Stellar (XLM) has been showing a recent upward trend. This has been triggered by the market's bullish sentiment. This upward trend can also be confirmed by current technical indicators.

XLM's price is showing signs of additional strength. Investors are paying close attention to whether this altcoin will continue its upward momentum.

Stellar's Potential for Continued Recovery

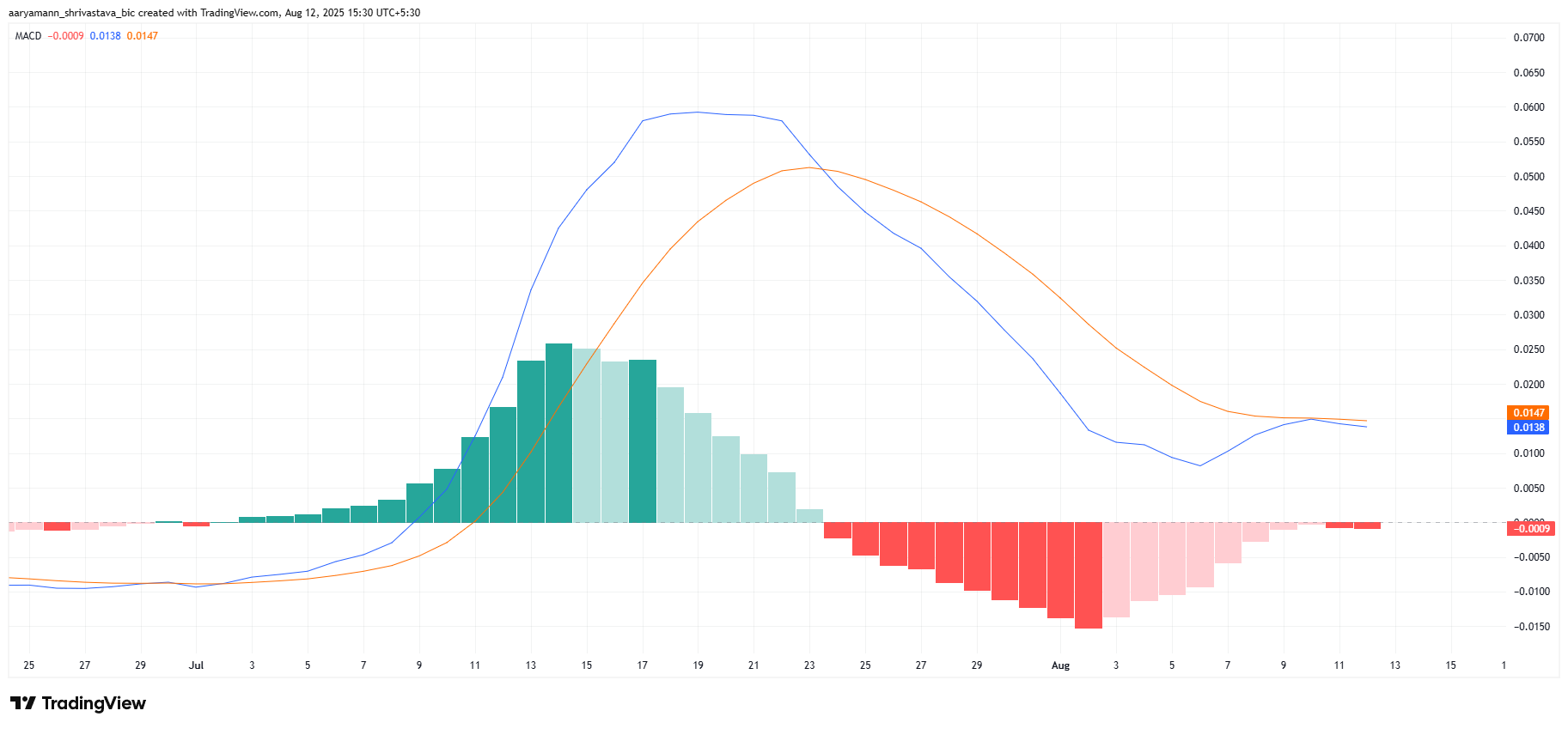

The Moving Average Convergence Divergence (MACD) indicator is showing a potential bullish crossover. In recent days, the MACD histogram was about to turn bullish but experienced a slight setback. However, this setback is likely to be short-term as market conditions improve.

As the overall market stabilizes, the MACD's bullish crossover could help XLM break through its current resistance level. This will open the door to further price increases as more investors enter the market, driven by positive momentum.

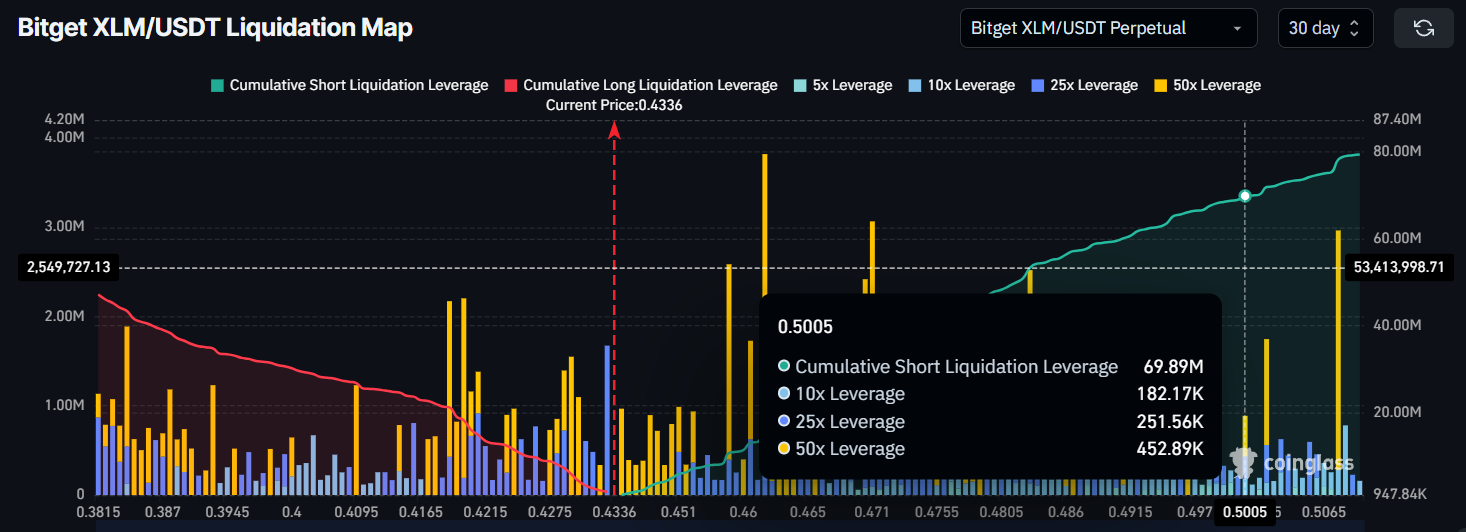

XLM's overall recovery is supported by the liquidation map, indicating that a significant number of bearish traders hold short positions. If XLM continues its upward trend, it could trigger the liquidation of approximately $70 million in short contracts. These liquidations will further strengthen the bullish momentum, making it difficult for bearish forces to control the market.

XLM's complete recovery is likely to occur around the $0.50 level. Here, the altcoin will establish a bottom and face a new resistance. Reaching this level will pressure bearish traders to liquidate their positions.

XLM Price, Need for Increase

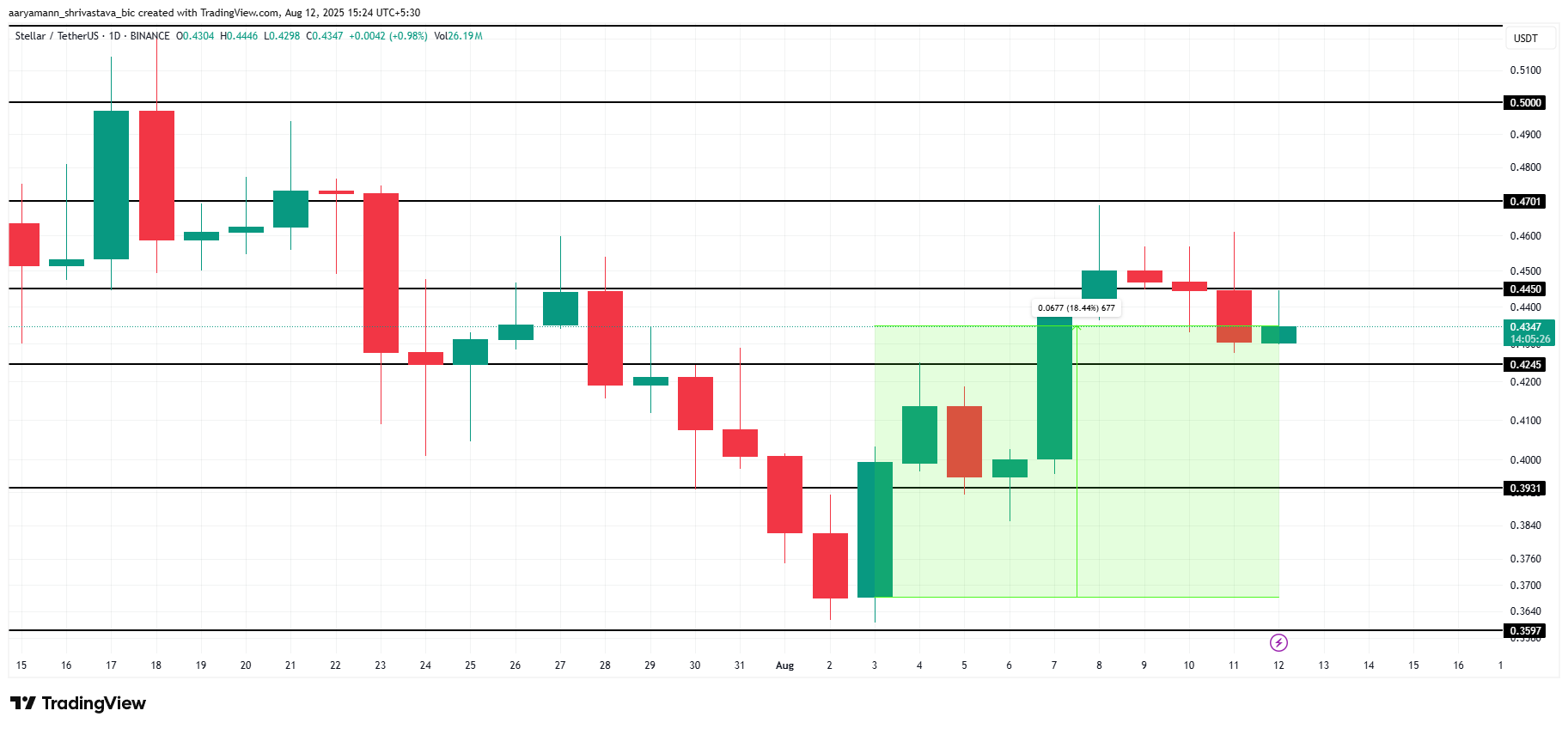

Currently, XLM is trading at $0.434, having risen 18% over the past 10 days. The altcoin is facing resistance at $0.445. To complete its recovery, XLM needs to break through this resistance and reach the $0.50 level. If the price continues to move in this direction, a sustained rally is expected.

The bullish momentum could drive XLM up to $0.470, bringing it closer to the $0.50 target. As short position liquidations increase, bearish pressure will disappear, and continued strength will follow. This scenario makes it likely that XLM will set a new high and break through $0.50.

However, if XLM faces selling pressure, it could fall below the $0.424 support level. A drop to $0.393 could invalidate the current bullish logic and cause a shift in sentiment. Such a retreat could temporarily delay XLM's recovery by raising concerns about the sustainability of the current trend.