As the global virtual asset market shows a unified strong trend, Bitcoin is firmly maintaining the $120,000 level, and Ethereum is making a storm surge, approaching its all-time high. The investment sentiment indicator has also entered the 'greed' stage, increasing market expectations for further rise.

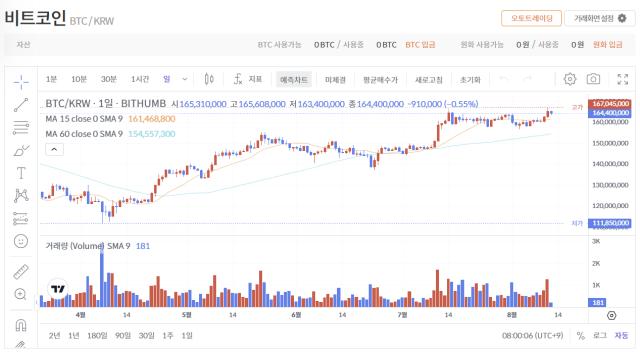

According to CoinMarketCap, a global virtual asset market site, as of 9 AM on the 13th, Bitcoin is stably maintaining the $120,000 level, recording $120,083. Its market capitalization reaches approximately $2.39 trillion and has increased by 5.28% in the last 7 days.

Particularly, Ethereum has soared to $4,605, leaving only 5% away from its all-time high of $4,891.70. This surge of 8.72% in a single day is analyzed to be driven by large-scale institutional purchases. On the 11th, the US spot Ethereum ETF saw an inflow of $1 billion in a single day, recording the largest scale since its launch, surpassing the inflow of Bitcoin ETF on the same day.

Bit Mine Emergence Technologies (BMNR), the world's largest Ethereum holder, announced a funding plan to potentially add up to $20 billion in purchases in addition to its existing $5 billion holdings. Experts predict that "even if there is a short-term adjustment, if this institutional buying trend continues, breaking Ethereum's all-time high is just a matter of time".

On the same day, Solana (SOL) also surged 16.84% over 7 days to $191, and BNB rose 10.26% to $832, showing a strong trend. The total virtual asset market capitalization increased by 2.95% from the previous day to approximately $4.06 trillion.

The investment sentiment is also optimistic. CoinMarketCap's 'Fear and Greed Index' recorded 60, entering the 'greed' section. This means investors are placing more weight on the possibility of rise rather than short-term adjustments.