Major cryptocurrencies are rising simultaneously. This is due to the increased expectation of a potential Federal Reserve rate cut in September as July consumer prices met market expectations.

As of 8 AM on the 13th, according to the global crypto asset tracking site CoinMarketCap, Bitcoin (BTC) is trading at $119,950.89, up 0.88% from the previous day. Altcoin growth rates are even steeper. At the same time, Ethereum (ETH) is trading at $4,570.02, up 8.31% from the previous day, XRP is up 4.06% at $3.266, and Solana (SOL) is up 9.52% at $191.26.

Related Articles

- New York Stock Market's Three Major Indices Decline... Bitcoin at $118,800 [Decenter Market Conditions]

- Bitcoin Recovers to $119,000... Ethereum Catching Breath in $4,200 Range [Decenter Market Conditions]

- Trump "Allows Investment in US Retirement Funds"... Cryptocurrencies Surge Simultaneously [Decenter Market Conditions]

- Bitcoin Recovers to $115,000 on Dollar Weakness [Decenter Market Conditions]

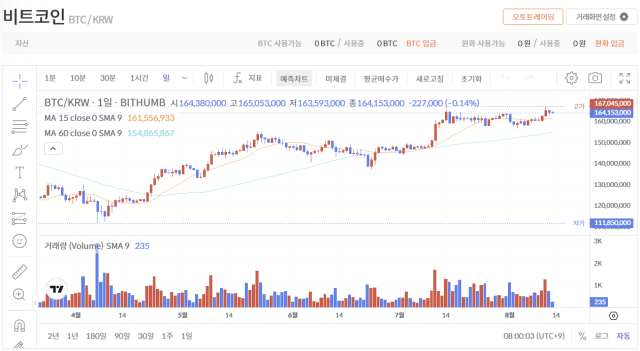

The domestic market is also showing an upward trend. At the same time, BTC on Bithumb recorded 164,153,000 won, down 0.14%. ETH is up 2.88% at 6,255,000 won, XRP is up 1.36% at 4,471 won, and SOL is up 5.78% at 261,700 won.

With the spread of rate cut expectations, buying sentiment spread across the New York stock market and cryptocurrency market. On the 12th (local time), the Dow Jones Industrial Average closed at 44,458.61, up 483.52 points (1.10%) from the previous session. The S&P 500 index rose 72.31 points (1.13%) to 6,445.76, and the Nasdaq Composite rose 296.50 points (1.39%) to 21,681.90. The S&P 500 and Nasdaq Composite set new all-time closing highs.

According to the US Department of Labor, the July Consumer Price Index (CPI) rose 2.7% year-on-year, the same as in June. Falling below the expert forecast of 2.8% by Dow Jones, this added momentum to rate cut expectations. According to the CME FedWatch, there is a 94% chance that the Fed will lower rates by 0.25 percentage points at its September monetary policy meeting.

The Fear and Greed Index from crypto data analysis firm Alternative.me is at 68 points, down 2 points from the previous day, indicating a state of "greed". This index means that the closer to 0, the more constrained the investment sentiment, and the closer to 100, the more overheated the market.

- Reporter Do Ye-ri

< Copyright ⓒ Decenter, reproduction and redistribution prohibited >