions should be attached. Redemption shall not be suspended or refused unless with the written consent of the HKMA.

- Reserve asset standards: The total amount of stablecoins in circulation must be fully backed by an equivalent amount of fiat currency assets. Reserve assets should be of high quality and high liquidity, and must be separated from operating funds and held in custody by an independent third party.

- Risk management requirements: Licensees must establish sound internal control mechanisms and risk management policies, including reserve asset management systems, liquidity monitoring, stress testing and emergency response processes, to ensure they maintain their ability to repay under various market conditions.

- Audit and information disclosure requirements: Licensees must entrust independent auditors to regularly verify reserve assets and related financial status, and disclose to the public information such as reserve composition, custody arrangements, repayment capacity, risk assessment policies and governance arrangements.

- Cross-border application mechanism: Even if a stablecoin issuer does not have an operating base in Hong Kong, as long as it provides services to the Hong Kong public or poses potential risks to Hong Kong's financial stability, the HKMA may designate it as a "designated entity" and force it to apply for a license and accept local supervision.

- Law enforcement and legal liability: Individuals or institutions that engage in stablecoin activities without a license, fail to fulfill redemption obligations, publish misleading information, or obstruct regulatory investigations will be committing a criminal offense and may be sentenced to fines, suspension of business, or imprisonment. The HKMA also has the right to take regulatory actions such as investigations, restrictions, and license revocation.

Over 40 institutions have expressed interest in applying for Hong Kong stablecoin licenses. Among them, Standard Chartered/Animoca/HKT Alliance, JD.com Coinlink, and RD InnoTech were selected for the HKMA's regulatory sandbox at the end of 2015 and have begun preliminary integration, giving them a first-mover advantage. The HKMA stated that it will exercise extreme caution in granting licenses, approving only a small number of applicants with high compliance, clear purpose, and robust risk management.

Thailand: USDT and USDC are legally tradable, and sandbox is exploring local currency anchoring applications.

On March 6, 2025, the Securities Commission of Thailand (SEC) issued a notice (Sor Jor. 9/2568) adding USDT and USDC to the list of digital assets eligible for trading benchmarks. This amendment, effective March 16, allows the two major US dollar stablecoins to be used as trading pairs on local regulated digital asset exchanges. This change marks the first time stablecoins have been included in Thailand's regulated trading market, signaling institutional recognition of their trading functionality in the local market.

Secondly, the Bank of Thailand (BOT) is promoting the Programmable Payments Sandbox , which allows companies to test innovative financial scenarios, including on-chain payments and automated clearing, in a controlled environment. According to the BOT's official website, this mechanism requires applicants to use electronic data units (EDUs) denominated in Thai baht with a 1:1 reserve mechanism and the ability to automatically execute conditions through distributed ledger technology (DLT) and smart contracts. This structure is highly similar to stablecoins pegged to local currencies, although the policy does not directly use the term "stablecoin."

The first test project to enter the sandbox was launched by SCB 10X, which completed its first phase of testing in May 2024, with the second phase expected to launch in the third quarter of 2025. SCB 10X is the innovation and venture capital subsidiary of SCBX Group, the parent company of Siam Commercial Bank (SCB) in Thailand, focusing on exploring blockchain, Web3, and fintech applications.

According to information released by the central bank, most other testing projects will be launched in the second half of 2025. Participating institutions include: Bank of Ayudhya, Kasikornbank, Bitkub, True Money, OM Platform, etc. The test content covers asset tokenization payment, custodial payment, global stablecoin exchange services and B2B digital loans. The testing cycle is expected to continue until 2026.

Malaysia: Clarifying financial attributes, stablecoins are under the supervision of the central bank

In its draft "Regulatory Framework for Tokenized Capital Market Products " (Consultation Paper No. 1/2025), released in May 2025, the Securities Commission Malaysia (SC) explicitly proposed regulating "digital twin tokens," structures that tokenize traditional capital market products (such as bonds and funds) on-chain. This framework emphasizes technology neutrality and is limited to off-chain, legally backed securities. It does not apply to "native on-chain assets" such as cryptocurrencies and stablecoins. However, it is worth noting that the document's provisions, such as custody requirements, on-chain and off-chain information consistency, and technical risk controls, strongly overlap with the design logic of interest-bearing stablecoins. Although not explicitly included in the scope of application, future technical and governance adaptations may still be based on this framework.

On June 17, 2025, at the Sasana Symposium 2025, Prime Minister Anwar Ibrahim announced the establishment of the Digital Asset Innovation Hub, led by Bank Negara Malaysia, as a platform to support financial innovation. Officially, the hub aims to provide a "controlled environment" for fintech players to experiment with new concepts and provide feedback on regulatory design. While the press release did not directly mention stablecoins, it explicitly stated that the platform would support exploration of asset digitization and fintech innovation. This means that projects such as stablecoins can apply for pilot programs under this mechanism, with regulatory boundaries and compliance mechanisms being assessed based on the project type and purpose.

On June 30, 2025, the SC issued the " Draft Amendment to the Guidelines for Recognized Markets - Digital Asset Exchanges " (Consultation Paper No. 3/2025), introducing a more open digital asset listing mechanism for local digital asset exchanges. In the section on classifying and assessing high-risk assets, the document explicitly mentions "stablecoins" as a separate category for the first time, noting that while they claim to be pegged to an asset and stable in value, their stabilization mechanisms are often controlled by the issuer, potentially posing financial stability risks. The document specifically emphasizes that the systemic impact of stablecoins "falls within the regulatory purview of Bank Negara Malaysia." This demonstrates that regulators have distinguished stablecoins from general cryptoassets, clarifying their nature as financial instruments and placing regulatory oversight responsibility with the central bank.

3.2 Indirect Coverage

Philippines: Defines crypto assets for the first time and establishes CASP regulatory system

In May 2025, the Philippine Securities and Exchange Commission officially issued the " Crypto Asset Service Provider Rules " (Circular No. 4) and the " Crypto Asset Service Provider Operation Guidelines " (Circular No. 5).

The term crypto-asset was clearly defined by Philippine regulators for the first time in these rules. It is defined as: "A digital form of value or rights secured by encryption technology, which relies on encrypted distributed ledgers or similar technologies for transaction verification and security, and can be transferred, stored or traded electronically."

Institutions offering crypto-asset issuance, trading, matchmaking, advisory, or marketing services in the Philippines must register as Crypto-Asset Service Providers (CASPs) and be subject to SEC oversight. If the asset possesses securities characteristics, they must also complete registration under the Securities Regulation Act, submit a securities registration statement, fully disclose information to investors prior to issuance, and comply with anti-money laundering and other relevant regulations.

Stablecoins, as a common form of cryptoasset, generally meet the above definition, and relevant service providers are required to fulfill CASP registration and operational compliance obligations. Furthermore, if a stablecoin design incorporates profit distribution, expectations of asset appreciation, or governance rights, it may also be deemed a "cryptoasset security" by the SEC, subjecting it to stricter securities regulations.

Specifically, if relevant institutions engaged in crypto asset services intend to provide related services to the public in the Philippines, they must apply to register as a CASP as a local legal person, establish a physical office, have a paid-in capital of no less than ₱100,000,000, submit a detailed business plan, risk disclosure and IT security architecture description, and fulfill various compliance obligations during operations.

While the SEC established its registration and compliance system, the Bangko Sentral ng Pilipinas (BSP) also promoted field testing of innovative cryptoasset projects through its "regulatory sandbox" mechanism. In 2024, the Philippine peso-pegged asset PHPC, launched by the local platform Coins.ph, was approved for sandbox testing. It officially withdrew in June 2025 after meeting repayment capacity, system security, and compliance requirements, becoming the first local currency-pegged digital asset to enter public market circulation with BSP approval.

Indonesia: OJK takes over regulatory responsibilities and continues to evaluate and review crypto assets

On January 10, 2025, Indonesia officially completed the transfer of cryptoasset regulatory responsibilities, with the Financial Services Authority (OJK) taking over full responsibility for the regulation of cryptoassets and securities derivatives from the Commodity and Futures Regulatory Authority (Bappebti). This shift, implemented under Law No. 4 of 2023 (the Comprehensive Financial Industry Law), was formalized through Government Regulation No. 49 of 2024 on the Transfer of Regulatory Responsibilities for Digital Financial Assets (Including Cryptoassets) and Financial Derivatives and OJK Regulation No. 27 of 2024 on the Provision of Transactions in Digital Financial Assets (Including Cryptoassets) . This marked a new era for digital financial regulation in Indonesia.

Although stablecoins are not directly mentioned in relevant regulations, the OJK regulation includes "backed crypto-assets" within its regulatory scope, encompassing the core characteristics of stablecoins. Therefore, as a type of asset-backed crypto-assets, stablecoins should be included in the scope of this regulatory system.

The regulations state that if crypto assets want to be legally traded in Indonesia, they must be included in the official "Crypto Asset List" and pass the corresponding assessment: the assets to be listed must have on-chain transparency, asset support mechanisms, issuer information disclosure and other elements.

Exchanges are also required to assess assets based on market capitalization, liquidity, and regulatory compliance, and update their asset lists quarterly. The OJK reserves the right to intervene in trading assets, including suspension, delisting, and forced liquidation orders. While these provisions are not specifically addressed for stablecoins, they also apply if risks or non-compliance are identified.

All institutions providing crypto asset trading, custody, and clearing services must obtain an OJK license and meet comprehensive standards for governance, anti-money laundering, system security, and investor protection. Directors, executives, and controlling shareholders of newly established institutions must pass a suitability review.

Under the new OJK regulations, all licensed cryptoasset exchanges must complete a review of their assets and update their list within three months (i.e., before April 2025). Stablecoins included in the list will also face compliance obligations such as reassessment and ongoing disclosure of their underlying mechanisms.

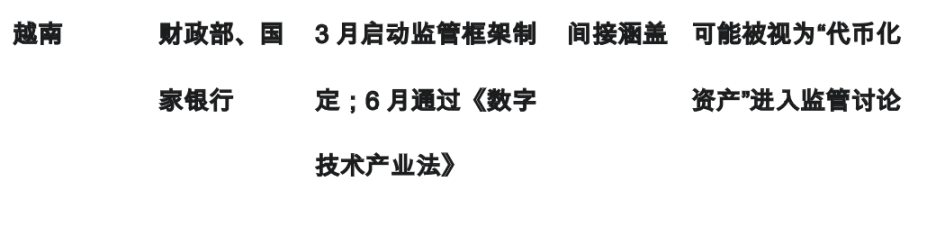

Vietnam: Digital Technology Industry Law Released, Stablecoins May Be Classified as Tokenized Assets

On March 1, 2025, the Prime Minister signed Directive No. 05/CT-TTg, instructing the Ministry of Finance and the State Bank to lead the development of a regulatory plan for digital assets and digital currencies and submit a preliminary framework to the government within the same month. While the directive did not specifically list crypto assets such as Bitcoin, it marked the transition of crypto asset regulation from administrative control to the preparatory stage of legalization.

On June 14th, Vietnam's National Assembly officially passed the " Digital Technology Industry Law ," which for the first time defines "digital assets" and distinguishes between their types. According to the law, digital assets are defined as assets that exist in the form of digital code and can be owned, controlled, and traded by organizations or individuals. They are further categorized into "virtual assets" and "tokenized assets."

Virtual assets are assets that are not anchored to any real-world value and are generated entirely through digital systems. Broadly speaking, they encompass the mainstream forms of existing cryptocurrencies. Tokenized assets, on the other hand, are digital assets that are generated by encoding real-world assets and are applicable to sectors such as real estate, debt, and commodities.

In terms of form and technical characteristics, stablecoins bear a high degree of similarity to tokenized assets. Therefore, they are likely to be included in this regulatory category. Furthermore, the law explicitly excludes fiat currency, central bank digital currencies (CBDCs), securities, and other financial assets subject to financial regulations, indicating that its regulatory focus is on digital assets outside the traditional financial system.

The Digital Technology Industry Law also establishes a "regulatory sandbox" mechanism for piloting new digital technologies and financial products. While the law does not directly mention stablecoins, the sandbox mechanism may provide a testing ground for stablecoins in limited applications such as cross-border payments and tourism.

The introduction of this regulation indicates that Vietnam is incorporating blockchain into the list of national strategic technologies. However, specific regulatory rules such as licensing system, compliance reporting, and anti-money laundering still need to wait for financial regulatory agencies (such as the Central Bank of Vietnam, the Ministry of Finance, and the Securities and Futures Commission) to issue more detailed supporting policies.

4. Challenges and opportunities in the implementation of stablecoins in Southeast Asia

4.1 Opportunities

The regulatory framework is becoming clearer, opening the door for compliance projects

By 2025, stablecoin regulation in major Southeast Asian countries had gradually become clearer, with an overall shift from a wait-and-see approach to cautious acceptance. Singapore and Hong Kong were the first to establish clear frameworks. Singapore incorporated stablecoins into its bank capital regulatory system, while Hong Kong established a formal regulatory framework through a licensing system and cross-border application mechanisms. While countries like the Philippines, Indonesia, and Malaysia haven't enacted specific laws, they have incorporated stablecoins into the regulatory framework for crypto assets or financial products, promoting compliance pilots through sandbox mechanisms and exchange reviews.

Local payment pain points are significant, and stablecoins have structural alternative space

Countries like the Philippines, Thailand, and Vietnam face widespread structural challenges, including poor international liquidity of fiat currencies, high cross-border exchange costs, and a weak retail payment infrastructure. Stablecoins can bypass intermediary clearing systems, enabling direct on-chain transfers and instant settlement, significantly reducing transaction times and fees. For example, in the Philippines, USDT has become a widely used alternative for labor remittances. Locally-owned stablecoins can also address this real-world need through compliant channels, addressing the last-mile challenge that traditional finance struggles to address.

Stablecoin projects led by local institutions are accelerating pilot implementation

Unlike previous stablecoin issuances, which were led by external technical teams, starting in 2025, a growing number of stablecoin projects have been led by local banks, licensed exchanges, or fintech companies. For example, the Thai baht programmable payment project promoted by SCB 10X naturally integrates with local compliance systems, making it easier to gain government trust. This suggests that stablecoins are shifting from being "DeFi tools" to "local financial infrastructure," with the potential to become a standard for digital payments.

Interoperability technology is mature and usage scenarios are continuously expanding.

Cross-chain communication protocols (such as Layerzero) already support the atomic swap and circulation of stablecoins across multiple chains, preventing value fragmentation. Furthermore, new-generation financial technologies such as on-chain proof of reserves, automated audits, and custody visualization are simultaneously enhancing stablecoin compliance and on-chain transparency. Combined with Singapore and Thailand's exploration of programmable payment scenarios, stablecoins will be used not only for transfers but also for more complex business capabilities such as automated settlement and event-triggered payments.

Stablecoins become an intermediate solution for the digitalization of local currencies

With most Southeast Asian countries still unprepared to launch retail CBDCs (Central Bank Digital Currencies), stablecoins issued by private institutions and pegged to their local currencies offer a controllable, testable, and scalable alternative. Stablecoins can serve as a "quasi-CBDC" for technical pilots, while also being closer to the real economy due to their redemption mechanisms and market liquidity. They are expected to serve as a bridge tool for governments to promote the digitization of their local currencies.

Stablecoins are expected to become a digital bridge for regional currency interconnection

As multiple countries promote the pilot and implementation of local currency-pegged stablecoins, Southeast Asia is gradually taking shape as a nascent cross-border clearing network mediated by digital assets. Unlike the traditional dollar-based intermediary settlement system, stablecoins promise to enable direct exchange and settlement between local currencies, reducing the structural costs of dollar dependence. Cross-chain stablecoin-to-stablecoin exchange mechanisms can establish value transmission channels for "regional local currency interconnection." This lays the foundation for a more sovereign and efficient ASEAN digital payment corridor in the future, and also gives stablecoins a strategic position beyond that of a single national payment tool.

4.2 Challenges

Severe regional regulatory fragmentation hinders cross-border expansion

Although several Southeast Asian countries have begun exploring stablecoin regulation by 2025, the level of regulation and clarity vary widely. For example, Singapore and Hong Kong adopt a strict definition and licensing approach, while Indonesia and the Philippines indirectly cover crypto assets through a broad cryptoasset regulatory framework. Vietnam and Malaysia are still in the definition and division of responsibilities phase. This disparity makes it difficult for stablecoin projects to cover multiple national markets simultaneously, hindering the scalable implementation of cross-border clearing, payment, and transfer functions.

The local stablecoin has insufficient liquidity and lacks a real usage environment

While several local currency-pegged stablecoins have emerged, they generally lack sufficient market depth, trading pairs, and user acceptance. This is partly due to users' lack of familiarity with local currency digital assets, and partly because these stablecoins often lack high-frequency use cases and an on-chain supporting ecosystem, leading to their immediate demise. In competition with widely circulated dollar-denominated stablecoins like USDT and USDC, local currency stablecoins are more likely to be marginalized.

High compliance thresholds increase entry costs for technical teams

With Hong Kong, Singapore, and other jurisdictions requiring "100% high-quality reserves, third-party custody, redemption guarantees, and a clear legal structure" as issuance requirements, stablecoins have gradually become "quasi-financial products." For small projects lacking banking resources, legal teams, or audit support, this means that technical expertise is no longer the only, or even the primary, barrier to entry. Teams lacking compliance resources and capital will be excluded from the mainstream market, and the stablecoin ecosystem is gradually becoming more institutionalized.

The US dollar stablecoin is a de facto monopoly, and the user switching cost is high

In actual payments and transactions, USDT and USDC dominate, even serving as the "de facto digital dollar" in many countries. For example, USDT is widely circulated in the over-the-counter (OTC) markets of the Philippines, Vietnam, and Indonesia, enjoying high acceptance among merchants and users. However, local currency stablecoins face challenges with trust and motivation to switch. Without clear price advantages, settlement efficiency, or regulatory compliance, local currency stablecoins face a difficult time gaining market share from dollar-pegged products.

Imperfect infrastructure and high user education costs

Stablecoin promotion in Southeast Asia faces challenges such as weak infrastructure and high user education costs. On-chain wallets, gas fees, and cross-chain bridges are not user-friendly for the average user, while supporting infrastructure such as deposit and withdrawal channels, merchant payment processing, and clearing interfaces remain underdeveloped, limiting practical application. Furthermore, public awareness of stablecoins as a payment tool remains low, forcing project developers to shoulder additional education and promotion costs, creating a high barrier to entry for teams with limited resources.

Fiat currency sovereignty and macroeconomic policies hinder the development of local currency stablecoins

Given the currency-like properties of stablecoins, some countries have expressed concerns about their potential to erode the sovereignty of fiat currencies and disrupt capital control mechanisms. For example, Malaysia explicitly defines stablecoins as instruments with potential systemic risks, with oversight being led by the central bank. This means that despite market demand, the political viability of local currency stablecoins remains uncertain.

5. Strategic Recommendations and Future Outlook

5.1 Recommendations for Enterprises

Prioritize entry into regulatory-friendly markets and establish compliance model cases

Given the varying levels of regulatory maturity across countries, companies should prioritize establishing pilot projects or issuing entities in countries with clear policy paths and predictable regulatory processes, such as Hong Kong, Singapore, and the Philippines. Obtaining local financial licenses, participating in regulatory sandboxes, and establishing audit and custody partnerships are fundamental to building trust. These "initial models" can serve as compliance assurance for future replication in other countries.

Design an end-to-end closed-loop path around real transaction scenarios

Rather than simply being a "stablecoin issuer," it's better to integrate into a complete closed-loop capital flow: exemplified by "user deposits → merchant receipts → on-chain settlement → fiat redemption." This requires not only deploying token contracts but also establishing deposit channels (e.g., OTC, crypto wallets), B2B/B2C applications (e.g., e-commerce, remittance platforms), and redemption mechanisms (e.g., wallet withdrawals, card-wallet integration), thereby establishing a truly usable and recyclable stablecoin trajectory.

Promote the modularization of stablecoin product structure and lower the integration threshold

For partners (such as wallets, e-commerce platforms, and payment API providers), stablecoin issuers should break down their capabilities into standardized modules: for example, on-chain issuance interfaces, price anchoring tools, audit APIs, and custody query modules, forming a stablecoin service capability matrix. This will significantly reduce partner integration costs and improve system compatibility.

Build a local alliance ecosystem and work with payment providers and compliant intermediaries to promote implementation

Rather than operating independently, businesses should proactively collaborate with local payment companies, retail platforms, crypto-fiat gateways, and banking institutions to form a "stablecoin localization alliance" to jointly facilitate merchant payment collection, settlement and liquidation, and tax compliance processes. Especially in cash-intensive countries like the Philippines and Thailand, establishing deep collaboration with offline distribution channels is key to promoting real-world adoption.

5.2 Recommendations to regulatory authorities

Build a multi-layered regulatory system to guide the development of stablecoins by type and stage

Regulators should avoid a one-size-fits-all approach and instead establish differentiated management paths based on the stablecoin's intended use (e.g., payment, transaction, asset-backed), the nature of the issuer (financial institution, technology company, DAO), and the scope of use (local, closed scenarios, open, cross-border circulation). Initially, innovative projects can be placed in a regulatory sandbox, with regulators monitoring testing results in real time and gradually guiding them toward a registration, filing, or licensing system. Through a "fault tolerance → verification → approval" approach, technical risks and compliance costs can be dynamically managed.

Establish an on-chain regulatory interface to strengthen dynamic control of capital flow and repayment capacity

Stablecoins offer on-chain visibility, which should be leveraged effectively. We recommend requiring projects to open standardized data interfaces (such as reserve addresses, redemption records, and circulation distribution), introduce on-chain reserve proof mechanisms, and integrate these with regulatory audit systems to enable real-time monitoring. For example, trigger mechanisms could be set to automatically issue warnings, freeze, or restrict related operations when specific conditions occur (such as large-scale redemptions or highly concentrated holdings), thereby strengthening risk control.

Explore regulatory templates for local currency stablecoins and reserve institutional space for non-CBDC paths

With most Southeast Asian countries still unprepared to issue retail CBDCs, compliant local currency stablecoins could serve as an intermediate approach for pilot programs. It is recommended to establish standardized parameters (such as reserve ratios, custody requirements, daily redemption limits, and redemption time limits) and allow financial institutions to conduct small-scale issuances under regulatory authorization. Such pilot programs should focus on manageable scenarios such as cross-border remittances, government subsidy distribution, and digital tourism payments, building regulatory experience and social trust.

Promote cross-border regulatory coordination mechanisms to reduce policy friction within the region

Given the inherent cross-border nature of stablecoins and the diffusibility of their technology, a single national regulatory framework cannot independently address all of their spillover effects. It is recommended to promote the establishment of a multilateral collaboration mechanism to promote regional coordination around areas such as sandbox mutual recognition, compatibility with technical and auditing standards, and wallet and node management regulations, thereby reducing operational and compliance frictions caused by policy fragmentation. Guiding the interconnection and mutual recognition of stablecoins within the region through this collaborative mechanism will help build a more consistent and efficient cross-border digital financial environment.

5.3 Recommendations for Users

Establish a basic understanding of stablecoins and clarify their risk and value attributes

Before using stablecoins, users should have a basic understanding: Stablecoins are digital assets pegged to fiat currencies and designed to maintain price stability. Compliant stablecoins typically have real asset reserves, public audits, redemption mechanisms, and a certain degree of regulatory approval. However, some token products that lack reserve backing or rely heavily on algorithmic adjustments, while appearing to have stable prices, may harbor significant credit and technical risks. Users should view stablecoins as "functional assets" rather than "high-yield investments" to avoid misjudging their financial attributes.

Prioritize stablecoins with redeemability and local availability

The value of a stablecoin lies not only in its on-chain existence but also in its ability to facilitate payments, receipts, and withdrawals in everyday life. Before choosing a stablecoin, users should confirm whether the asset supports deposits and withdrawals in local fiat currency, whether it can be circulated on mainstream platforms, and whether it has a clear redemption path. Stablecoins that support a closed loop of "on-chain use + local redemption" offer greater practical usability and controllability.

Improve digital wallet usage and asset security awareness

Stablecoin usage typically relies on blockchain wallets, which involve private key management, on-chain transactions, and contract authorization. Users should master basic wallet usage skills, including creating and backing up seed phrase, distinguishing between the main chain, identifying risky authorizations, and adjusting transaction fees. Users should also be wary of common security risks, such as phishing links, malicious airdrops, and counterfeit wallet plugins, to avoid asset losses due to improper operation.

Explore the practical uses of stablecoins in cross-border, payment, storage and other scenarios

Stablecoins serve as efficient and secure value transfer tools, widely used in scenarios such as cross-border remittances, remote payment collection, platform settlement, and digital goods payments. Compared to traditional payment systems, stablecoins offer advantages such as fast transfer speeds, low costs, and strong programmability. Users can gradually incorporate stablecoins into their daily payments and financial management based on their needs, improving transaction efficiency and asset flexibility.

Merchants and platform users can incorporate stablecoins into their daily business processes

For merchants and platform users who need to collect payments, settle accounts, or split accounts, stablecoins can serve as a new payment channel. Combined with digital wallets, aggregated payment interfaces, and exchange rate tools, merchants can automate pricing, on-chain settlement, and fund clearing processes. For e-commerce companies, creator platforms, and online service providers targeting international customers, stablecoins can also significantly reduce cross-border settlement costs and wait times, improving capital turnover efficiency.

6. Conclusion

By the first half of 2025, stablecoins have established their strategic position as a tool for structural change in the global financial system, with Southeast Asia becoming a frontier region for adoption and policy experimentation.

Although the region still faces challenges such as inconsistent regulatory frameworks, risks of illegal activities on the chain, and weak off-chain infrastructure, stablecoins have shown significant potential in enhancing financial inclusion, optimizing cross-border payment efficiency, and promoting the modernization of the financial system.

Regulators in various countries are gradually advancing the process of policy clarification through multilateral dialogues, sandbox mechanisms and functional taxonomies; at the same time, the accelerated entry of institutional investors and the continuous emergence of stablecoins anchored to local fiat currencies are laying the foundation for establishing a controllable, auditable and interoperable stablecoin ecosystem in the region.

Looking ahead, strategic collaboration between policymakers, financial services providers, and technology infrastructure builders will be key to unlocking the full value of stablecoins. This not only impacts individual countries' payment innovation capabilities, but also whether Southeast Asia as a whole can build a more inclusive, efficient, and resilient regional value network within the global digital financial landscape.