In the past 24 hours, approximately $393 million (about 575 billion won) worth of leveraged positions were liquidated in the cryptocurrency market.

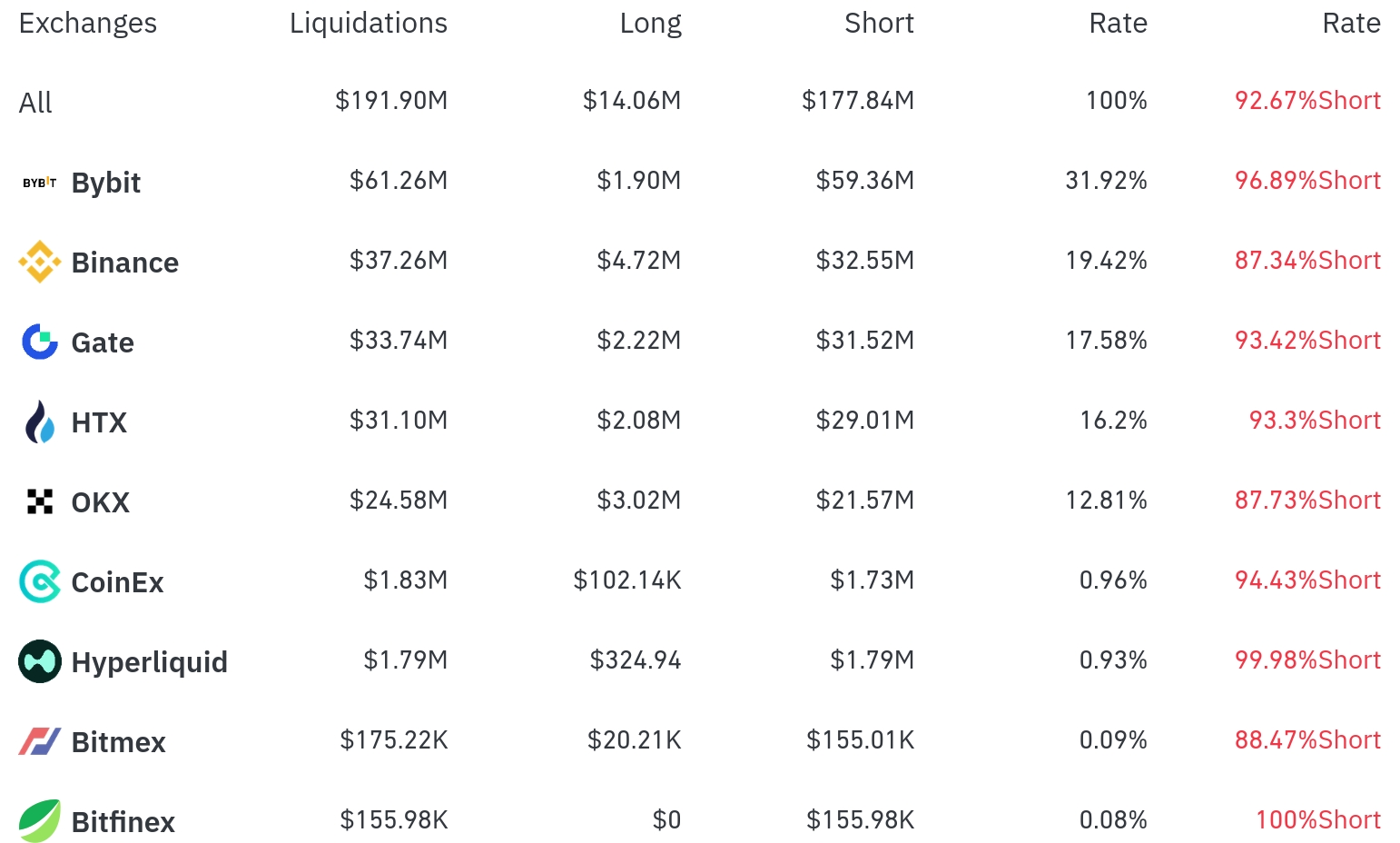

According to the currently compiled data, interestingly, short position liquidations were overwhelmingly dominant in this liquidation. Looking at the 4-hour liquidation data from major exchanges, Bybit saw liquidations of $61.26 million, of which 96.89% were short position liquidations.

Binance also saw liquidations of $37.26 million, with 87.34% being short positions. Gate and HTX also experienced liquidations of $33.74 million and $31.10 million respectively, with both exchanges showing over 93% short position liquidations.

OKX saw liquidations of $24.58 million (short ratio 87.73%), and while Hyperliquid had a smaller amount, it's noteworthy that 99.98% of its liquidations were short positions.

By coin, Ethereum (ETH) recorded the most liquidations. Ethereum saw positions totaling $264.44 million liquidated in 24 hours, with a massive $132.81 million in short position liquidations in 4 hours. This appears to be related to Ethereum's 8.83% price increase over 24 hours.

Bitcoin (BTC) had approximately $46.37 million in positions liquidated in 24 hours, with $10.33 million in short positions and $3.45 million in long positions liquidated in 4 hours. Bitcoin's price is currently at $120,125, up 1.14%.

Solana (SOL) saw about $25.78 million liquidated in 24 hours, with a notable short position liquidation alongside an 8.64% price increase. Among other major altcoins, XRP ($13.41 million) and Doge ($12.57 million) saw significant liquidations.

Particularly noteworthy is the PUMP Token, which saw substantial short position liquidations with a significant 16.80% increase. Link (LINK) also experienced active short position liquidations with an 11.06% rise.

This liquidation data reflects the recent strong trend in the cryptocurrency market, with short position traders taking a significant hit, especially those betting against the strong upward movement of Ethereum and other major altcoins.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leveraged position when a trader fails to meet margin requirements. This large-scale short position liquidation can be seen as an indicator that the recent cryptocurrency market's upward trend was stronger than expected.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>