Crypto venture capital firm Pantera Capital has invested a total of $300 million (approximately 41.7 billion won) in the Crypto Treasury Company, demonstrating strong confidence that they will generate higher returns than cryptocurrency exchange-traded funds (ETFs).

Pantera Capital's General Partner Cosmo Jiang and Content Head Erik Lowe analyzed in a recent blog post that the so-called 'Digital Asset Treasury (DAT)' will "generate revenue, continuously increase net asset value (NAV) per share, and acquire more underlying assets compared to simple holding". They emphasized that through DAT investment, "superior return potential can be expected compared to physical holding or ETFs".

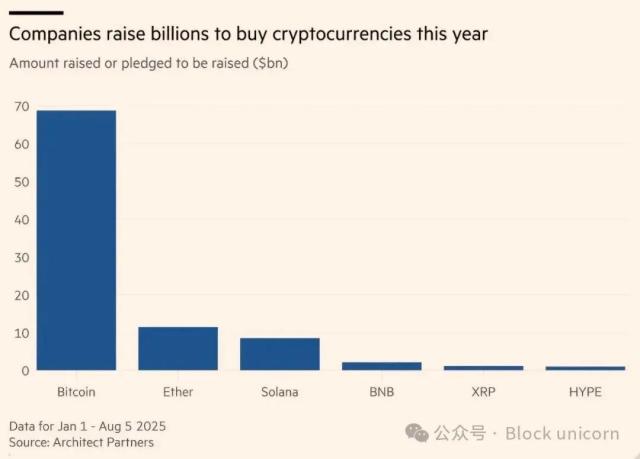

Pantera has so far executed $300 million (approximately 41.7 billion won) in various DAT companies based in the United States, United Kingdom, and Israel, which hold multiple altcoins including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Pantera explained that "these DAT companies are efficiently expanding their digital asset holdings on a per-share basis based on different strategies".

Recently, DAT companies have emerged as the hottest investment theme on Wall Street. While attracting billions of dollars from investors and seeing stock price surges, there are also concerns that excessive competition has led some companies to face risks of market overheating and collapse.

Among these, Pantera highlighted 'BitMine Immersion Technologies', an Ethereum-focused DAT company chaired by Tom Lee, as a representative investment case. As the first investment company executed by Pantera's DAT-dedicated fund, it received evaluation as a "model of clear strategy and execution leadership". Within just two and a half months, BitMine has emerged as the world's largest Ethereum holding company and the third-largest cryptocurrency asset holder among public companies.

Currently, BitMine holds approximately 1.2 million ETH (about 7.347 trillion won), aiming to secure 5% of Ethereum's total issuance. The company is implementing strategies to effectively increase token holdings through issuing stocks with a premium NAV, operating convertible bonds utilizing volatility, staking, and generating DeFi revenues.

Pantera stated that "while we need to observe how sustainable BitMine's strategic execution is long-term, it has already secured support from prominent traditional financial institutional investors such as Stan Druckenmiller, Bill Miller, and ARK Invest", drawing market attention.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>