As the US dollar shows weakness, opportunities are emerging for the euro in the cryptocurrency economy. The increasing adoption of euro-based stablecoins reflects European investors' desire to offset foreign exchange losses on dollar-pegged assets.

Luke Nolan, senior researcher at CoinShares, told BeInCrypto that this trend is expected to continue, but the role of the US dollar will not completely disappear.

Dollar at its lowest in 50 years

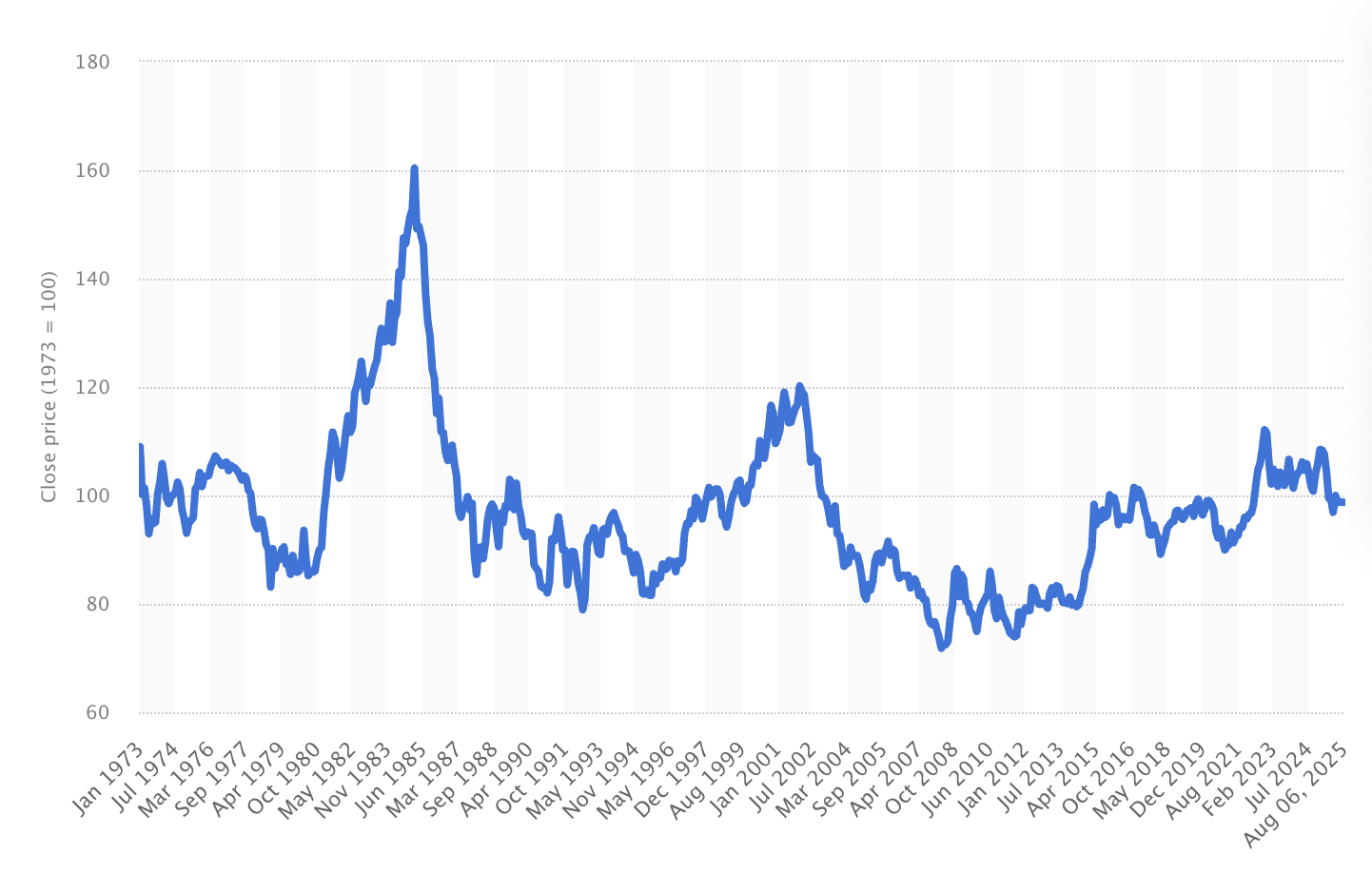

In recent months, the US dollar has experienced a significant and sharp decline. Its performance in the first six months of 2025 was the worst since 1973.

According to Morgan Stanley, the value of the US dollar fell by approximately 11% compared to other currencies during the first half of this year, marking the largest decline in 50 years and ending a 15-year growth period.

Investor confidence in the US economy and assets has been damaged by unpredictable government policies, particularly those related to tariffs and trade.

The recently passed "One Big Beautiful Bill Act" has amplified concerns about increasing budget deficits and national debt.

These policies have caused investors to move away from US Treasury bonds. As these policies continue, Morgan Stanley expects the dollar to fall an additional 10% by the end of 2026.

Moving away from the concept of American exceptionalism could benefit currencies like the euro. This trend could be particularly prominent in the cryptocurrency sector.

Will Dollar's Cryptocurrency Dominance End in Europe?

The previous stability and dominance of the US dollar served as the foundation of the global financial system, and the cryptocurrency market was no exception.

For many European investors, the recent dollar decline has caused confusing issues. On the surface, Bitcoin prices stabilized in dollars might seem good. However, this masks important currency dynamics.

"If a European holder buys Bitcoin through an exchange and holds it for a certain period, during which the price remains the same but the dollar weakens against the euro, the holder will effectively lose that difference." – Luke Nolan, Senior Researcher at CoinShares

This foreign exchange loss shows why European investors are becoming more aware of currency risks. They are realizing that they are directly exposed not just to Bitcoin's performance, but also to the strength or weakness of the US dollar.

"This will be reflected in BTC/EUR nominal terms, and even if the holder cashes out in dollars, when converted to euros, they will receive fewer euros than they invested." – Luke Nolan

Faced with this issue, European investors are taking practical measures to protect their cryptocurrency portfolios from dollar volatility.

Responding to Foreign Exchange Drag

The long-standing dollar strength made investing in dollar-denominated assets attractive. This provided European investors with a "double benefit". However, current macroeconomic changes have reversed that dynamic.

As a result, a notable shift towards euro-denominated transactions is underway. This reassessment of currency risk is also reflected in market data.

According to Kaiko's research, the popularity of trading pairs quoted in USD Tether (USDT) on European exchanges has decreased in 2025, with euro-denominated trades taking its place. The market data provider also noted that the liquidity of ETH/EUR pairs has doubled compared to the previous year, indicating a trend not limited to Bitcoin.

For European investors, this change is not just a simple strategic shift but a direct response to macroeconomic forces.

"We can say there is an impact, but it's not enormous... Now that the dollar is weakening, if you buy or cash out through dollar-denominated stablecoins, the decision becomes dual: Do you think Bitcoin will rise and exceed the USD/EUR pair?" – Luke Nolan

By trading and holding cryptocurrencies in euros, they are trying to "partially offset these foreign exchange losses". As Nolan mentioned, this represents a more direct and less risky way of participating in the digital asset market.

These changes suggest that the European market is maturing and developing its own methods and infrastructure tailored to specific economic conditions.

A New Era of Euro Assets

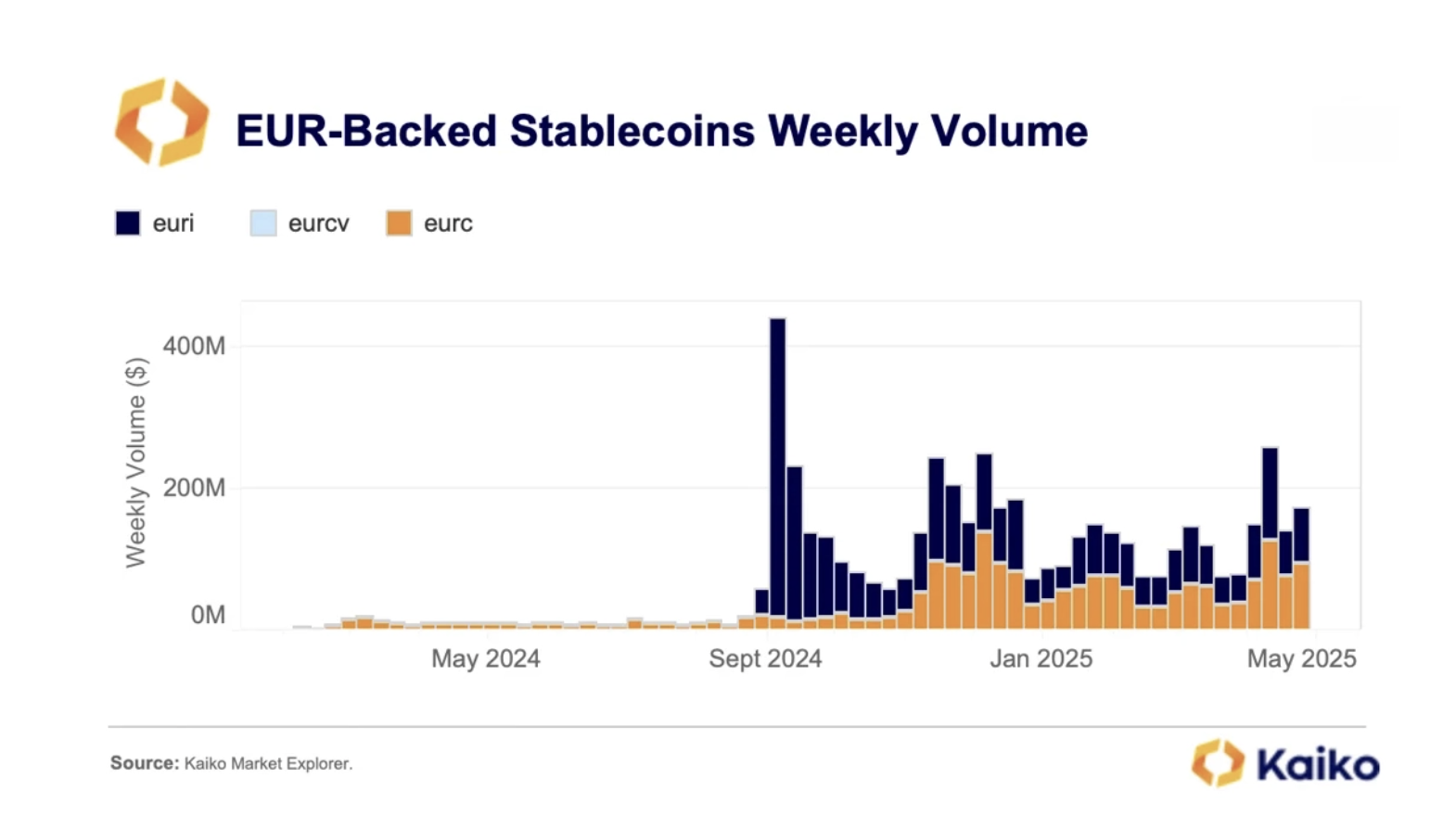

The shift to euro trading has sparked new interest in euro-pegged stablecoins.

While still playing a small role in the cryptocurrency sector, recent growth is undeniable. These digital assets provide a way to trade on the blockchain without exposure to a weakening dollar.

"Noticeable, but still small overall. EURC (Circle) grew 55% year-to-date to $211 million, and EURS (Stasis) grew 31% year-to-date to $146 million. The total market cap of euro stablecoins is $585 million. So overall, it's still a small scale. (The total market cap of stablecoins is $250 billion)," Nolan told BeInCrypto.

The practical utility of such stablecoins is particularly important for professional investors and businesses. They provide a way to hold funds in crypto assets while avoiding foreign exchange risks. The ability to operate directly in euros is a significant attraction.

"The finance department can now operate entirely in euros, avoiding foreign exchange risks (at least partially). Therefore, if the dollar continues to weaken, we expect stablecoins pegged to the euro to gain more popularity," Nolan added.

This recent trend raises larger questions about the long-term role of the dollar in the cryptocurrency market.

Will the Dollar's Cryptocurrency Dominance Weaken?

The transition to euros and global de-dollarization efforts prompt considerations of whether the cryptocurrency market will follow suit.

According to Nolan, the result is complex and not as extreme as the terms suggest. The growth of euro-denominated products is important but will not fundamentally impact cryptocurrencies. The scale and dominance of dollar-pegged stablecoins continue to reinforce the dollar's global role.

"I think the likelihood of impacting the entire cryptocurrency market is very low. Dollar-pegged stablecoins are still growing very rapidly and support global dollar circulation as natural buyers of US Treasury bonds," he explained.

However, this trend should not be ignored. While full de-dollarization is not imminent, Nolan acknowledges that market changes are evident. For example, the growth of stablecoins pegged to the euro is a specific indicator of this change.

"I believe stablecoins pegged to the euro are likely to exceed $1 billion by the end of the year," Nolan added.

This trend points to a more diversified future for the cryptocurrency market. While the dollar is likely to maintain its lead, the euro and other currencies will gain more influence. This will create a more localized and less risky environment for investors and businesses.