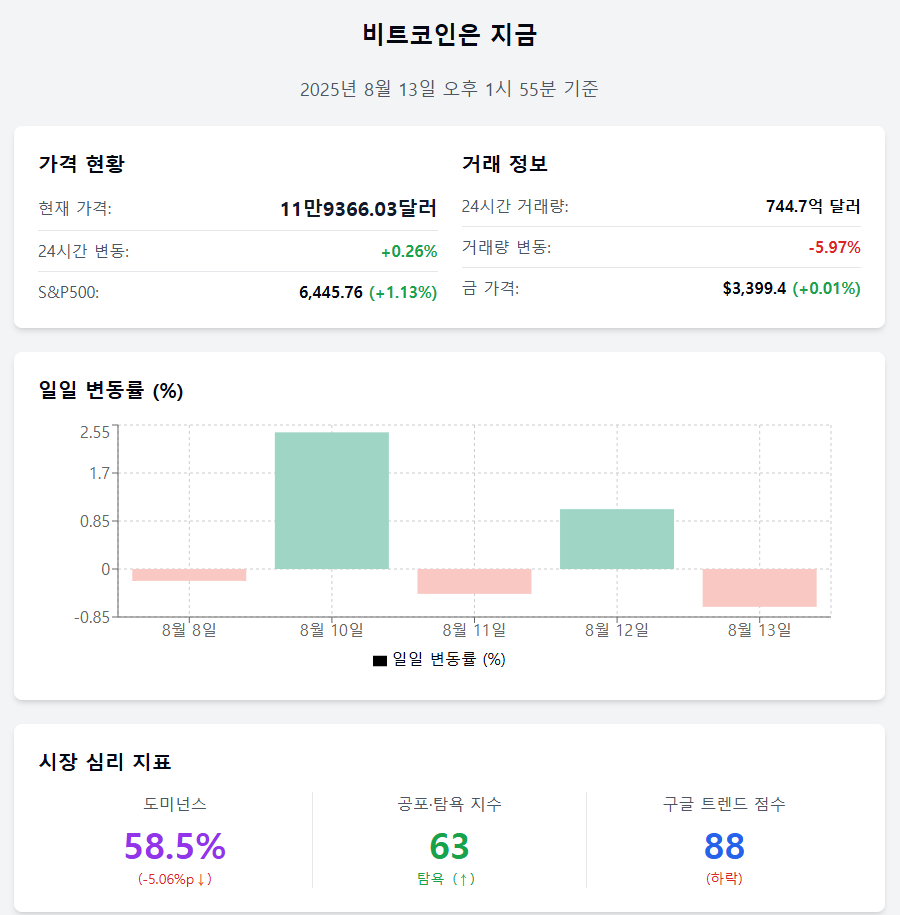

As of August 13, 2025, 1:55 PM

With a decrease in trading volume and a slight slowdown in buying pressure, the rise in the Bitcoin market was also limited. Internal market indicators, such as the decline in dominance, suggest the possibility of altcoin strength.

📈 Price right now

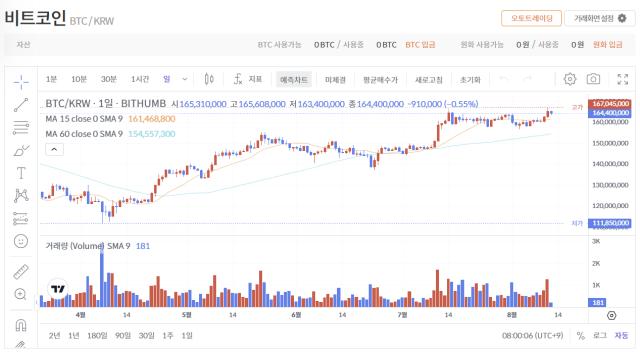

Price $119,366.03 (+0.26%) Bitcoin is trading at $119,366.03, up 0.26% from the previous day. After a short-term rebound, the rise is limited.

Trading volume $7.447 billion (–5.97%) The 24-hour trading volume decreased by 5.97% to $7.447 billion, showing a slight reduction in short-term investor participation.

Daily volatility –0.67% Over the past 5 trading days, the daily volatility was -0.21% on the 8th, +2.42% on the 10th, -0.44% on the 11th, +1.06% on the 12th, and -0.67% on the 13th, continuing a pattern of adjustment and rebound.

Asset comparison S&P500↑ · Gold steady As of the 12th, the S&P500 index rose 1.13% to 6,445.76, and gold price increased slightly by 0.01% to $3,399.4. Gold maintained a steady trend amid a strong risk asset environment.

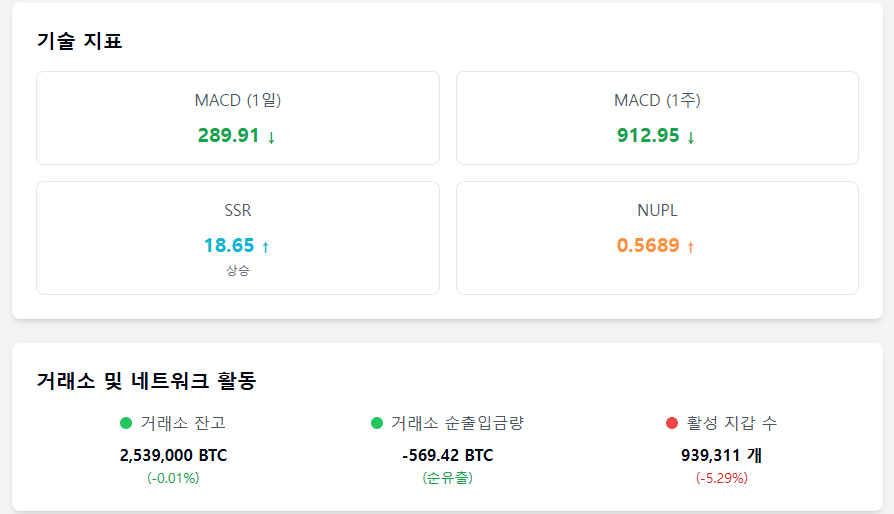

MACD 289.91 The short-term MACD is 289.91, attempting a gradual upward trend, and the 1-week MACD is 912.95, maintaining a medium-term upward trend.

❤️ Investor sentiment now

Dominance 58.5% (–5.06%p) Bitcoin dominance dropped 5.06 percentage points, making the movement of funds to altcoins more evident.

Fear & Greed Index 63 (Greed) Slightly increased from the previous day (60, Greed), maintaining the 'Greed -0.67%' range. Compared to last week (52, Neutral), investment sentiment shows a clear recovery.

Google Trend 88 Bitcoin-related search scores rose slightly from 86 on the 12th to 88 on the 13th, maintaining steady interest.

🧭 Market now

SSR 18.6511 (+0.1410) The Stablecoin Supply Ratio (SSR) is 18.6511, up from 18.51 the previous day, indicating a relatively higher Bitcoin value. Buying capacity may be somewhat limited.

NUPL 0.5689 (+0.0046) The Unrealized Profit Ratio is 0.5689, up 0.0046 from the previous day, expanding the proportion of investors in the profit zone.

Exchange balance 2.539 million BTC (–0.01%) The Bitcoin balance on exchanges decreased by 0.01% to 2.539 million BTC, showing a reduction in short-term selling inventory.

Exchange net inflow –569.42 BTC (–0.3%) The net exchange inflow is –569.41697132 BTC, decreasing by 0.3% from the previous day, indicating a net outflow of Bitcoin from exchanges.

Active wallets 939,311 (–5.29%) The number of active wallets decreased from 991,915 the previous day to 939,311, showing a slowdown in on-chain activity.

Get news in real-time... Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>