The price of XLM has been trading quietly within a narrow range over the past five trading days.

This sideways movement occurs as Stellar prepares for an important milestone. The reset and stable release of Protocol 23 testnet is scheduled for August 14th.

Stellar Protocol 23, Testnet Reset Preparation

The Protocol 23 upgrade, which is generating expectations for Stellar, was first deployed to the testnet on July 17th. It is scheduled to go live on the mainnet in September.

According to the blog post on June 10th, Protocol 23 introduces eight key development proposals to improve Stellar's performance, smart contract capabilities, and developer tools.

Major upgrades include faster and cheaper Soroban smart contracts through in-memory storage and parallel execution, an integrated event stream to facilitate tracking, new host functions for better data processing, and configurable consensus settings to reduce ledger latency.

The testnet reset and stable release are scheduled for August 14th.

XLM's Recent Uptrend at Risk of Disappearing

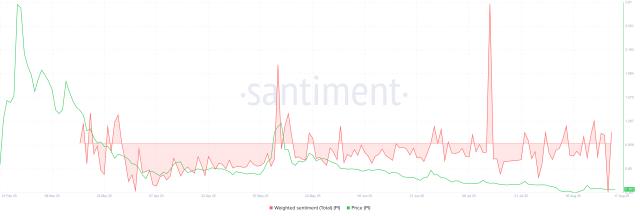

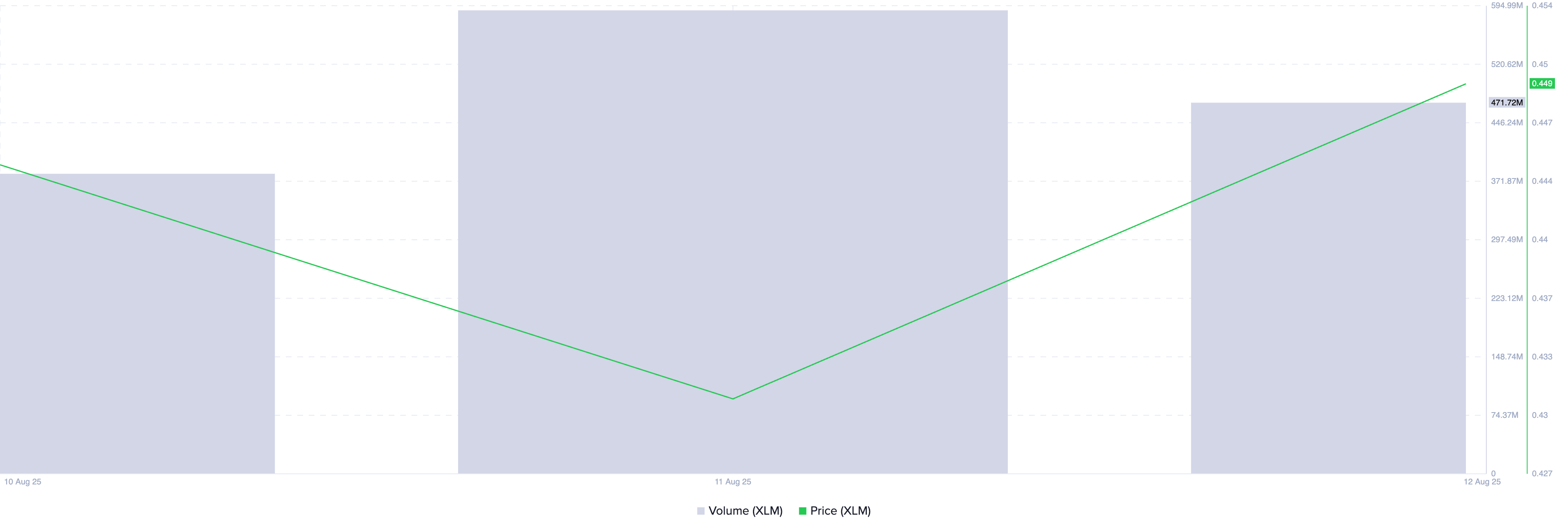

Ahead of this reset, XLM's price performance remains sluggish. The price has risen 4% over the past day, but trading volume is decreasing. This negative divergence suggests that true demand for altcoins is not supporting the rise.

When an asset's price rises while volume decreases, it indicates a lack of strong market participation. Such movements depend on thin liquidity and are unsustainable, potentially quickly reversing if selling pressure returns. This puts XLM at risk of losing its recent gains.

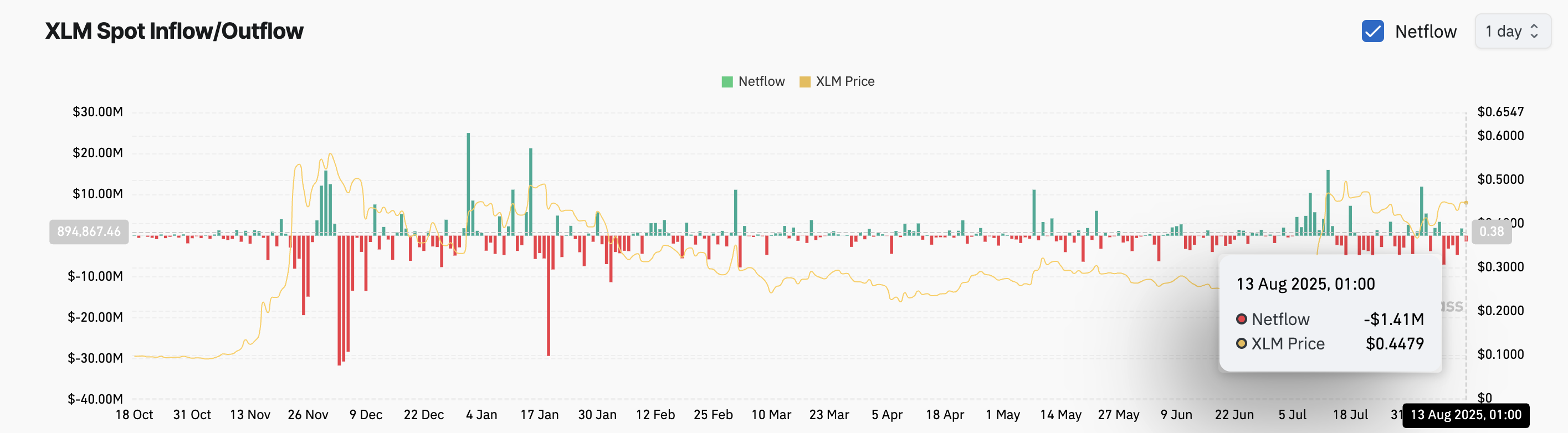

Moreover, the decrease in capital inflows to the XLM spot market confirms reduced demand for altcoins. According to Coinglass, altcoins recorded a net outflow of $1.41 million today, highlighting insufficient support for XLM's 4% rise.

This shows weakening token demand and increasing selling pressure, which could lower the price.

Can XLM Maintain Its Strength?

Increased selling pressure risks pushing XLM below the critical $0.42 support line. If this occurs, continued profit-taking could cause the token's value to drop to $0.39.

Conversely, if upward momentum strengthens, the token could break through the $0.4689 resistance. This opens the door to rising to $0.5206.