Ethereum (ETH) has risen to 22nd place in the global asset market capitalization ranking with a strong upward trend. The surge in ETF inflows and massive whale accumulation are fueling the price momentum. Experts predict that ETH could break through the 4,800-5,000 dollar range in the near future.

Over the past week, Ethereum has risen nearly 17% and is currently trading around 4,300 dollars. ETF investment inflows have reached an all-time high. In just one day, the inflows into Ethereum spot ETFs amounted to 1.01 billion dollars, with BlackRock's iShares Ethereum Trust (ETHA) attracting 640 million dollars and Fidelity's fund drawing 277 million dollars. The interest in Ethereum from traditional financial markets is rapidly expanding.

Positive signals are also emerging within the market. Whale investors have purchased over 312,000 ETH from core liquidity providers over the past 8 days, with a total purchase amount of approximately 1.34 billion dollars. The ETH holdings on exchanges are at an all-time low, with about 30% of the circulating supply already staked. This suggests a potential reduction in supply pressure and could act as a price increase factor.

Technical analysis indicators are also supporting the upward trend. ETH is currently trading above the upper Bollinger Band, with the RSI (Relative Strength Index) at 73. While an RSI above 70 typically indicates an overbought condition, it also demonstrates sustained buying demand. The ETH derivatives open interest on Binance has surged 46% in 30 days to 10 billion dollars. Notably, short positions have increased by 500% year-on-year, suggesting the possibility of a sharp rise due to short covering.

Market analysts have set the 4,400-4,450 dollar range as a strong resistance level, and breaking through this range could make 4,800-5,000 dollars a realistic short-term target. Analyst Ali, based on the price band model, has also proposed long-term scenarios of 5,210 dollars and 6,946 dollars.

In addition to ETF inflows, direct institutional purchases are also notable. The mining-based company BitMine Immersion has officially announced that its ETH holdings exceed 1.15 million. The total evaluated assets amount to 4.9 billion dollars, which is the largest corporate holding worldwide. They have additionally purchased over 317,000 ETH in just one week.

External market variables are also working favorably for Ethereum's strength. Investors are paying attention to macroeconomic trends such as the possibility of US interest rate cuts, expansion of ETF legislation, and increased institutional investment. There are many analyses suggesting that Ethereum is being re-evaluated as a core technology for traditional financial infrastructure. Twitter commentator Nate Geraci stated, "Traditional institutions are just beginning to recognize Ethereum's potential," forecasting that ETH will become the core of future financial systems.

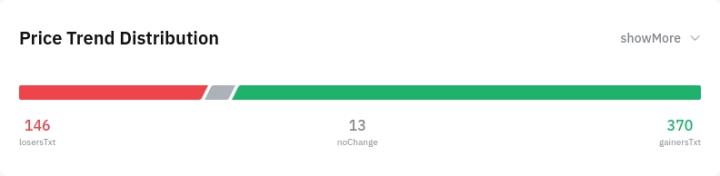

The entire altcoin market is also rebounding along with ETH. The altcoin market capitalization has once again reached its pre-decline peak from the end of 2024, and some analysts emphasize that the liquidity and market sentiment are significantly different this time. Expectations are spreading that Ethereum will be the central axis driving the future upward trend.

Ethereum's all-time high was 4,878 dollars recorded in November 2021. Currently trading about 12% below that, all factors including ETF fund inflows, technical indicators, institutional demand, and on-chain data are supporting an upward movement. While keeping the possibility of short-term adjustments open, the scenario of breaking through 5,000 dollars is gaining weight.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>