In the past 24 hours, approximately $354.27 million (about 518 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, short positions were overwhelmingly dominant among the liquidated positions, with Ethereum (ETH) showing the largest liquidation scale.

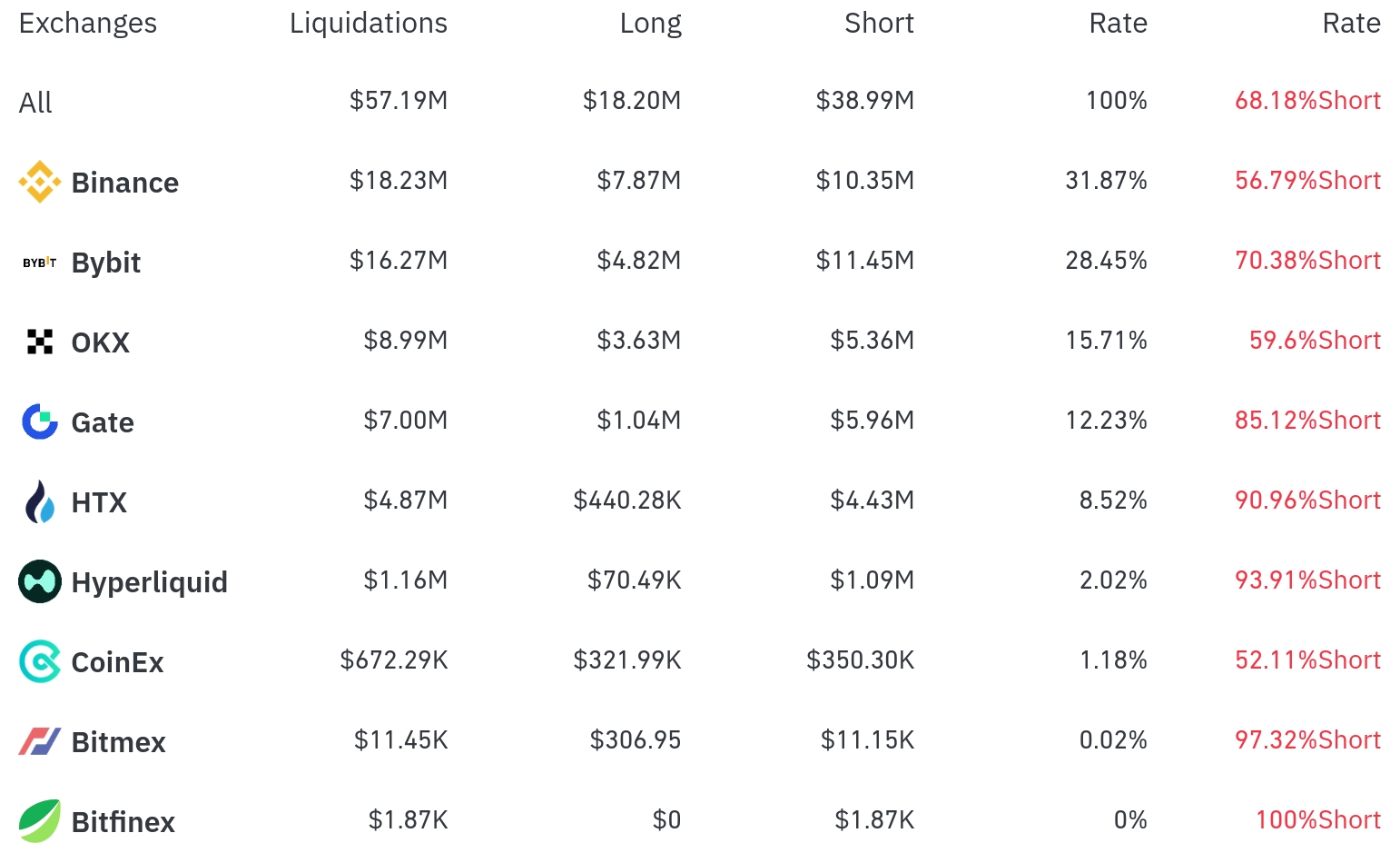

Binance experienced the most position liquidations in the past 4 hours, with a total of $18.23 million (31.87% of the total) liquidated. Among this, short positions accounted for $10.35 million, or 56.79%.

Bybit was the second-highest exchange for liquidations, with $16.27 million (28.45%) of positions liquidated, of which short positions were $11.45 million (70.38%).

OKX saw approximately $8.99 million (15.71%) in liquidations, with short positions accounting for 59.6%.

Notably, HTX and Hyperliquid showed extremely high short position liquidation rates of 90.96% and 93.91% respectively, while BitMEX recorded 97.32% as short position liquidations.

By coin, Ethereum (ETH) had the most liquidated positions. Approximately $284.32 million in Ethereum positions were liquidated in 24 hours, with $22.77 million liquidated in 4 hours. Particularly, Ethereum showed an +8.42% upward trend, causing massive short position liquidations.

Bitcoin (BTC) had about $36.09 million in positions liquidated in 24 hours, with $3.59 million liquidated in 4 hours. Bitcoin is currently trading at $119,280, slightly rising 0.22% in 24 hours.

Solana (SOL) saw approximately $31.55 million liquidated in 24 hours, with $6.40 million liquidated in 4 hours. Solana showed a strong 12.75% upward trend, causing numerous short position liquidations.

Doge (DOGE) also experienced about $20.92 million in liquidations over 24 hours, with $2.05 million liquidated in 4 hours, accompanied by a 6.20% price increase.

A particularly noteworthy coin was FARTCOIN (FARTCO), which saw an explosive 26.77% price increase in 24 hours, causing $12.75 million in liquidations. In 4 hours, $9.22 million was liquidated.

Link (LINK) and Litecoin (LTC) also triggered substantial short position liquidations with strong upward trends of 12.41% and 11.49% respectively.

This large-scale liquidation can be seen as a result of the overall altcoin market's strong rebound, with the upward trend centered on Ethereum and major altcoins causing significant losses for many short position traders.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>