Jessy, Jinse Finance

In the Q2 2025 financial report, Circle disclosed that it will launch a dedicated blockchain called ARC for stablecoins. Not only Circle, but previously, there were reports that payment giant Stripe, in collaboration with venture capital firm Paradigm, is quietly developing a payment-focused blockchain codenamed Tempo.

With Circle and Stripe leading the way, will building their own blockchain become a trend? And how will this threaten the "global settlement layer" narrative of existing blockchains like Ethereum?

Giants Enter the Market with Specialized Chains

Circle announced a major product plan in its Q2 2025 financial report - launching a Layer-1 named ARC later this year, specifically designed for stablecoin finance. The chain will be fully compatible with the Ethereum Virtual Machine (EVM), with USDC set as the native gas token. According to its disclosure, the ARC blockchain will have sub-second settlement confirmation and support "optional privacy" features, suitable for financial compliance needs.

For Circle, the core reason behind building its own blockchain is the continuous expansion of its stablecoin business. Its Q2 2025 fiscal data shows USDC circulation increased by 90% year-on-year, reaching $61.3 billion, and rising to $65 billion as of August 10th. The platform's USDC balance surged 924% year-on-year to $6 billion, with user wallet count growing 68% to 5.7 million.

With the surge in stablecoin business, reducing costs has become a top priority. Circle's Q2 financial report shows distribution costs increased by 64% year-on-year to $407 million, undoubtedly squeezing profit margins. ARC will directly use USDC as Gas and integrate into Circle's own ecosystem, potentially reducing dependence on distribution costs from partners like Coinbase and reclaiming profit space.

ARC offers sub-second settlement, optimizing performance around payment scenarios rather than pure decentralization. Currently, Circle has applied to establish a national trust bank and seeks access to the Federal Reserve's main account and payment system, which will significantly reduce clearing costs and improve fund efficiency. ARC's optional privacy and regulatory interfaces are tailored for institutional scenarios like cross-border payments and securities settlement.

On the other hand, for payment companies, the settlement layer is their lifeline. Relying on third-party blockchains means core infrastructure is controlled by others. Gas fee fluctuations and network upgrade uncertainties can affect payment experience and profit margins. Building their own chain means controllable fee models and upgrade rhythms. Moreover, payment business's core needs are low latency, high throughput, and predictable confirmation times.

Specialized chains for specialized tasks. For a compliance stablecoin leader like Circle, having their own blockchain is something they would do sooner or later. The current push is driven by the passage of the US GENIUS Act and the continuous expansion of the USDC market.

For Ethereum, Is the Self-Built Chain Trend a Threat or an Opportunity?

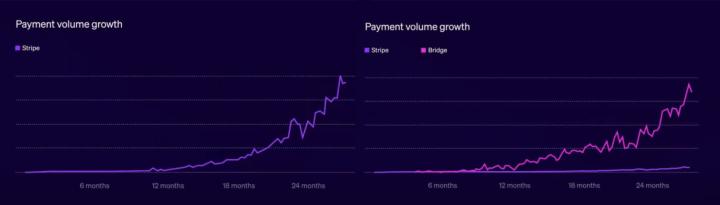

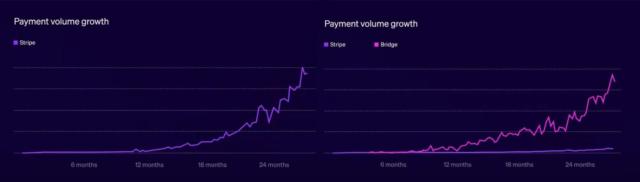

Not only is Circle building its own blockchain, but payment giant Stripe is also collaborating with venture capital firm Paradigm to develop a payment-focused blockchain called Tempo. Tempo plans to be EVM-compatible, focusing on high-performance, low-latency settlement, targeting global merchant payments and cross-border clearing scenarios.

Moreover, this doesn't seem to be just a strategy for a few companies. After Circle and Stripe, PayPal, Shopify, Adyen, and even large banks might launch their own blockchain plans, with each giant wanting to control their payment sovereignty.

What impact will this have on existing blockchain ecosystems? Especially for Ethereum, which has just donned the narrative of global RWA and stablecoin settlement layer in this cycle?

In the short term, these giants' self-built chains won't directly compete with Ethereum, Solana, BNB Chain, etc., because their design goals are highly verticalized - prioritizing performance and compliance, not pursuing maximum decentralization or diverse DeFi application ecosystems. However, long-term threats definitely exist.

Currently, a large volume of USDC transactions occurs on Ethereum and its Layer 2s. If USDC natively runs on ARC and is integrated into various payment applications via API, it might shift chain-based stablecoin settlement from "open multi-chain" to "vertical closed loop", potentially drawing away some of Ethereum's stablecoin settlement volume and DeFi ecosystem liquidity.

Similarly, when payment giants like Stripe or PayPal directly embed on-chain payment functions into merchant settlement systems, developers might prefer building applications around these proprietary chains rather than adapting to public chains like Ethereum for compliant payment scenarios.

For investors, the more obvious impact might be the compressed imagination space for Ethereum. Giants' early implementation of RWA and stablecoin settlement layers could affect the capital market's pricing expectations for Ethereum.

Of course, opportunities also exist - most giants' self-built chains will maintain EVM compatibility and provide cross-chain bridges or settlement channels. Ethereum might still become their clearing backup layer and value aggregation center, which could be seen as a powerful reinforcement of Ethereum's new narrative.